The AUD in September

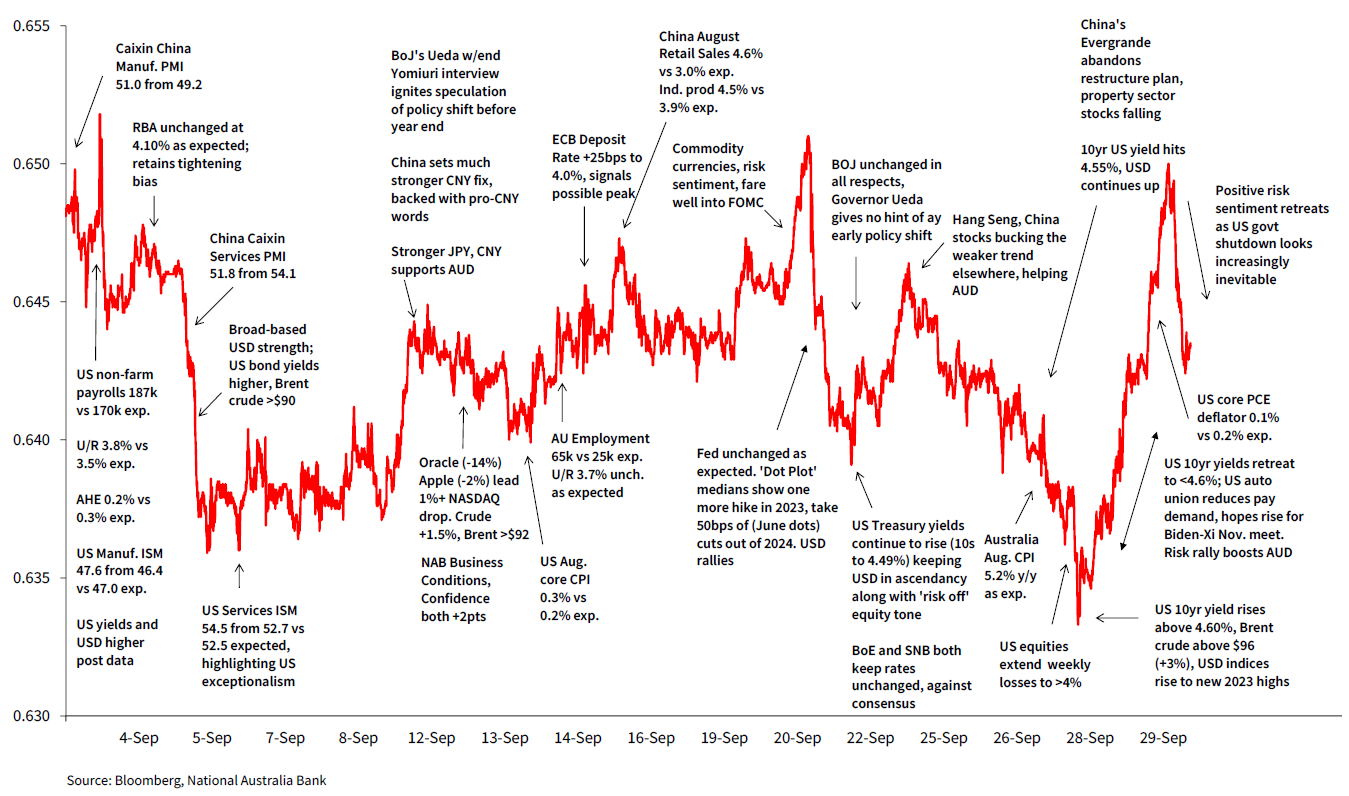

The AUD/USD’s 1.9 cents range in September was the narrowest since the 1.74 cents October 2019 range (Chart 1). This encompassed a high of 0.6522 (Sep 2) and a low of 0.6332 (27 Sep), the latter a new year-to-date low.

AUD weakness in the early part of the month was driven by a combination of USD/CNY strength, for which the slump in the Caixin China Services PMI, to 51.8 from 54.1, was a contributing factor, and USD strength in the wake of a ‘goldilocks’ August US employment report quickly followed by a strong Services ISM, data which collectively highlighted the United States’ ongoing economic exceptionalism.

A subsequent rally from below 64 cents to its high above 65 cents came in conjunction with a pullback in USD/CNY from above 7.35 to below 7.30, aided by aggressive defences of its currency by the PBOC (including record strong daily fixes relative to market-implied levels). The CNY later received some backing from upside surprises in the mid-month release of August activity readings (Retail Sales and Industrial Production). Temporary local support for AUD came from the big upside surprise in August employment (gain of 65k against 25k expected).

The AUD’s renewed fall in the last third of the month, to its 2023 lows was largely a USD story, the greenback propelled higher by rising US bond yields (to their highest since 2007) for which the ‘higher for longer’ messaging out of the Fed’s Sep 20 meeting was a major contributor. Weaker US equity markets and associated haven support for the USD also featured, though on occasion stronger HK/China equities shielded AUD from negative DM risk sentiment. Into month-end, a USD pull back, in conjunction with a fall-back in US yields and stronger equities (both DM & EM) pulled AUD up from its lows.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.