Economic Update

Webinar

Economic Update

Webinar

Wellbeing inches up but anxiety worsens

Insight

NAB’s Non-rural Commodity Price Index declined in Q2

Insight

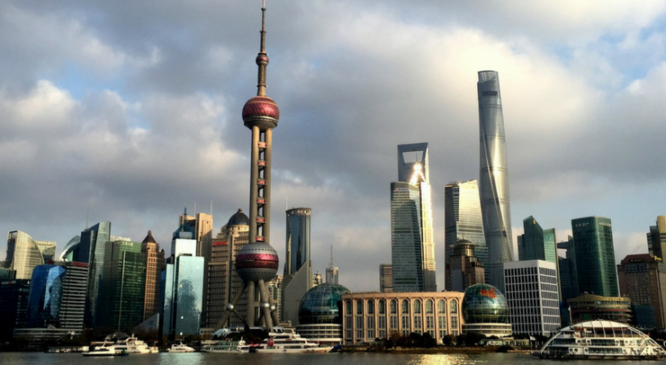

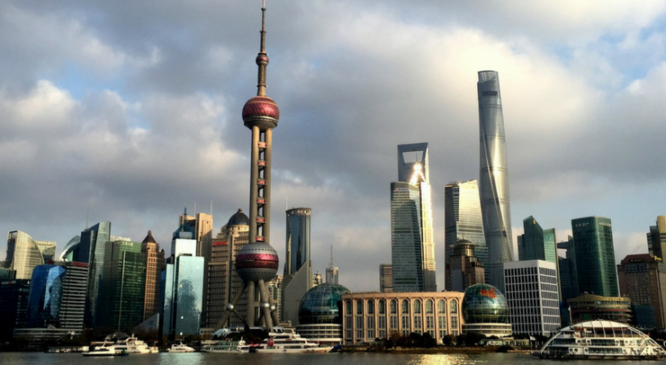

Indonesia may mark a turning point for EM trade policies with China

Insight

NAB pushes out first rate cuts to May 2025 as “lower for longer” strategy plays out

Insight

NAB’s Non-rural Commodity Price Index is forecast to fall by 12.3% in 2024 and a further 12.6% in 2025 – led by softer prices for bulk commodities (iron ore and coal).

Insight

China steps up support for the property sector – but will it be effective?

Insight

Tariffs on China’s EV exports could spark another trade war

Insight

The NAB Australian Wellbeing Index remained unchanged in Q1 2024

Insight

We see our NAB commodity index falling substantially in 2024, despite higher forecasts for base metals and gold.

Insight

Is China headed for a new trade war?

Insight

Inflation disappointment pushes out Fed cuts

Insight

Slower global economic growth in 2024 and 2025 set to constrain commodity demand

Insight

Alan Oster, NAB's Group Chief Economist, shares his insights on the economy

Webinar

Inflation – two steps forward, one step back

Insight

NAB’s Non-rural Commodity Price Index is expected to ease in Q1 2024

Insight

Reports of US supply chain realignment from China to Mexico are overblown

Insight

The NAB Australian Wellbeing Index fell in the final quarter of 2023.

Insight

Labour mobility has slowed as concerns around job security rise.

Insight

Tougher target: China faces a more challenging outlook in 2024

Insight

Weaker global growth in 2024 to drive modest commodity demand

Insight

Good news on growth and inflation – rate cut expectations brought forward

Insight

NAB now expects an unchanged cash rate until late 2024

Insight

Growth, inflation and labour market all easing

Insight

A further slowing in growth

Insight

The inflation figures surprised on the upside in October leading many pundits to believe there will be a rate hike on Melbourne Cup Day. At this webinar we will discuss the RBA decision on the first Tuesday in November and what this means for interest rates.

Webinar

NAB expects follow up hike in February 2024

Insight

Q3 GDP growth very strong but not sustainable

Insight

Searching for some signal in the noise – digging deeper into China’s Q3 GDP data

Insight

Household financial stress eases after rising for the past 6 quarters as Australians grow more accustomed to a number of ongoing pressures, but financial concerns are still climbing among lower income earners.

