Economic and financial market update

Insight

A bear flattening of the UST curve post a better than expected University of Michigan survey so the S&P 500 closed marginal lower while the USD found some support.

Coming Up Today: NZ PSI, China Q2 GDP, June activity readings and MLF decision, ECB speakers, NY Empire manufacturing

Rest of the Week highlights: AU Jobs, RBA Minutes, NZ CPI, UK CPI, CH GDP & Activity, US Retail Sales, G20, Earnings

US: PPI final demand (y/y%), June: 0.1 vs 0.4 exp.

US: PPI ex food and energy (y/y%), June: 2.4 vs. 2.6 exp.

US: Initial jobless claims (k), wk to Jul-08: 237 vs. 250 exp.

US: U. of Mich. Consumer sent, July: 72.6 vs. 65.5 exp.

US: U. of Mich. 5-10yr inflation exp, July: 3.1 vs. 3.0 exp.

The University of Michigan Consumer sentiment beat expectations in July, jumping to its highest level in nearly two years, inflation expectations also edged higher. Solid US bank earnings result lifted equities at the start of the day, but a bear flattening of the UST curve post the Michigan survey

dampened the initial mood with the S&P 500 closing marginal lower, but up on the week. After falling for five consecutive days, the USD found some support on Friday, edging gains across the board. AUD and NZD lost altitude on Friday, but still close over 2% higher on the week.

The university of Michigan Survey revealed US consumer sentiment improved more than expected in July, extending the improvement recorded in recent months and reaching a level last since in September 2021. The headline sentiment reading came at 72.6, up nearly 13% from June’s print of 64.4 and well above the 65.5 expected by consensus. All components of the consumer sentiment index “improved considerably,” led by increases of 19% and 16% for long- and short-term business conditions. Although the relationship with consumption is not strong, the fall in gasoline prices and gains in the equity market were cited as the main contributors for the survey improvements.

Importantly for the Fed, year-ahead inflation expectations edged up to 3.4% in July from 3.3% in June, while the five-year outlook moved to 3.1% from 3% in June. The report also showed consumers expect a low unemployment rate over the next year, and the majority sees their incomes rising at least as much as inflation.

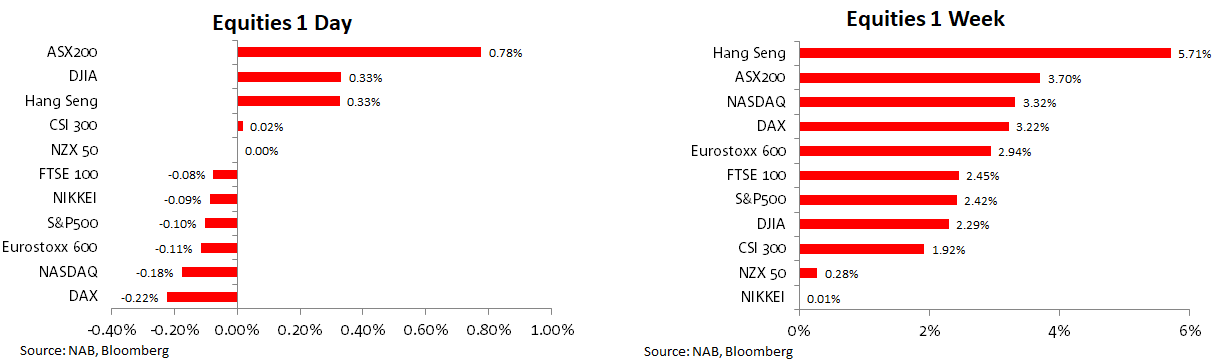

US equities opened Friday’s session higher supported by solid bank earnings reports, but the move up in US Treasury yields (more below) post the Michigan survey release dampened the initial optimism with the S&P 500 ending the day marginally lower at -0.10%. Friday’s decline ended a four-day winning streak which helped the index close 2.4% higher on the week. The NASDAQ close 0.18% down on the day, but 3.3% higher on the week.

JPMorgan, Wells Fargo and Citigroup reported good earnings for the second quarter with the three banks raising forecasts for net interest income. US big banks are seemingly enjoying a sweet spot for lending, with rising revenue outpacing the impact from a smaller group of customers unable to keep up with payments.

Bank shares rose at the start of the day, but in most instances these gains reversed before the close (financials close 0.68% down, Banks -0.9%). On the day Healthcare was the best performing sector up 1.5% with UnitedHealth up over 7% after a better than expected earnings report. Energy was the worst performing sector, down 2.75%.

Looking at other equity markets, Europe’s Stoxx 600 also closed lower on Friday, -0.11%, but 2.94% higher on the week. Our S&P/ASX200 was the best performing index on Friday, up 0.78% and on the week the index gained 3.70% with the Hang Send the top weekly performer up 5.71%.

