Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

The Euro gained on two fronts overnight.

https://soundcloud.com/user-291029717/chinas-credit-surprise-boosts-euro-heres-why?in=user-291029717/sets/the-morning-call

Money makes the world go round, the world go round, the world go round, Money makes the wold go round, Of that we both are sure – Liza Minelli

Arguably the most important economic and market news since Australia went home, or shifted rooms, yesterday was the China January money supply and credit numbers. These had been particularly keenly awaited in light of recent efforts by the PBoC to tighten monetary conditions somewhat via liquidity withdrawals and which had produced higher overnight lending rates, but which we had interpreted more as an effort to rein in some speculative excesses in local markets that an overt tightening of monetary policy.

This view was vindicated by the credit numbers showing the broadest ‘Aggregate Financing’ measure jumping by CNY5.17tn. last month, above the 4.6tn expected and the (seasonally soft) 1.7tn in December. New Yuan Loans (traditional bank lending) was up 3.6tn, above the 3.5tn expected. The tightening of money market liquidity does show up in slightly weaker M2 money supply growth, down to 9.4% from 10.1% yr/yr.

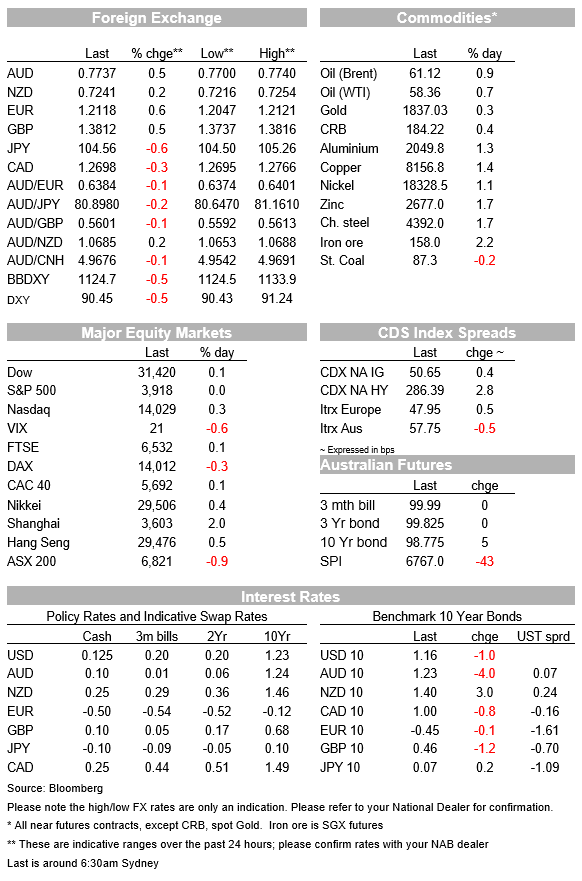

The fuel to fire the ongoing strong China recovery is evidently available in abundance, a message not lost, perhaps curiously, on the EUR/USD exchange rate, which is up 0.5% overnight and the main contributor to the 0.5% fall in the DXY index. The broader BBDXY index is down a slightly lesser 0.4%. Here, it is possible to argue that since Germany is the Western Hemisphere economy most leveraged to China, the strong credit data are a good signal for ongoing/even stronger export demand.

Also supportive for the Euro have been latest comments from incoming Italian Prime Minister Mario Draghi, who told lawyers on Monday evening that he’ll make a common EU budget a policy priority (i.e. more movement towards fiscal union). He has also outlined a program focused on Italy’s EUR209bn share of the EU recovery fund, with more investment and fiscal reform. Italian 10-year bond yield fell to a record low of just below 0.50% yesterday before pulling up to 0.51%, and as we have notes on many occasions, a narrowing Bund/BTP spread correlates well with a higher EUR.

The China credit numbers also gave a small immediate boost to the AUD, AUD/USD lifting to 0.7736 before pulling back, though as we type it is pushing back up to re-test this level. Note here that oil, and all base metals prices, are currently higher on the day, albeit helped at least in part by the weaker USD. The NZD is also higher (+0.25%) but lagging AUD such that the AUD/NZD cross has risen to its best levels of the month, just shy of 1.07. So much for RBNZ/RBA relativities, for the moment at least, in which respect yesterday’s lift in NZ inflation expectations to just shy of 2% played with the grain of thinking regarding the RBNZ lifting its OCR well ahead of the RBA’s Cash Rate; for the currency cross though, a story for another day.

Yesterday’s NAB Business Survey showed the main readings remaining above long-run average levels in January, though Business Conditions did dip to +7 from 16, while Business Confidence rose to +10 from 5. Elsewhere capacity utilisation lifted further to 81 from 80.8 and is consistent with the unemployment rate trending lower over the next six months. Note capacity utilisation is back to average levels, while being above average in retail and manufacturing. In trend terms conditions remains strongest in retail, wholesale, mining and business services, and weakest in construction and in recreational and personal services. The latter categories obviously impacted by the lockdowns in parts of Sydney and Melbourne in early January.

NFIB survey, showing small business optimism dipping to 95.0 from 95.7 and well below the 97.0 expected, and Dec. JOLTS job openings, which at 6.646mn were above both the 6.4mn expected and last month’s 6.527mn.

US equity market are coming into the last hour of trading flat to slightly higher (S&P unchanged, NASDAQ +0.3%) following what was a mixed day for European bonds, while 10 year Treasury yields are down 1.5bps to 1.155%. US break-evens are unchanged though, implying 10-year real yields are down 1.5bps to -1.05% (their lowest since 28 January).

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.