Insight

Alan Oster, NAB's Group Chief Economist, shares his insights on the slowing down of the economy.

Webinar

Job switching & intentions, employee satisfaction, working from home & perceptions of collaboration & productivity.

Insight

Revising up short-term growth; Fed cuts delayed

Insight

Todays Podcast UK gilts lead global bond yields higher, Italy and France also up a lot, budget news hurts Treasuries recoil ~10bps from new (4.685%) high ahead of expected government shutdown tomorrow This plus reduced UAW pay demands, news of possible Xi-Biden meet, boosts US equity sentiment, AUD/USD recovers more than 1% of recent losses […]

On a month-on-month, seasonally adjusted basis, growth contracted in August

Report

It’s the same story again today – equities hurting, the US dollar higher and bond yields reaching 16 hear highs. What’s changed today is a sharp rise in oil prices. NAB’s Tapas Strickland says there’s a great deal of nervousness that supplies in the US have been destocked too far, down to levels last seen in 2014

US equity and FX markets have for once pushed the bond market vigilantes out of the spotlight, albeit the weakness in stocks and strength in the USD doubtless owes something to the lagged impact of the earlier run up in Treasury yields to post 2007 highs

The bond selloff continued overnight in what was a very quiet night for newsflow. The US 10yr hit a 16yr high of 4.55%, now 4.53%, and up some 11.2bps over the past 24 hours.

The path of central banks does seem to be having as many twists and turns as a Dickensian novel. NAB’s Ray Attrill says the path of bond yields at the end of the week showed how the UK is taking a divergent path from the US, where central bank speakers are still suggesting there will be more hike(s) to come.

Growth remained subdued in Q2.

Report

Are authorities unable or unwilling to address the real problem in China’s economy?

Report

Q3 off to a strong start even as inflation eases

Report

NAB Online Retail Sales Index growth contracted in July.

Report

NAB sees a +0.5% q/q (1.9% y/y) GDP print for Q2 2023 which will confirm the slowing in domestic demand we have seen across other indicators. Both ABS retail sales data and our own transactions data points to a flat outcome for consumption following 0.2% growth in Q1.

Rising costs are having a big impact on small business owners. The good news: there’s lots you can do to stay one step ahead.

Article

RBA on hold for now but one more rise still likely

Insight

Beyond GDP: Insights into wellbeing, and the role money and finances play in our lives

Economic Update

Cash rate likely to hit 4.6% as narrow path sinks

Insight

A soft start to 2023

Insight

Watch the webinar now.

Webinar

Cash rate likely to pass 4% in the coming months

Insight

Beyond GDP: Insights into wellbeing, and the role money and finances play in our lives.

Insight

The cash rate at a peak, but upside risks remain

Insight

Line-ball April meeting to take rates to 3.85% peak

Insight

Alan Oster, NAB's Group Chief Economist, shares his insights on the challenging times ahead.

Webinar

Growth slows as consumption softens

Insight

Beyond GDP: Insights into wellbeing, and the role money and finances play in our lives.

Insight

Three further hikes to come, cash rate to hit 4.1%

Insight

As investors, growth is something we like to see in the economy. While we have entered a period of decline, we see scenarios emerging later in the year that could create growth and upside for equities.

Article

Alan Oster, NAB's Group Chief Economist, shares his insights on the challenging times ahead.

Webinar

Post-COVID normalisation continues.

Insight

Beyond GDP: Insights into wellbeing, and the role money and finances play in our lives.

Insight

Market sentiment: is it a good time to buy, sell, renovate & other property intentions

Insight

Series of 25bp rises ahead; peak rate of 3.6%

Insight

Watch NAB Chief Economist Alan Oster's Economic Update

Webinar

50BP rate rise now likely in Oct; 3.10% cash rate by end-22

Insight

Australian agricultural commodity prices have continued to unwind, posting a second month of lower prices as measured by NAB’s Rural Commodities Index. This comes against a backdrop of continued excellent seasonal conditions, but elevated input costs and rapidly rising interest rates to control global inflation.

