Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

The pound took a hammering after Boris Johnson indicated the end of 2020 will be a firm deadline for Brexit, deal or no deal.

https://soundcloud.com/user-291029717/brexit-risk-returns-us-output-boosted-aussie-dollar-lower?in=user-291029717/sets/the-morning-call

Wrote it down and read it out…Hopin’ it would save me

I’ve got new rules, I count ’em, I’ve gotta tell them to myself – Dua Lupa

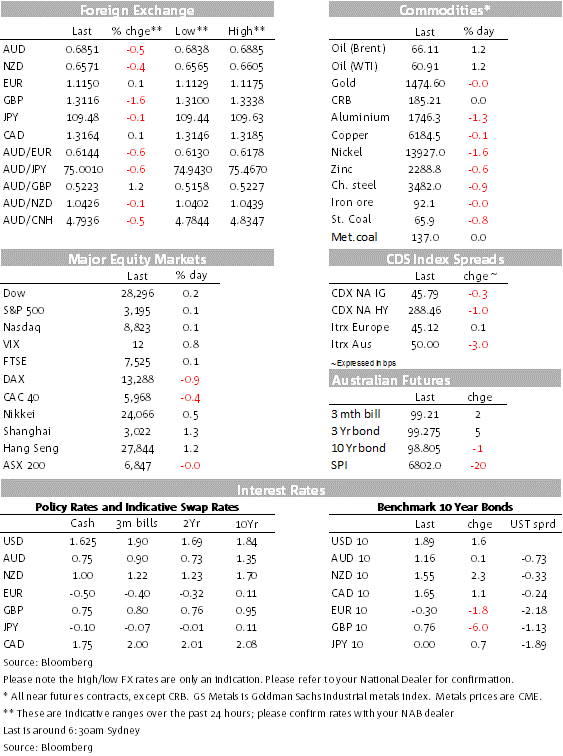

GBP has been the big mover over the past 24 hours, collapsing on the news that PM Johnson will aim to change the law to prevent an extension to the Brexit transition arrangement. European equities had a bad day note helped by this news, but also weighed down by Uniliver sales-growth warning. US equities are steady while the UST curve has bear steepened amid solid US data releases. The AUD and NZD have also underperformed with dovish RBA minutes and softness in European equities factors at play while an underwhelming dairy auction didn’t help the kiwi either.

Last week, the solid Conservative election win boosted GBP on the basis that a Brexit resolution was now more likely, today that still holds true, but PM Johnson move to amend the Withdrawal Agreement Bill, aimed at cancelling the possibility of an extension, has essentially increase the possibility of a no deal Brexit on 31 December 2020. The current Withdrawal Agreement Bill (WAB) provides for an extension of the transition by 1 or 2 years by agreement if the basis of a future trade arrangement is not agreed by mid-2020. Bojo’s plan is for a revised WAB that says a transition arrangements with the EU must end December 31, 2020.

From a strategic move one could argue that this is a smart move by the PM, forcing the EU to come to the table and push for an agreement in 2020 without the option of kicking the can yet again ( wouldn’t that be nice?). BoJo now has a strong mandate with the ability to execute it, this is a stronger negotiating position. The move suggest GBP path in 2020 looks set to be a volatile one, a hard Brexit cannot be ruled out, but the probability of a positive Brexit resolution has also increased. Note too that BoJo could still introduce a new bill for an extension in 2020 if he so wishes, after all not all Conservative support a hard Brexit.

GBP is the big underperformer over the last 24 hours, down 1.7% to 1.3121, the euro on the other hand has been remarkably steady, now trading at 1.1147, up 0.07%. Meanwhile a look at the equity board shows the UK FTSE 100 up 0.08% for the day, the sharp decline in the pound seemingly providing a boost to export led companies. In contrast European equities are the underperformers with the Stoxx 600 index down 0.7%. The personal and household goods sub index the big underperformer following a sales-growth warning from Unilever.

AUD and NZD are the other underperformers, down 0.51% and 0.39% to 0.6849 and 0.66569 respectively. Yesterday dovish RBA minutes didn’t help the AUD ( more on that below) and as a good cousin, the NZD followed in sympathy. Later on, softness in European equity markets on the back of Brexit news weighed on sentiment and both antipodean currencies extended their decline.

Weakness in NZD is probably most surprising given yesterday’s positive data releases. The ANZ NZ business outlook survey showed a further wilting in pessimism and broadly based rise in activity indicators, consistent with the economy growing at a trend-like pace of about 2½%. Business confidence itself rose to a 2-year high, suggesting less concern about the government’s policy direction. Earlier in the day consumer confidence showed a decent increase, sneaking back above its long-term average on the quarterly Westpac measure. These indicators supported our view that the monetary policy easing cycle was probably over. Overnight, the latest GDT dairy auction wasn’t so flash, with a larger fall than expected, down 5.1% in the average winning prices, driven by wholemilk powder (-6.7%) and skim milk powder (-6.3%). This follows a decent move higher in dairy prices and might be the first of many indicators that will show NZ’s commodity prices in a peaking-out phase.

Yesterday the December RBA Minutes noted that “Members agreed that it would be important to reassess the economic outlook in February 2020, when the Bank would prepare updated forecasts. As part of their deliberations, members noted that the Board had the ability to provide further stimulus to the economy, if required.”. So clear evidence of continuing easing bias, prefaced by a reiteration of the view that the net effects of lower rates are positive for the economy (including via a weaker than otherwise exchange rate) despite acknowledgment that some sectors of the community are disadvantaged by lower rates.

In an interview with the WSJ, RBA Harper said that a pause in rate cuts was needed adding that with greater clarity around the likelihood of Brexit and some evidence that U.S.-China trade tensions are cooling, the global outlook could shift quickly and radically – “When these things start to resolve, the outlook could become very different, and you don’t want to be in a place where you are overstimulated,” he said.

The S&P 500 is +0.07%, the daw is +0.1% and the NASDAQ is +0.09%. A mild supporting factor, bearing in mind European equity weakness can be attributed to positive second-tier economic data. Housing starts and permits continue to trend higher (the latter at a 12-year high), with supply meeting much stronger demand, a trend that is likely to continue as rates remain low and household income growth remains solid. Industrial production was inflated by the end of the GM strike, but even excluding that, production remains stronger than implied by the weak manufacturing surveys.

Solid US data, resilience of US equities and rise in oil prices ( Brent +1.24% , WTRI +1.28%) probably contributed to a mild bear steepening of the UST curve with the 30y bond up 3bps to 2.316% while the 10y note climbed 1.5bps to 1.8840%. Meanwhile the rise in no-deal Brexit risks saw UK rates fall, with the 10-year gilt down 6bps to 0.76% and this dragged down other European rates.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.