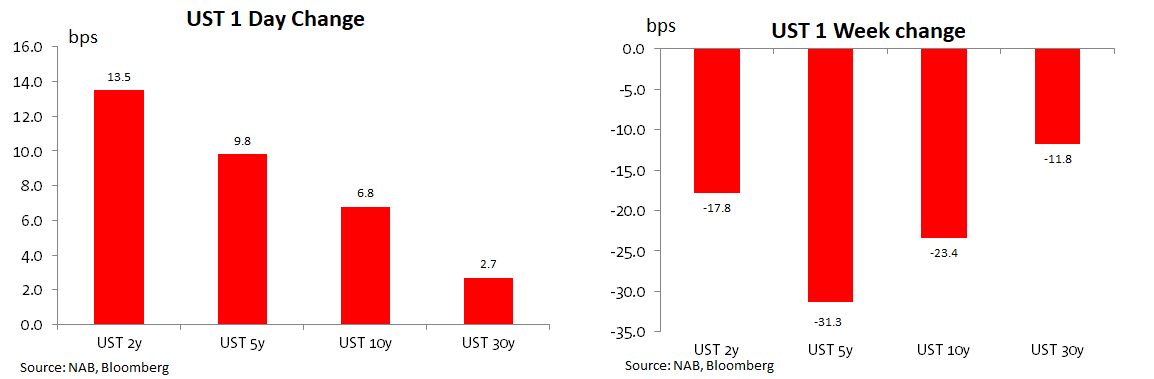

he US Treasury curve bear flattened on Friday following the better than expected University of Michigan survey . Reaction to the uptick in the inflation expectations figures within the survey triggered a scale back in Fed rate cut expectations over 2024, also fuelling a jump in UST yields which were led by the front end of the curve.

Pricing expectations for a 25bps Fed hike at the end of the month were little changed at ~91%, instead bigger moves were recorded over rate cut expectations during 2024. For instance, looking at the OIS market, the Fed funds rates in June 2024 now prices at 4.68% (from a peak of 5.40% in November this year), 14bps higher relative to Thursday’s closing levels.

The 2y UST note gained 14.5bps to 4.751% on Friday while 10y tenor climbed 6.8bps to 3.83%. That said, the weekly theme was a broad decline in yields aided by the lower than expected US CPI print half way through the week. The belly of the curve led the move lower with the 5y tenor down 31.3bps over the past 5 days.

Other core global yields also edged higher on Friday, but just like in the US, lower yields was the theme for the week with 10y Bunds down 12bps to 2.507%, 10 UK gilts were -20 bps to 4.436% while in Australia the 10y bond future fell 27bps over the past week to 4%.

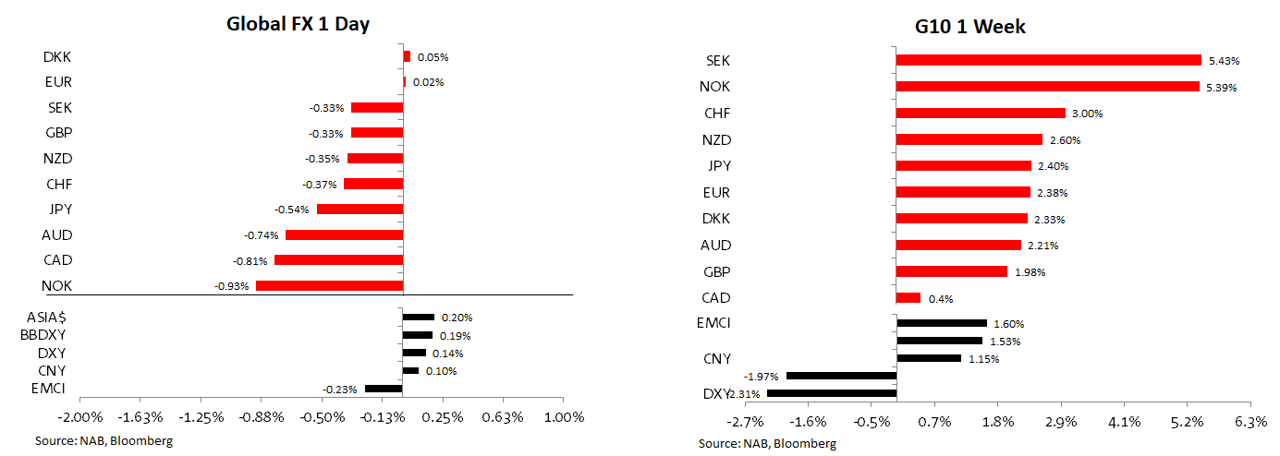

After falling for five days in a row, the USD found some support on Friday with the move up in UST yields and cautiousness in equity market helping the greenback . The DXY gained 0.14% on Friday, a small consolation to the 2.31% weekly decline, which was the biggest five day decline since November last year.

From a technical perspective the weekly DXY close below the 100 mark (99.96) leaves the index vulnerable to further declines. The softer US CPI in June, out halfway through last week, is fuelling the notion that the Fed is close to ending its tightening cycle while other major central banks still have more work to do.

The euro was little changed on Friday closing the week above the 1.12 mark and with room to trade from here. After breaking below key support levels during the week, the move up in UST yields on Friday lifted USD/JPY (+0.57%) and now the pair starts the new week at ¥138.74. Sterling also retreated on Friday (-0.33%) and after trading above the 1.31 mark half way through the week, the pound trades at 1.3095.

The AUD (-0.74%) and NZD (-0.35% to 0.6366) also lost ground on Friday. The AUD starts the new week at 0.6884, up 2.21% over the past five days, but unlike other major G10, the AUD was unable to break above previous high, briefly kissing 69c before easing at the end of the week. Solid risk appetite and a broadly weaker USD have helped the AUD but concerns over China remain a headwind. News over the weekend were of not helpful either with China reporting home prices falling for the first time in 5 months. Yet another piece of evidence the economy is losing momentum. Today, China reports Q2 GDP figures and activity readings for June (more below), another round of soft numbers (as expected) is going to increase the pressure on Beijing to deliver on a meaningful fiscal stimulus and keep downward pressure on CNY. CNY closed Friday at 7.1420, up 1.16% on the week.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.