Report

A solid result ahead of a slower H2 2022

Insight

We'll help you find the right foreign exchange risk management strategy by understanding your core business and the challenges you face every day.

The “Great Resignation”, Working from Home & Returning to the Office

Insight

NAB now expects rates to reach 2.85% by year-end.

Insight

Beyond GDP: Insights into wellbeing, and the role money and finances play in our lives.

Insight

NAB now expects rates to reach 2.35% by year-end.

Insight

Since last month’s wrap, we have seen further gains in most agricultural commodity prices, tentative signs of a stabilisation in fertiliser prices, combined with a lower AUD and a weakening global growth outlook.

Report

RBA rushing to neutral, rates to reach 2.10% by year-end.

Insight

A solid result despite virus disruptions early in the year.

Insight

An exclusive webinar on Perth’s property market and rent roll insights for real estate agents. Watch now.

Webinar

Australia’s wellbeing falls, but the gap by income now at its narrowest in almost 3 years. Wellbeing diverging across the country, highest in TAS & lowest in WA. Home ownership a significant differentiator. Household financial stress up slightly but falling for low income earners & rising sharply for those on higher incomes. The share of Australians experiencing some form of financial hardship now at a survey low.

Insight

Strong CPI to bring forward first rate increase to May.

Insight

The changing workplace - attitudes to jobs, working from home & barriers to returning to the office.

Insight

RBA to hike rates in June, July, August and November, followed by a more gradual path through 2023 and 2024.

Insight

NAB now sees the first rate hike coming in August; Gradual normalisation to follow through in 2023 and 2024.

Insight

Wellbeing rose in Q4 to levels last seen before the pandemic & household financial stress remains well below the survey average.

Insight

A strong rebound in activity as lockdowns end.

Insight

Despite everything the COVID-19 pandemic has thrown at the small business community the spirit of entrepreneurship is alive and well in Australia.

Insight

RBA to hike in November, QE to end in February as expected.

Insight

Australia's wellbeing levels fall sharply as lockdowns bite in several states. But financial stress has eased & fewer Australians are experiencing financial hardship.

Insight

GDP Q3 2021 – A short and sharp fall, now firmly in the rear view mirror.

Insight

NAB brings forward rate rise timing to mid-2023; YCC to end in November given the RBA's lack of commitment; QE to end in February.

Insight

NAB re-affirms its 2024 rate call and expects economic activity to rebound strongly as restrictions are eased.

Insight

GDP surprises, rising 0.7% q/q.

While Sydney and Melbourne remain a key risk to the outlook, NAB re-affirms its 2024 rate call.

Insight

Wellbeing up & now at its highest level since 2019. Resilience is building, but wellbeing is falling for the unemployed & low income earners. NSW lockdown a key risk.

Insight

Re-Affirming our rate view and an update on the outlook for QE.

Insight

YCC to end at Apr-24 and QE to be tapered to $75bn.

Insight

GDP Recovers Pre-COVID Levels

Insight

NAB recently hosted our inaugural Capital Markets 2021 Virtual Conference for issuers and investors.

COVID-19 continues to present some uncertainty around the outlook, particularly with the rollout of vaccines to emerging markets lagging that of advanced economies.

Insight

Despite a very strong start to the recovery, the economy is likely to have spare capacity for some time.

Insight

We all value our time, but some of us feel we are under more time pressure than others.

Insight

Rebound continues as Victoria ends lockdown.

Insight

A range of key commodity prices rose in January.

Insight

QE to continue, RBA to grapple with ending YCC.

Insight

Markets have been buoyed by positive COVID-19 vaccine news, which could correspond with stronger economic activity and demand for commodities next year.

