We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

The early market response to a new Brexit deal and Aussie employment numbers.

https://soundcloud.com/user-291029717/the-brexit-see-saw-and-the-aussie-employment-bonus?in=user-291029717/sets/the-morning-call

This is the beginning, May be too late as far as I can tell.. We see no consequence, This is the beginning of the end – Nine Inch Nails.

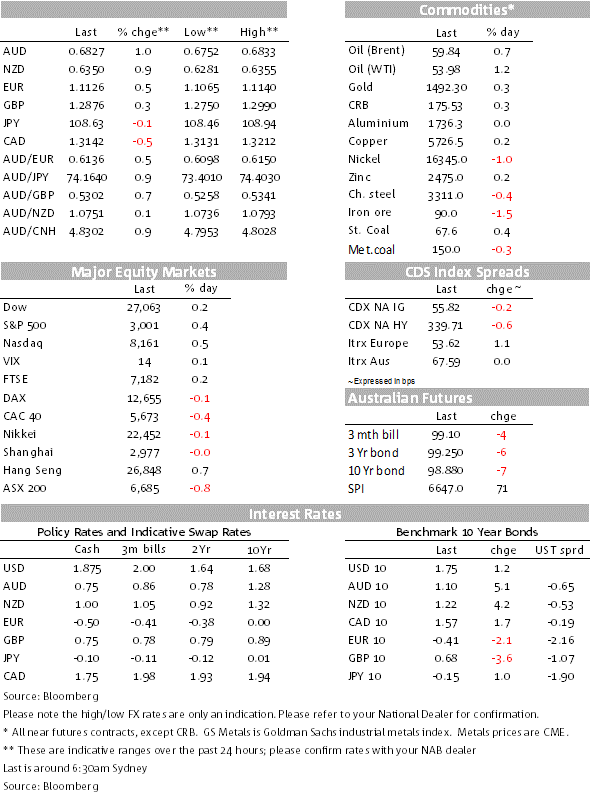

Well, we have potentially witnessed a big step in that direction with the PM Johnson and EU officials agreeing on a new Brexit deal overnight. The news triggered a spike in the pound and broad improvement in risk sentiment, but in the end the euphoria proved short lived as the DUP and SNP (Scottish National Party) members said that they wouldn’t support the deal. The UK Parliament is set to vote on the deal on Saturday and the arithmetics right now don’t look encouraging. US equities began the session on a positive note, but eased back later in the session. The S&P500 made a new short lived excursion above 3000, earnings results were mostly positive, but key US data releases were softer than expected. UST yields close marginally higher and the USD is broadly weaker. AUD and NZD outperform, boosted by yesterday’s better than expected AU unemployment rate and positive vibes in the US-China trade and Turkey-Syria front.

After a lot of drama over the past few days and extensions on seemingly non-negotiable deadlines, overnight UK PM Johnson and EU Commission President JC Junker made the big announcement that the UK and EU had finally agreed on a new Brexit deal. The news triggered a broad improvement in risk sentiment across markets with GBP leading the way jumping from an intraday low of 1.2755 to an overnight high of 1.2990. The move however proved short lived as headlines started hitting the screen with DUP and then SNP officials confirming they would oppose the deal.

Now that the UK Government and the EU have agreed on a deal, attention shifts to the British Parliament vote on Saturday with the DUP and SNP opposition suggesting PM Johnson does not have enough votes in order to get the deal approved. Much will depend on the PM’s ability to get some if not all DUP and SNP MPs on side in addition to also getting the backing from the 21 ex Conservative PM he expelled from the Party last month. Worth pointing out that the new deal not only makes some controversial concessions on Northern Ireland’s custom relationship with the UK (a major sticking point for the DUP), relative to PM May’s original deal, Johnson’s new proposition also provides the UK more room to set its own rules and ability to make trade deals independently. These concessions may be appealing to hard Brexitiers, but they are also likely to alienate soft Brexitiers that blocked May’s original deal as they wanted a closer alignment with the EU. Needless to say the Labour Party also said that they cannot support the deal. So in addition to the Australia-England RWC quarter finals games, now we also need to keep an eye on Brexit development on Saturday night! Rejection of the deal might well see more political brinksmanship around a “no-deal” Brexit, but the most likely scenario would be yet another extension of the 31 October Brexit date. GDP is back down to 1.2865, barely higher from this time yesterday.

UST yields ended the day marginally higher with the 10y note climbing to 1.7956%, before reversing course to end the day at 1.757%, about 1bps higher relative to this time yesterday. As well as the disappointing news out of the UK, US data releases were on the soft side. US housing starts were much weaker than expected, albeit dragged down by the volatile multi-family units component. The underlying data remained strong and permits were stronger. Industrial production was weak, not helped by the GM strike, but even excluding that the manufacturing sector looks fragile. The Philly Fed business outlook index fell by more than expected. Citigroup’s US economic surprise indicator has fallen steadily through October, highlighting the underwhelming run of US data over the past couple of weeks, and reversing the positive run through September.

The Stoxx Europe 600 Index closed 0.1% lower after rising as much as 0.9% on the Brexit news and similarly the S&P 500 opened with some vigour punching through the 3000, but in the end the move lacked momentum with the index now set to close below the mark. IBM results disappointed, but Morgan Stanley joined other big US banks (ex GS) with a better than expected report while Netflix also impressed notwithstanding concerns over an increasingly competitive environment.

The USD has ended the day broadly weaker with GBP and EUR a little bit stronger, but notably the AUD and NZD are at the top of the leader board up 0.99% and 0.92% respectively. NZD is up to 0.6347 and the AUD now trades at 0.6825 after getting a double boost over the past 24 hours. Yesterday the Australian unemployment rate edged lower to 5.2% which saw a trimming of rate cut expectations for early November – now seeing only about 4bps priced at that meeting, while December now looks like a closer call, with 14bps of rate cuts priced (previously 18bps). Then the broad USD weakness gave the AUD another leg higher, softer US data not helping the USD, but comments from China’s Ministry of Commerce spokesman, Gao Feng, saying that China is currently working on text of phase 1 deal with the US and it is also discussing next phase of trade talks also played a part. Gao also added that China hopes it can make progress with the US in removing tariffs. Adding to the positive mood music on the geopolitical front, early this morning US Vice President Pence and Turkish President Erdogan agreed to a temporary pause of military operations in Syria that could be extended if Kurdish fighters leave the border region. EM FX also made inroads against the USD with the high yielding ZAR (+0.88%) and TRY leading the charge.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.