NAB specialists and clients from across the bank’s Fund Sponsors, Strategic Investors and Alternative Assets (FSA) business gathered over lunch recently to share career stories and advice on promoting greater diversity and inclusion.

Crude oil markets may tighten significantly following weaponised drone attacks on the world's largest oil refinery at Abqaiq on Saturday.

Saturday morning Saudi Arabia time, the world’s largest oil refinery at Abqaiq sustained at least 10 strikes from suspected weaponised drones. Yemen’s Iran backed Houthi rebels have claimed responsibility. The immediate impacts of the attacks include:

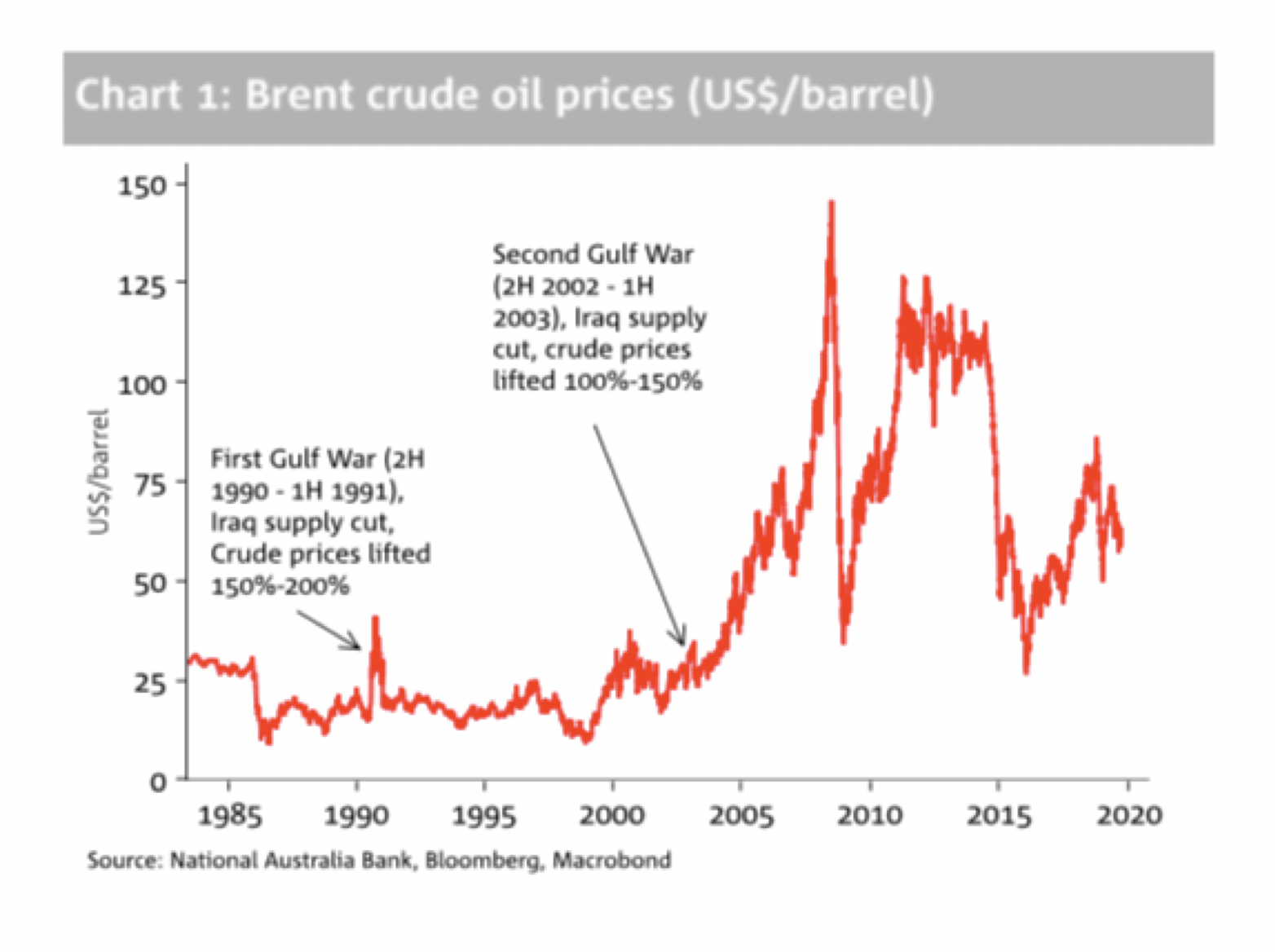

Crude oil and product prices should lift near term from direct impacts, and added uncertainty on Abqaiq’s expected recovery time. But a quick restart would see bullish crude oil prices move as short lived.

For the full picture, download the report- Commodity Watch: Crude Oil.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.