Insight

A strong rebound as the recovery begins. GDP rose by a large 3.3% in Q3, following the sharp 7% fall in Q2.

Insight

October was another mixed month in commodity markets.

Insight

RBA cuts rates to 0.1% and announces $100bn worth of QE.

Insight

Australians are expecting lasting changes in their post COVID behaviours, but a growing number of us are yearning to return to our “old lives”.

Insight

Trends in global commodity prices remain mixed.

Insight

A desire for social connection is fundamental to our wellbeing; being deprived of it can pose significant mental and physical consequences.

Webinar

At a high level, commodity prices broadly strengthened in August (with coal and gold the notable exceptions).

GDP is expected to decline by 5.8% (-5.1% y/y) in Q2 – the largest quarterly fall on record.

Insight

Commodity markets have continued to display differing trends.

Insight

A number of commodity markets saw stronger prices in June –particularly base metals, gold and oil.

Insight

How Australians are changing their behaviours, their biggest fears, and what of the “new normal”.

Podcast

Trends across commodity markets were mixed in May.

Insight

GDP declines on early COVID-19 impacts.

Insight

NAB Online Retail Sales Index rapid growth accelerated again in April

Insight

The calm before the storm.

Commodity prices generally fell in April – with particularly steep falls in oil and LNG markets, along with declines in iron ore and coal.

Our NAB Online Retail Sales Index data indicates that the rebound in online spend continued in March, with a large jump in sales.

Overall, the global economic outlook has deteriorated since last month, with the downturn expected to far exceed the Global Financial Crisis.

Our NAB Online Retail Sales Index data indicates that there was a rebound in online spend in February.

How Australians are changing their behaviours and their biggest fears in response to the Coronavirus.

Insight

Fiscal stimulus to support near-term growth, with more likely to come in the May Federal Budget.

Commodity markets generally remain volatile, reflecting the uncertainty presented by the Coronavirus (Covid-19) outbreak.

RBA to soon undertake yield curve control, reinforcing fiscal stimulus.

Our data indicates that there was a contraction in online retail sales spend in January relative to December.

A moderate outcome pre COVID-19.

RBA to cut in March and again in April.

A weak result ahead of the Coronavirus outbreak.

Commodity prices have generally retreated in early February in response to the Coronavirus outbreak in China.

Our NAB Online Retail Sales Index data indicates that, while slowing slightly, growth continued in December.

RBA likely to stay on hold in February – with labour market conditions buying time. But cuts are still coming.

NAB Online Retail Sales Index data indicates that volatility continues in sales, with a jump in November sales after contracting in October.

Amid conflicting trade signals, signs growth is stabilising

Economic conditions in 2020 are expected to remain unfavourable for commodity markets.

Little support from fiscal policy to see further cuts in February and June, with a move to QE in the second half of 2020 a real prospect.

Consumer growth slows further.

Our NAB Online Retail Sales Index data indicates that after two solid months of growth in August and September, online retail sales weakened in October.

Consumption growth remains weak.

After surviving multiple challenges to their market share in recent years, the nation’s wine producers have bounced back and look set to enjoy vintage times.

Next RBA cut delayed to February 2020, with the risk of further cuts and QE by mid-2020 without fiscal stimulus.

NAB’s Non-Rural Commodity Price Index is forecast to fall by 7.9% quarter on quarter in Q4 2019.

After a weak mid-year period, online retail sales continued to grow in September, albeit at a more moderate pace than the significant growth rate recorded in August.

NAB’s Non-Rural Commodity Price Index is forecast to fall significantly in Q4 2019.

Private sector stalls.

Private sector weakness continues.

Household weakness persists.

Prospects of another soft quarter.

Household income and construction drag.

Household sector weakness to persist.

Turning 40: Charting the rise of China since reform and opening up

The NAB Cashless Retail Sales Index rose 0.6% in November on a month-on-month basis, repeating its 0.6% (revised) increase in October.

Healthy momentum continues

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.