We expect growth in the global economy to remain subdued out to 2026.

Insight

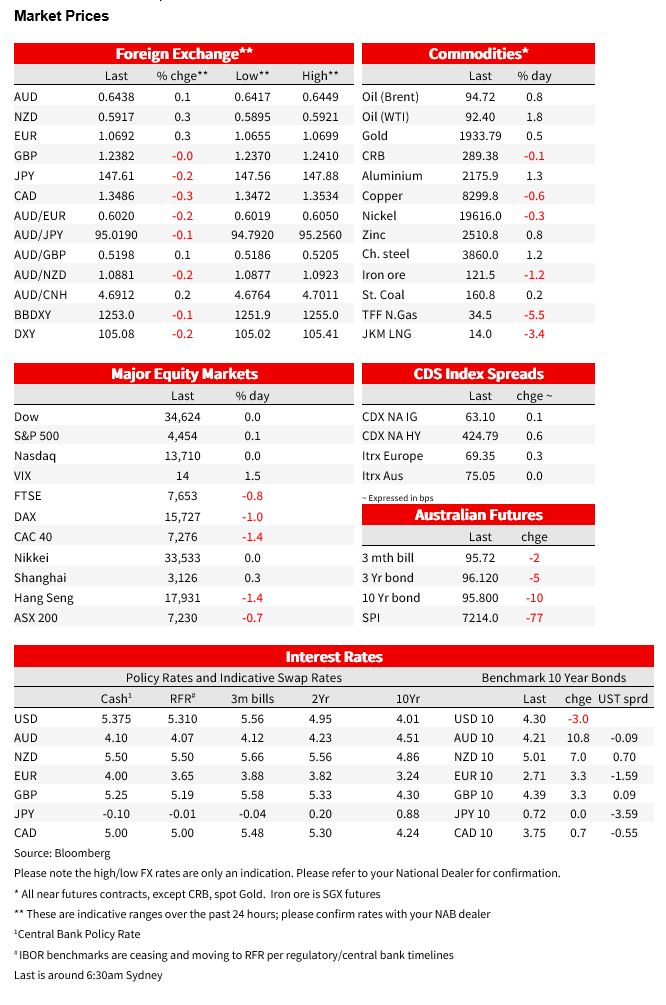

US equities start the new week in a sedated manner while European counterparts record sharp declines. Front end yields have a led a bear flattening of the UST curve and the USD is a tad softer

Events Round-Up

NZ: Performance of services index, Aug: 47.1 vs. 48.0 prev.

US: NAHB housing market index, Sep: 45 vs. 49 exp.

Good Morning

We’re living in the calm before the storm – Saxon

US equities start the new week in a sedated manner while European counterparts record sharp declines. Front end yields have a led a bear flattening of the UST curve and the USD is a tad softer with European pairs at the top of the leader board. The AUD consolidates above 64c.

US equities closed little changed with the S&P 500 and NASDAQ ending the Monday session up by 0.07% and 0.01% respectively. In a classic case of calm before the storm, investors have seemingly taken a wait and see mode ahead the Fed, BoE and BoJ meetings later in the week. On company news Apple gained close to 2% while Tesla fell over 3%. The latter not helped by a downward revision to the company’s earnings estimates by Goldman Sachs.

Earlier in the session European equities recorded a nasty start to the new week with all regional equity indices closing in the red while the Eurostoxx 600 fell 1.13%. Sentiment was not helped by ECB comments suggesting EU rates will remain high for longer while a Reuters report also noted the ECB is considering plans to withdraw excess liquidity from the banking system (more below).

The fall in the Eurostoxx 600 comes after the benchmark recorded its biggest weekly advance in two months. In addition to ECB concerns noted above, company specific news where not helpful either. Soc. Generale shares declined by the most since March 2020 after the bank’s new strategic plan disappointed investors, while Nordic Semiconductor retreated after the chipmaker reduced quarterly revenue and margin forecasts. Yesterday Asia’s shares closed mixed with the Hang Seng down over 1% amid renewed concerns over the health of the Chinese property sector.

Moving onto the rates market, the UST curve shows a flattening bias with the 2y Note up 3bps to 5.06% while the 10y tenor is down 2 to 4.30%. Of some interest, Jason Wong, my BNZ colleague noted the Bank for International Settlements (in its quarterly report) warned about the growing leverage in the US Treasuries market, an area of financial market vulnerability. It noted the popularity of the basis trade or exploiting the gap in pricing between the prices of Treasury bonds and futures. Exploiting the pricing gap was seen to be a factor behind $600bn of short positions in Treasury futures. It said that “margin deleveraging, if disorderly, has the potential to dislocate core fixed-income markets”.

Earlier in the night, German yields closed 3-4bps higher across the curve with 30-year yields hitting a high of 2.86%, surpassing the 2.82% peak recorded on Friday that was already the highest since 2011 . ECB pricing expectation were little changed with a peak in the deposit rate seen close to 4%, suggesting the market thinks the ECB has probably reached the top in the current tightening cycle. Consistent with this view, ECB Vice President Luis de Guindos said that underlying inflation should continue to moderate, while Governing Council member Peter Kazimir implied that September’s interest-rate increase may be the final one of the cycle. Also speaking overnight, ECB Villeroy said the ECB will keep interest rates at 4% for as long as needed to tame inflation- indicating he doesn’t favour future increases at this stage, but with inflation not seen close to 2% until 2025, Villeroy is suggesting rates will remain high for an extended period of time.

The FX market also shows modest moves with the USD a tad softer (DXY -0.17% and BBDXY -0.07%) with European pairs at the top of the leader board. The Euro is 0.26% stronger and currently trades at 1.0691 , after reaching an overnight high of 1.0699. Overnight gains in the euro were supported by a Reuters report noting the ECB plans to soon start discussing how to tackle the multi-trillion-euro pool of excess liquidity in banks. An uptick in reserve requirements could be the Bank’s the first move.

The CAD and NZD gained around 0.25% over the past 24 hours , with the former boosted by a move up in domestic yields following better than expected Canadian housing starts figures and a surprise uptick in industrial product prices in August. NZD gains were backed by a move up in domestic yields (10y NZGB closing back over the 5% mark), notwithstanding news that the NZ performance of services index fell for a third consecutive month in August. At 47.1, the headline index remained consistent with an economic contraction in Q3 particularly when viewed against a contractionary PMI index as well.

The AUD has traded in a tight range, very briefly slipping to 0.6417 around midnight, recovering shortly after and now starts the new day at 0.6437, little changed from levels this time yesterday. RBA minutes are released this morning (Sydney time), but after an unchanged September meeting outcome we don’t expect them to reveal any surprises (more below).

As for overnight economic data releases, for the record, the US NAHB housing market index was weaker than expected, falling 5pts to a five-month low of 45, with weaker homebuilder sentiment attributed to concerns about elevated mortgage rates, which recently broke up through 7%. This portends weaker sales and housing starts over the remainder of the year.

Coming Up

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.