Robust growth for online retail sales observed in June

Insight

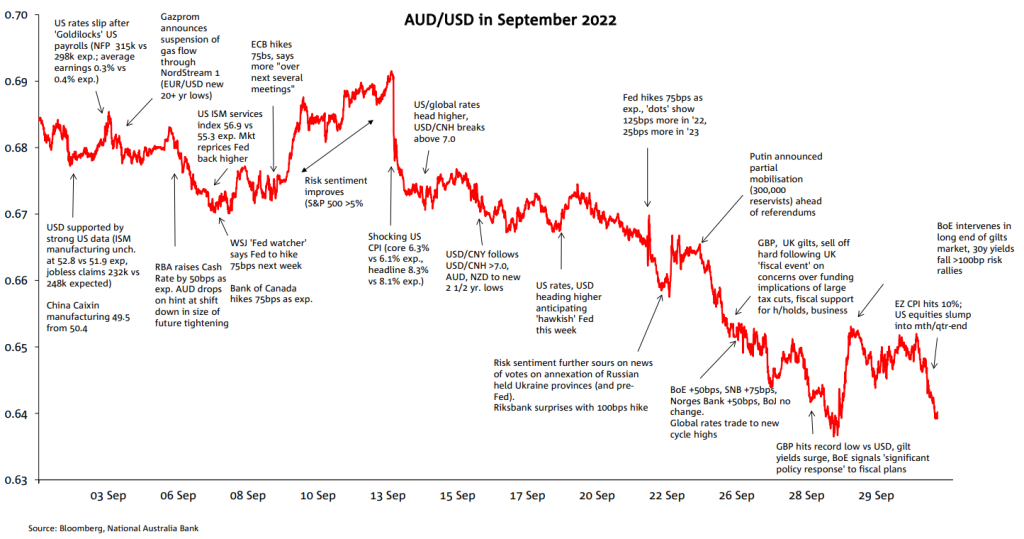

The AUD/USD high of 0.6916 came on the 13th and the low of 0.6363 on the 29th (last day of the month).

A 5 ½ cent range for AUD/USD in September was the largest since April 2022, but in percentage terms the range slightly exceeded April (8.0% versus 7.9%) to make it the most volatile month since April 2020 (when AUD was in the throes of recovering from its March 2020 crunch lower at the onset of the pandemic). The AUD/USD high of 0.6916 came on the 13th and the low of 0.6363 on the 29th (last day of the month).

AUD meandered within an effective 0.67-0.69 range in the first 10 days of September, suffering somewhat out of the ‘as expected’ 50bps RBA rate hike on September 6, on comments suggesting a downshift in the scale of future rate hikes could soon be forthcoming. AUD subsequently drew support (up to the month’s highs) on improved risk sentiment, encompassing a 5% rally in the S&P500 over three days.

It was ‘all change’ from September 13 following the release of ‘shocking’ August US CPI inflation data with both headline and core readings exceeding consensus expectations by 0.2% (8.3% and 6.3% yoy respectively). The data cut the rug from under the earlier risk rally, saw markets repricing Fed policy expectations, drove a US-led global bond market sell-off and, a sharp reversal of earlier USD slippage.

Adding weight to AUD (and NZD) in the days following the US CPI report was the Chinese Yuan falling through 7.0 to the US dollar (initially on CNH, soon followed by the onshore CNY). USD/CNY subsequently rose to a high of 7.25 toward the end of the month. Further pressuring AUD in the latter half of the month, via adding to deteriorating global risk sentiment, was news that Russia planned to hold referendums on annexing four Russian held Ukrainian provinces and President Putin’s announcement of the mobilisation of 300,00 reservists.

Adding insult to an already injured AUD in the last days of September was the scathing market reaction to the UK government’s ‘fiscal event’. Deficit funding concerns from announced plans for large scale tax cuts and fiscal spending saw a dramatic rise in UK gilt yields – necessitating Bank of England buying at the longer end to prevent fall-out on the UK Pensions industry – plus record low for GBP/USD as well as a broadly stronger USD, the latter making new cycle highs.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.