For further details, please see the Q1 2019 GDP Preview

Australian GDP Preview: Q1 2019

Prospects of another soft quarter.

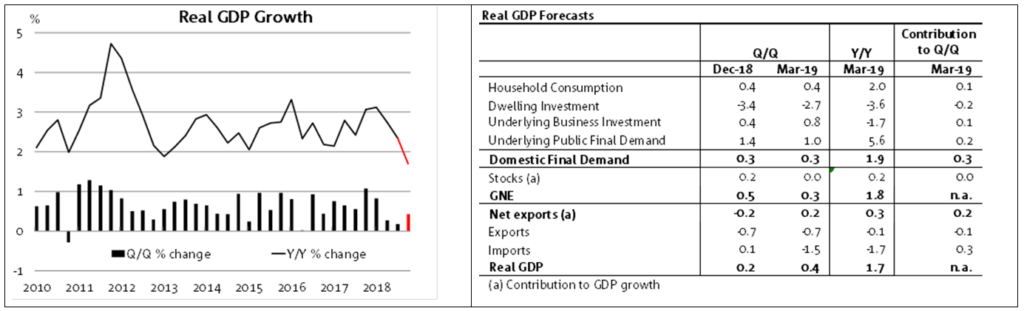

We forecast growth to remain soft in Q1 2019, recording a 0.4% q/q rise, continuing the weakness recorded in the second half of 2018. We expect private domestic demand to be soft, with weak household consumption, another fall in residential investment and only a small contribution from business investment. Offsetting this weakness will be net exports and ongoing growth in public-sector spending. Such a result would be weaker than the RBA’s implied forecast of 0.6% growth in the quarter, forcing it to revise downward its expectation for a rebound in activity. Given weak growth and low inflation our view is for two 25bp cash rate cuts this year, with risk of further stimulus by early 2020. Another quarter of weak growth would suggest increased risk of further stimulus.

- Next Wednesday’s GDP figures are forecast to show another weak outcome for quarterly growth, printing at 0.4% q/q and 1.7% y/y. We expect household consumption to rise by 0.4% q/q with another weak quarter of goods spending offset by a rise in spending on services. Residential construction data suggests that the decline in dwelling investment will be broadly in line with our prior view, and is expected to decline by around 2.7% in the quarter. Offsetting some of this weakness will be a 0.2ppt contribution from net exports and a solid contribution from public demand. Business investment looks likely to make a small contribution in the quarter (0.1%).

- Looking forward, we expect a similar pattern of grow to persist. Household consumption is expected to record only modest growth, with ongoing weakness in incomes and the dwelling investment cycle will continue to play out – subtracting from GDP growth as the outstanding stock of work yet to be done is completed. Offsetting this weakness, we expect public sector spending to continue to support growth, with a large pipeline on infrastructure work and government consumption based on the roll-out of the NDIS continuing.

- The key uncertainty around our forecasts is the outlook for business investment. We currently forecast solid growth in the business sector over the next few years, with the decline in mining fading and a pickup in non-mining investment. However, the NAB business survey suggests there is some risk to this, with conditions having eased significantly over the past year. There is also some risk to our consumption forecasts, with a larger than expected ‘wealth effect’ from falling house prices potentially seeing weaker growth. Against that, the potential for more substantial tax cuts could see a stronger growth in household income.

- Monetary policy implications: Next week’s release will have little impact on the near-term path for monetary policy with a cut for June completely priced in and a follow up likely in August based on already weak inflation, a slowing in growth and little recent progress in reducing unemployment. However, a third consecutive quarter of weak growth will confirm the overall softening trend in economic activity and raise further concern over whether the current pace of economic activity will be enough to see further gains in the labour market. With potential growth estimated at around 2½%, ongoing growth of around 2% or less will likely see a build-up of spare capacity, and hence weaker inflation outcomes for some time. The data will also likely confirm that household income has remained weak on the back of slow wage growth and that the downturn in the housing construction cycle is continuing to play out. Both factors have served to weigh on inflation over the past year and will take some time to fully play out. The data will also provide an update on private business investment – which is forecast to grow relatively strongly over the next few years, offsetting some of the weakness on the household side.