Coming in for landing in a heavy cross wind

Insight

Bond yields are on the rise, in the US and in Australia – for very similar reasons.

https://soundcloud.com/user-291029717/powell-gives-no-answers-bond-yields-climb-again?in=user-291029717/sets/the-morning-call

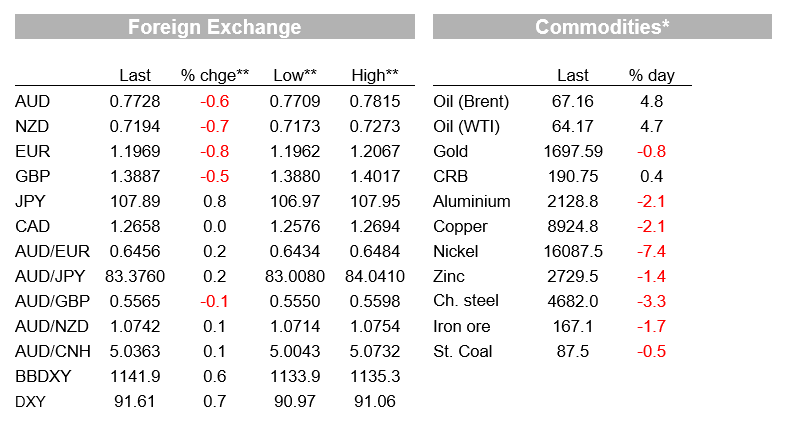

It was quite a night for market volatility with the bond market the centre of attention with the Fed Chair Powell’s speech doing nothing to calm market nerves, at least not today and now with Fed speakers going into purdah into the FOMC on March 17. Treasury yields spiked higher, stocks wilted apart from energy stocks, the VIX is back above 30 and the USD is bid. The AUD/USD is trading at 0.7722 this morning.

As my BNZ colleague Nick Smyth has already noted this morning, the bond market sell-off resumed, the US 10-year Treasury yield pushing up aggressively through 1.5% (currently 1.54%) in the aftermath Fed Chair Powell speaking in the afternoon session. The market was seemingly looking for Powell to push back harder on the recent increase in yields. One poll from an ex-Wall Street big firm strategist found that a portion of those surveyed were looking for an “Operation Twist” type announcement ahead of the upcoming FOMC, 55% expecting a new Operation Twist by June, that would tilt purchases to the long end of the curve. Instead, while the Fed Chair gave a nod to bond market ructions by noting they had “caught my attention”, the Fed was in essence holding back and prepared to use their tools only “if conditions change materially”. Equities turned down and the USD appreciated as US yields rose. The turnaround in the USD has pushed risk currencies such as the AUD and the NZD lower, the AUD down to 0.7730/35 and the NZD back below 0.72.

Injecting another element of volatility into the mix, oil prices spiked higher after OPEC+ decided not to raise output next month against expectations they might sanction some rise in prices. Brent is currently up $2.52/bbl, +4.14% to $66.69/bbl. Earlier in the night, base metals markets were especially active, nickel in particular seeing a big reversal (down 7.4%) on news of more supply possible from Tsingshan Holdings to provide additional nickel matte for the battery market from its Indonesian operations. Other base metals were also weaker, copper down 2.13%.

Powell gave an interview as part of the Wall Street Journal Jobs Summit in the past hour. Powell reiterated a number of familiar dovish themes, including that the Fed was a long way from achieving its goals and there was “a lot of ground to cover” before it would be appropriate to tighten policy. Echoing comments from Fed Governor Brainard from a few days ago, Powell said recent bond market volatility had “caught my attention”, adding that the Fed would be concerned if financial conditions tightened or there were disorderly market conditions. Those comments suggest the Fed might be prepared to increase its bond buying if market conditions worsen or risk asset markets fall sharply, but for now he saw the current policy stance ($120b per month in bond buying) as appropriate.

