Online retail sales growth slowed in May following a fairly strong April

Insight

Bond yield have been rising sharply overnight.

https://soundcloud.com/user-291029717/bond-yields-are-at-it-again?in=user-291029717/sets/the-morning-call

And then you scream, You drive me nervous, nervous

And then I screamed, You drive me nervous, nervous, nervous, oh – Alice Cooper

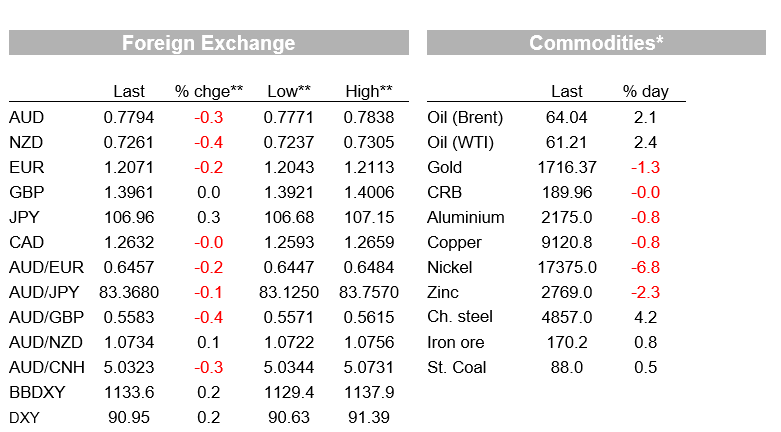

Core global yields are on the rise one more time spooking long duration stocks with the NASDAQ leading the declines in US equities. US data disappointed, but details in the ISM Services survey are yet another reminder that US inflation is on the rise. UK Chancellor’s budget was well received, but the increase in debt issuance also played into the move higher in yields overnight. Currency have been relatively subdued, the USD is mildly stronger, GBP has held its own while AUD and NZD are softer.

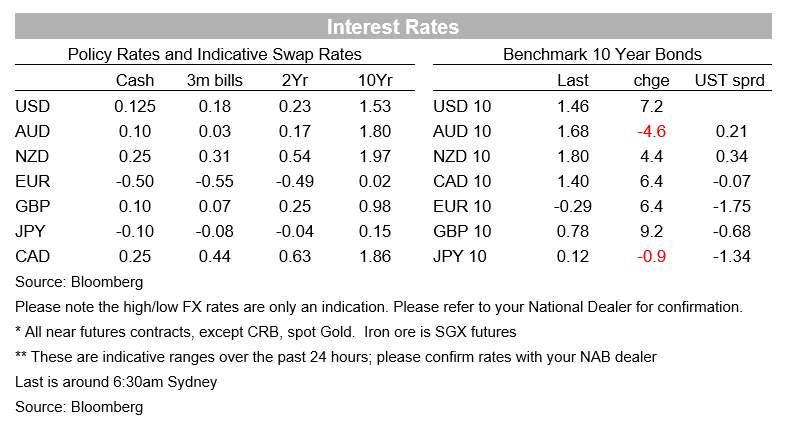

The bond market is back in focus with a decent move in up core yields overnight. 10y UK gilts are up over 9bps to 0.776% while 10y Bunds closed 6bps higher at -0.29%. The UST curve has bear steepened with the 10y Note up 7.5 bps to 1.4652%, after trading to an overnight high of 1.4946%.

Core global yields began their ascendency early in the European session with news and eventual delivery of the UK budget seemingly a factor at play . UK Chancellor Rishi Sunak delivered a balanced Budget, extending near term support in order to help the UK economy embark into a broader and steady recovery while also pencilling budget repair measures later in the forecast when the economy is expected to be on a stronger footing. The furlough wage support programme will be extended through to September, although with a phasing out beginning from July while on the revenue side, some current tax relief will remain in place for a little bit longer, but the corporate tax rate will rise from 19% to 25% from 2023 and income tax thresholds will be frozen, meaning higher effective personal tax rates as incomes rise over time.

That was all well and good, but the move up in yields came from the higher than expected debt issuance plan. UK Debt Management Office is now looking to sell £296b of bonds in FY21/22, almost £50b higher than the market expected. Higher debt sovereign issuance is certainly not just a UK theme and the overnight reaction to the UK issuance plan is a nice reminder of what is yet to come from the US, once the next round of stimulus is agreed and before we start to talk about US infrastructure / green energy spending later in the year.

