Online retail sales growth slowed in May following a fairly strong April

Insight

The Aussie dollar is under pressure because of global market uncertainty over COVID says NAB’s Rodrigo Catril on today’s podcast.

https://soundcloud.com/user-291029717/opec-drip-feeds-more-oil?in=user-291029717/sets/the-morning-call

Markets traded with a cautious tone on Friday as investors look at covid delta developments with suspicious minds. Equities were weaker across the board with mixed US data releases unable to shake the risk aversion in the air, the USD and JPY benefitted from safe-haven demand while UST yields were little changed, the 10y note ended the week at 1.2903%. USD strength and risk aversion have kept the AUD under pressure, the pair traded sub 74c on Friday and opens the new week at 0.7403, notwithstanding higher iron ore and thermal coal prices. Oil prices were flat on Friday and late our Sunday, OPEC + agree on a deal to gradually increase output from next month.

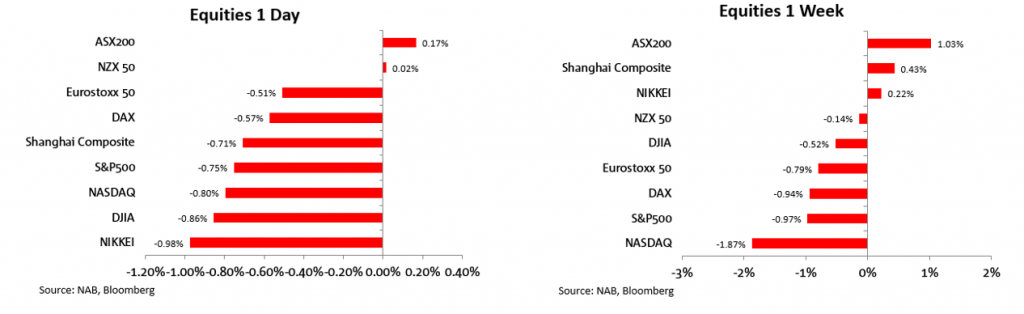

US and European equity markets ended the week on a very cautious tone with the S&P 500 down 0.75% on the day and 0.97% for the week . The NASDAQ was the biggest underperformer within main equity indices, down 0.80% on the day and -1.87% on the week. Meanwhile all major European indices also closed lower with losses between 0.24% and -0.057%. Main US and European indices were also down on the week.

US data releases were mixed on Friday . On the positive side June retail sales were very strong with the core reading beating expectations (sales ex-autos rose 1.3%, above the consensus, 0.4%) although net downward revision were a negative factor, subtraction 0.4%. Details showed core retail sales were strong across the board, but some commentators also noted how the figures were flattered by higher inflation. That said the overall strength of the reports alleviated concern the cashed-up US consumer with $2.5trn of savings may turn cautious as we have seen in other economies. For now that is not the case in the US, but it remains to be seen if US consumers can pick up the slack from the expected fiscal cliff next year while covid infections are also a concerns (more below).

Reaction to US retail sales figures were not longer lasting, the market seemed to take more notice of the University of Michigan index of consumer sentiment which unexpectedly fell to a five-month low in July . The survey commentary noted that higher inflation had put added pressure on living standards, with “consumers’ complaints about rising prices on homes, vehicles, and household durables” reaching an all-time record. Year-ahead expected inflation rose to a 13-year high of 4.8%. The longer term 5-10 year measure, which Fed policy is more sensitive to, rose to 2.9%, at the higher end of the 2.2-3.0% range of the past decade.

The cautiousness in the air can also be attributed to covid developments. US officials confirmed on Friday the Delta variant is now the dominant strain worldwide with the surge in US death almost entirely among unvaccinated people. US cases of COVID-19 are up 70% over the previous week and deaths are up 26%, with outbreaks occurring in parts of the country with low vaccination rates. New cases were surging in the UK, with the daily rate surpassing 50,000 – the highest in six months – and ahead of the lifting of final restrictions from today, so-called Freedom Day. Markets are looking at these dynamics wondering whether the consumer will remain ( UK) or turn cautious ( US), particularly in countries where reopening strategies look set to continue in spite of the increase in infection rates.

Currency movements were relatively subdued on Friday, although the USD and JPY continue to benefit from safe-haven demand given the uncertain backdrop. USD indices gained ~0.12% on Friday with BBDXY and DXY up around 0.6% on the week. The USD remains in an uptrend supported by markets pricing in a 25bp Fed rate hike in H2 2022 versus no ECB or BOJ rate hikes on the policy horizon. Meanwhile the risk aversion evident in equity markets is an added factor of safe-haven demand for the USD.

Looking at G10, JPY is the only pair that has managed to keep up with USD, little changed and now trading at ¥110.03, after trading to a Friday night low of ¥109.7503. GBP was the big underperformer on Friday, -0.45% and opening the week at 1.3767 . Monday is Freedom Day in England and GBP weakness probably reflects investors wariness over the reopening strategy with covid cases continuing to rise (daily rate surpassing 50,000 – the highest in six months), although hospitalisation are not (yet??) rising at an exponential rate. To add to the drama, British health minister Sajid Javid announced on Saturday that he had tested positive for COVID-19, but then added that his symptoms were mild and he was thankful to have had two doses of vaccine against the disease.

Meanwhile the AUD has remained under pressure, early our Saturday the pair traded down to an intraday low of 0.7392, before closing the week at 0.7401 (now at 0.7403). USD strength/risk aversion are the main culprits for AUD weakens, although the technical picture is not helping either, after breaking below the 0.7420 area the AUD now has more freedom to trade lower. Covid dynamics in Australia are also a drag for the AUD, the elevated numbers of infections now means the entire Sydney construction industry will be closed, essential businesses have been defined for the first time, meaning hundreds of others business also have to close. Meanwhile from a fundamental perspective the AUD is showing no reaction to the solid rise in key commodity exports (more below).

NZD was little changed on Friday (now at 0.7004), avoiding the AUD misfortunes following a solid CPI print on Friday that cemented in expectations that the official cash rate would need to head higher from next month. The AUDNZD now trades at 1.0569. it lowest levels since early February.

UST yields were little changed on Friday, the 10y Note ended the week at 1.29%, close to its lows for the week. The theme for the week was curve flattening with the 10y note and 30y bond down 7bps over the past five trading days.

Late our Sunday, OPEC + agreed on a deal to gradually increase output from next month until the full 5.8m b/pd which are currently restricted are added back to supply. Saudi Arabia and the UAE have met halfway following demands from the latter to increase its output limit. This means the UAE’s level was increased to 3.5m b/pd, below the 3.8m it was originally demanding, but above the previous baseline of 3.17m. The baselines for Saudi Arabia and Russia both rose by 500k b/pd to 11.5m. The deal provides consumer a better idea how oil supply will increase over time, although as it has been the case since the pandemic, OPEC+ will meet on a monthly basis to asses market conditions with an alteration to supply a consideration. The agreement also alleviates concerns of a potential breakdown in the cartel as two important allies (Saudi Arabia and UAE) patch up their differences. The deal means an increase in production of 400k b/pd per day from next month should happen as per the originally proposal.

Brent crude was relatively flat on Friday near USD73.50 and the supply deal should ensure that the market will remain tight over the short term. That said, looking at commodities for the week Brent (-2.59%) and WTI (3.69%) oil were the underperformers, while iron ore and thermal coal gained on Friday, closing the week as the top performers, up 3.57% and 1.85% respectively.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

Read our NAB Markets Research disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.