The market was seemingly looking for Powell to push back more firmly on the recent increase in US yields. As Powell spoke, the US 10-year Treasury yield broke above 1.5%. The US 10y is currently trading at 1.54%, 6bps higher on the day, its intra-day high and approaching the highs set last week, of 1.6%. Equities turned lower as yields rose, with tech stocks underperforming again. The NASDAQ is down 2% and the S&P500 down 1.3%. US energy stocks was the stand-out exception for the day, benefiting from the overnight rise in oil prices. The USD also appreciated, supported from the increase in US real yields and the pickup in risk aversion. The BBDXY USD index is up 0.6% for the session and has traded at a one-month high. The EUR has broken back below 1.20 and sterling below 1.39. Before Powell spoke, the AUD was 0.7810; it’s dropped the best part of a cent to 0.7724 as we go to print.

The NZD took a similar volume of heat and has traded through 0.72 to 0.7186 (AUD/NZD 1.0746), even after the announcement just hitting the screens that Fonterra Co-operative Group Limited has lifted its 2020/21 forecast Farmgate Milk Price range to NZD $7.30 – $7.90 per kgMS, up from NZD $6.90 – $7.50 per kgMS, a move well anticipated by our BNZ colleagues. “It’s very much a China demand led story but there is also good demand for New Zealand dairy across South East Asia and the Middle East.”

The Biden administration has reportedly agreed to tighten the eligibility for those who will receive $1,400 cheques as part of the stimulus package. The compromise is aimed at appeasing centrist Democrats whose votes are needed to ensure the bill passes the Senate. The proposed change is only expected to lower the cost of the $1.9 trillion fiscal package by around $12b, so it’s unlikely to derail the ‘reflation trade’ that has taken hold in markets. The Senate is expected to start voting on the package over the next day or so, with a vote on the bill possible by the weekend.

Oil prices shot higher, with Brent crude oil reaching $67/barrel (+5%), its highest level since the start of 2020. The spike in oil prices followed reports that OPEC+ had decided to keep oil production unchanged in April with Saudi Arabia maintaining its own voluntary supply cuts next month. There had been some expectation that OPEC+ might increase output from next month, as it gradually unwinds its big supply cuts from last year. Comments from Saudi Arabia’s oil minister, that the country was in “no hurry” to restore its voluntary cuts, added to the upward pressure on oil prices. Unsurprisingly, the oil-sensitive CAD has been the two best performing currency over the past 24 hours and is the only G-10 currency not to have fallen against the USD.

Volatility seen in local interest rate markets yesterday with another large increase in long-term rates and government bond yields has set the scene for a choppy makret again today if overnight developments are any guide. The market was seemingly disappointed by the RBA’s decision to revert to a $2b purchase of Australian government bonds under its QE programme, after it upsized its purchase amount to $4b earlier in the week. The RBA also passed up the opportunity to buy 3-year bonds under its Yield Curve Control policy. Australia’s 10-year yield rose 10bps on the session, to 1.78%, which dragged NZ rates up with it. Aussie 10y futures have sold off in tandem with the move in US Treasury yields, trading up to an implied yield of 1.815%.

The NZ government will review the Covid alert levels today. There have been no new Covid-19 community cases for four days running, raising the possibility that there might be some loosening of the alert levels ahead. The current alert levels (Level 3 for Auckland and Level 2 for the rest of the country) were initially set to run until Sunday. There will also be focus in the rates market on the RBNZ’s week-ahead bond buying schedule at 2pm.

It’s US non-farm payrolls tonight, the market looking for a bounce back in employment growth in February (+195k) and a steady unemployment rate (6.3%). We suspect the market will be inclined to look through a weaker number, with investors looking ahead to the big fiscal stimulus planned in the US and the eventual removal of Covid-related restrictions later this year.

Also today and over coming days is the annual National People’s Congress meetings in China, including to affirm their growth agenda, their “2035 vision” to double by then the size of their economy, a strategy to build self reliance in technology, and their climate change agenda. This meetings will endorse their 14th 5 year plan at a time of the 100 year anniversary of the Party. There has usually been a growth target announced at these meetings but their wasn’t last year because of the pandemic and there may well not be one this year for the same reason. The Bloomberg consensus sees China’s growth having rebounded to 8.4% this year (NAB 9.5%) after 2.3% last year, tapering economic support as the management through the pandemic proceeds.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.