On the US stimulus front, President Biden has apparently agreed to moderate Democrats’ demands to narrow the eligibility for stimulus checks, but rejected a push to trim extra unemployment benefits. Unofficially, Democrats aids are now suggesting the Bill that will be placed before the Senate will now show individuals earning over $80k won’t qualify for the direct payments, compared with a $100k cap in the previously drafted legislation and the ceiling for couples will now be $160k against $200k before. If approved, this has the potential to reduce the $1.9trn stimulus proposal from the House, although at this stage the final number is still expected to be north of $1.5trn.

Before moving onto other asset classes, comments from ECB policy maker also played into the higher mover in yield overnight. Bloomberg reported that ECB Governing Council members, who meet next week to set policy, see no need for drastic action such as expanding the overall size of their 1.85 trillion-euro ($2.24 trillion) emergency asset-purchase program. This view was backed by comment from ECB Vice President Luis De Guindos and Bundesbank President Jens Weidmann, noting that they were not too worried by the recent move in up yields.

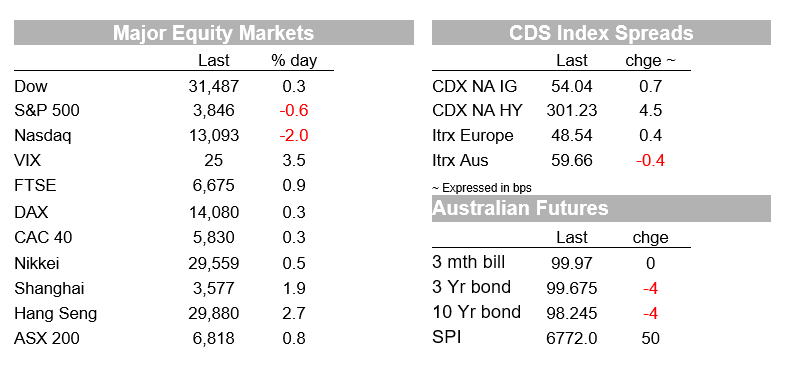

The move in yields dented the appetite for longer duration/rate sensitive stocks with IT and Utilities heading the decline in the S&P 500 . As I type the S&P 500 is down ~0.70% with the IT sector down ~2% and Utilities are down ~1.50%. Meanwhile the NASDAQ is down just over 2% and the industrial heavy Dow is up -0.26%. Early in the session EU equities closed mostly higher with the Stoxx Europe 600 Index up a modest 0.05% after shifting between gains and losses.

US data releases came on the softer side of expectations. The ADP private payrolls rose 117K in February, below the consensus, 205K. The ADP is not the most reliable leading indicator for non- farm payroll, but more recently it hasn’t been too bad, so the overnight print might dampened expectations for a solid non-farm payrolls report on Friday ( 200k print expected). Meanwhile, the ISM services index was 3½ points weaker, down to a nine-month low of 55.3, possibly driven down by the polar blast during the month. On the inflation side, the prices paid index surged further to a 12½-year high of 71.8 – consistent with headline PCE inflation well above the 2% mark, perhaps closer to 3%.

The cautious tone in equities and higher move in UST yields has benefited the USD dollar, specially against the most risk sensitive currencies such as the AUD and NZD (-043% @ 0.7260). In index terms the USD is up around 0.20% (BBDXY and DXY). The AUD is down 0.36% and is now trading below the 78c mark at 0,7793. In addition to the spike in risk aversion (VIX up to 25, +1.5), the AUD has not been helped by the softer commodity backdrop with metal prices and copper down between 1.3 and 2%. Oil prices, however, are the exception, up over 2% following news OPEC + is considering rolling over production cuts into April instead of raising output as a recovery in oil demand remains fragile due to the coronavirus crisis.

Looking at other G10 pairs, the euro is down 0.17% and now trading at 1.2070. USDJPY is again benefiting by the move up in UST yields and now trades at 106.961, after briefly trading above 1.07 mark. GBP is the sole USD outperformer (CAD unchanged), now trading at 1.3960, 0.05% over the past 24 hours.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.