A private sector improvement to support growth

Insight

Ursula von der Leyen and Boris Johnson have been meeting over dinner to discuss the progress of the UK-EU trade deal.

https://soundcloud.com/user-291029717/a-big-day-for-europe?in=user-291029717/sets/the-morning-call

You’ve got to get yourself together, You’ve got stuck in a moment

And now you can’t get out of it, Don’t say that later will be better

Now you’re stuck in a moment, And you can’t get out of it – U2

The positive start to the overnight session, quickly ran out of steam as doubts emerged over any potential progress in EU-UK trade negotiations and US fiscal stimulus.

European equities drifted lower for the rest of the session, scrapping small gains for the day, but the decline in US equities has accelerated in the past couple our hours with IT shares leading the decline.

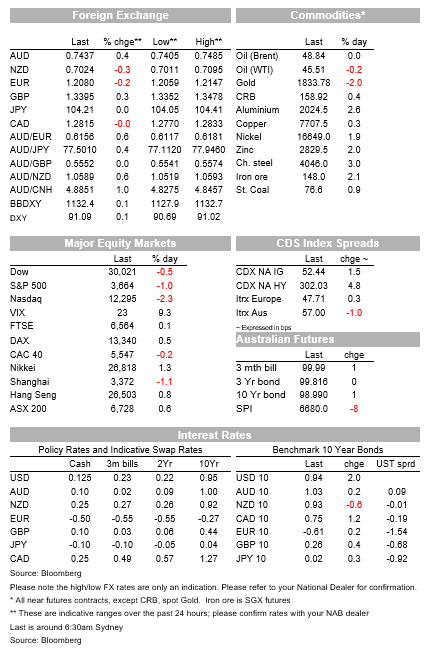

AUD has marginally outperformed against a broadly stronger USD backdrop. 10y UST yields trade at 0.9361%, after trading to an overnight high of 0.9576%.

Before we went home (for those like me who went to the office yesterday) Asian equity markets ex China and US Futures were trading in positive territory assisted by encouraging US stimulus news.

US Treasury Secretary Mnuchin presented House speaker Nancy Pelosi with a new $916bn US fiscal relief plan and the market was also encouraged by Mnuchin tweets noting he had conferred with Republican congressional leaders on the plan, as well as President Donald Trump.

Given recent history, this initial optimism proved to be somewhat premature as key player remain opposed to key details within the relief plan .

For one there appears to be no appetite for compromise on the issue of liability limits and state aid.

Senate Majority Leader Mitch McConnell suggested setting aside his top priority of business liability protections in exchange for Democrats dropping their demands for state government aid in a final 2020 pandemic relief package. But Senate Democratic leader Chuck Schumer said leaving out state and local aid would hurt essential workers across the nation, including police officers and firefighters, who face job losses. Schumer then accused McConnell of sabotaging the bipartisan negotiations saying “And now he’s (McConnell) sabotaging good faith, bipartisan negotiations because his partisan ideological effort is not getting a good reception.” .

There are still lawmakers from both parties pushing to add stimulus payments to individuals. Hence, the fiscal stimulus debates still has plenty to go, an optimistic outcome would be that something is agreed next week while the prospect of no stimulus this year remains a high probability.

US equity markets are now trading in the red with the IT heavy NASDAQ leading the declines, currently down 1.89%.

The S&P 500 is down 0.89% and the Dow is -0.46%. Company specific news have also played a part in the negative vibes with JP Morgan downgrading Tesla and Zoom while Facebook has also come under pressure following news US antitrust officials and a coalition of states sued the company for anti-monopoly behaviour.

Ahead of the much awaited dinner between UK PM Johnson and EU Commission President von der Leyen (currently taking place), there has been no news suggesting any progress over key contentious issues – fishing rights, the governance of a deal, and fair competition rules for businesses.

Political comments highlight the difficulties for a compromise. German Chancellor Merkel warned the dispute over what happens if British rules diverge from the EU could wreck a deal, meanwhile PM Johnsons remarked that “Our friends in the EU are currently insisting that if they pass a new law in the future with which we in this country do not comply or don’t follow suit, then they want the automatic right to punish us and to retaliate,”.

We think it is unlikely an agreement will be reached today, but a good outcome would be that both parties agree to keep talking.

Most European equities managed to record small gains for the day with the Stoxx Europe 600 Index up 0.3%, it highest level since late February this year.

The euro is trading weaker, down 0.35% and it is now back below the 1.21 mark (now @1.2072). The euro decline came late in the session, perhaps reflecting a bit more concern over the EU-UK trade negotiations.

GBP has been more stable, unchanged at 1.3394, after trading to an overnight high of 1.3478. NOK has been the big underperformer, down 1% during a night where all prices have remained relatively stable.

AUD is at the top of the leader board, up around 0.2% against a broadly stronger USD backdrop . The Aussie hit a fresh 18-month high of 0.7485 overnight as the USD weakened further, before paring gains to 0.7440.

Westpac-MI November consumer sentiment climbed to 112.0 from 107.1 and Westpac noted the index is “now 48% above the low in April and has reached its highest level since October 2010 – marking a ten year high. After only eight months the evidence seems clear that sentiment has fully recovered from the COVID recession”. The AUD didn’t jump on the news but may be the good news took a bit of time digest, aiding the AUD climb during the overnight session.

Initial USD weakness overnight saw the NZD make another charge towards 0.71, falling short at 0.7095, before falling back to around 0.7025 as the USD recovered.

There was little market reaction to a number of Q3 NZ activity indicators released– including strong manufacturing data. These data allowed us to firm up our Q3 GDP estimate (data released next week) at 14% q/q, a strong bounce-back following the 12.2% contraction in Q2.

The Bank of Canada policy meeting came and went with no changes to policy, as expected, with the policy rate to be left at 0.25% “until economic slack is absorbed” and inflation is sustainably back to the 2% target (not expected until at least 2023), while the Bank will continue to buy at least CAD4 billion a week in government bonds until the recovery is “well underway”.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.