Our global forecasts are unchanged and we continue to expect soft global growth of only 3.0 to 3.1% between 2024 and 2026.

Insight

Are the markets more concerned about the relative strength of the Chinese currency than they are about tariffs?

https://soundcloud.com/user-291029717/china-fixes-whilst-trump-fiddles?in=user-291029717/sets/the-morning-call

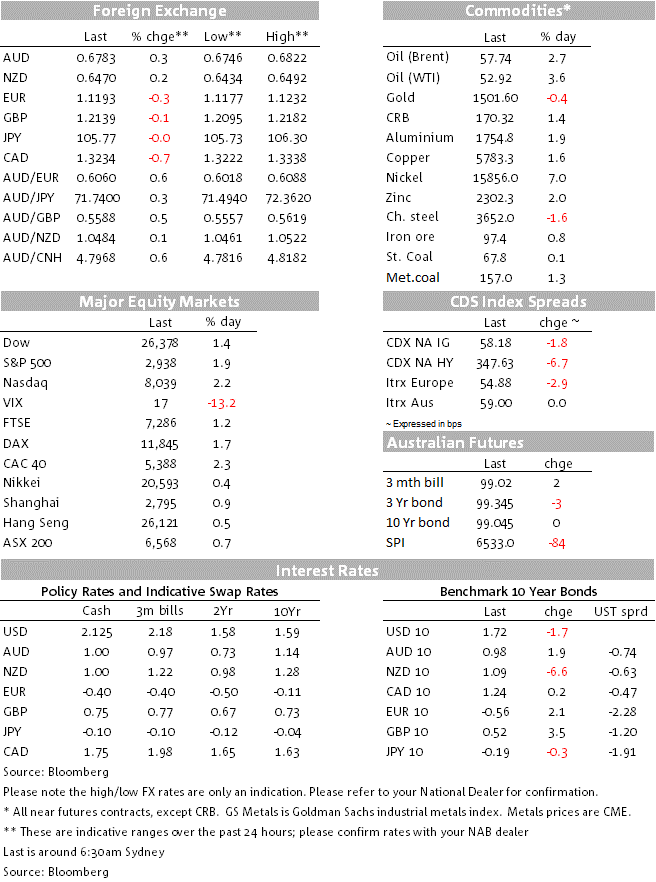

Risk sentiment improved overnight (though remains fragile) on a combination of a stronger than expected CNY fix, and suggestions of greater fiscal stimulus from Germany and China. Notions of fiscal stimulus in the pipeline takes out today’s song title courtesy of Justine Timberlake’s Can’t Stop the Feeling! Equities are up sharply with the S&P500 +1.9%, while risk-sensitive currencies are higher including the AUD +0.6%, NZD +0.4%. The overall USD (DXY) however is flat over the day with falls in EUR -0.4% and GBP -0.1% and only a small rise in USD/Yen +0.2%. Yields are mixed with US 10yrs -1.5bps to 1.72%, but German Bund yields are higher +2.1bps to -0.56 on fiscal stimulus hopes, while Italian bond yields are up a sharp 11.5bps on election fears. Hopes of fiscal stimulus will be important to watch in coming weeks with a broad-based global expansion of fiscal policy being one way to scare a bond market with yields at extreme lows. As we go to print the US has said it will hold off on Huawei licences after China’s halting of crop buying – though this has been flagged in the press in recent days with little market reaction.

First to hopes of fiscal stimulus. German lawmakers have sent smoke signals that they may abandon the balance budget target in order to finance the fight against climate change with the rule no longer being seen as sacrosanct. One senior German minister said “The challenge now is how to shape such a fundamental shift in fiscal policy without opening the floodgates for the federal budget”. There has been some pushback within the government and Euronews reports Berlin would link any new fiscal expansion to a climate protection package that the Cabinet is expected to sign-off on around the September 20, funded via green bonds (see Euronews for details). Whether we see a fiscal expansion remains to be seen, but an expansion is desperately needed by the Eurozone economy. Chinese press also report new stimulus measures being drawn up to offset the effects of the trade war, and it is also worth reiterating that NDRC’s approved FAI projects are up around 81% in the first of half of the year compared to last year.

The key driver of improved sentiment overnight was the PBoC setting the CNY fix at 7.0039, lower than the 7.0156 expected by markets. While initial headlines played up the fact it was the first fix above 7 since 2008, given the fix was lower than what markets were expecting it was taken as a signal that the PBoC was using its discretion and not letting the Yuan depreciate rapidly and helping to offset market forces. Chinese trade data also added to the more positive tone with the trade balance at $45.1bn against $42.6bn expected. With both exports and imports better than expected it played to the view of activity holding up ok in July, though the data does pre-date the latest intensification in the trade war. It is also worth noting that the trade surplus with the US remains at the levels seen late last year despite tariffs to date, and underpins notions of a protracted trade war.

Global rates were mixed overnight with European rates up around 2-4bps with 10 year German Bund yields +2.2bps to -0.563%. UK Gilt yields continue to trade below the bank rate at 0.517% with Brexit uncertainty the overriding factor. US yields did initially pushed higher to 1.78%, driven by what it seems the German fiscal stimulus headlines, but retraced to be -1.7bps on net to 1.72%. Intra-day volatility has picked up since the latest intensification in the US-China trade war.

In FX, risk sensitive currencies were buoyed with the AUD +0.6% to 0.6804 and the NZD +0.4% to 0.6481 – the kiwi experiencing its first gain in 10 days. A strong rebound in the oil price (WTI +3.6% to 52.96) on the back of Saudi supply cuts helped oil-linked currencies with USD/CAD -0.7% to 1.3234 and EUR/NOK -0.8% to 9.9847. Saudi Arabia stated it planned to keep oil exports below 7m barrels in a bid to stabilise prices – equivalent to a 700,000 barrel a day cut; note the latest IEA data estimated the oil market was in oversupply by around 1.3m barrels a day.

The USD (DXY) was little changed at 97.60 with weakness in the EUR (-0.4% to 1.1181) and GBP (-0.1% to 1.2139 though reached a low of 1.2095) weighing. Election uncertainty is weighing on both EUR and GBP. Italians look like they are closer to going to the polls with the two major coalition parties voting against each other in Parliament on a bill, while Deputy PM Salvini said the government lacks a majority and he would make his position clear by Monday. Brexit uncertainty continues with summer headlines not great with the FT reporting Boris Johnson could hold a general election in the “days after” the UK has left the EU – in effect preventing Parliament from avoiding a no-deal Brexit. While this is unlikely, it probably brings forward moves for a vote of no-confidence in early September and until Parliament bares its teeth, GBP is likely to come under further pressure.

President Trump meanwhile continues to rail against the dollar, stating “Fed’s high interest rate level, in comparison to other countries, is keeping the dollar high, making it more difficult for our great manufacturers” and wanting substantial Fed cuts to equate US monetary policy with that of the ECB and BoJ. While the USD sits above most estimates of fair value, there remains very few alternatives to the Dollar with the UK embroiled in Brexit, the Eurozone needing reform and fiscal stumulus, and Japan not wanting to see Yen appreciation.

Finally, in terms of data there was little out overnight. US Jobless Claims remained at low levels at 209k and below the 215k consensus and is consistent with a still healthy labour market. Focus though will be going forward and whether the latest intensification in the US-China trade war affects firms’ investment and hiring decisions.

A very busy day ahead domestically with RBA Governor Lowe giving testimony to the House Economics Committee, followed by the publication of the August Statement on Monetary Policy. International focus will be on Japanese and UK Q2 GDP, while Chinese CPI and Canadian Unemployment data will also garner some attention.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.