Total spending grew 0.9% in June.

A swift turnaround in market sentiment on Friday. NAB’s Ray Attrill provides some of the reasons.

https://soundcloud.com/user-291029717/deltas-day-off?in=user-291029717/sets/the-morning-call

PBoC 50bps RRR cut for all lenders, effective July 15

China June Aggregative Financing Y3,670bn vs 2,890bn expected

China June M2 money supply growth 8.6% vs 8.2% expected

UK May GDP 0.8% vs 1.5% expected

Canada June 230.7k vs 175.0k expected

Canada June unemployment rate 7.8% from 8.2% as expected

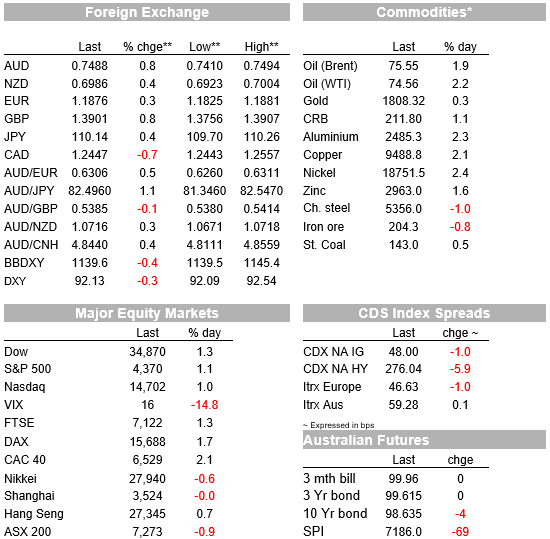

Delta what delta? Friday’s market price action in offshore markets, across all asset classes, came in complete contrast to Thursday (and Friday’s APAC morning) when fears were starting to grip markets that the spread of the delta covid strain could deal a killer blow to the already stressed global reflation trade. Instead, we got new record highs for US stocks, higher US bond yields with curve re-steepening, a softer USD with commodity-linked currencies claiming 4 of the 5 top spots amongst the majors (along with GBP) and, with the exception of a slight fall in iron ore futures, stronger commodity prices across the board.

Market sentiment was already shifting for the better prior to the announcement at the end of the China trading day that the PBoC was enacting a 0.5 percentage point cut to Reserve Requirement Ratios, effective from July 15. Though a move has been flagged earlier in the week by the reports of China’s State Council urging just such a cut, the timing, and extent – i.e. applying to all lenders – was earlier and more aggressive than generally anticipated, ourselves included. The PBoC said that the cut will help financial institutions to repay maturing MLF loans (Medium Term Lending Facility) and meet their seasonal liquidity demand in mid-to-late July. The move also aims to offer more support to small and medium-sized firms, which this year have been facing rising costs with commodity inflation. The PBoC did though qualify its actions, saying the cut doesn’t mean a shift in its prudent monetary policy stance, and says it will not flood the market with liquidity.

The PBOC announcement came at around the same time that it released the June money supply and credit data, showing a further small acceleration in M2 growth and stronger than expected New Yun Loan and Aggregative Financing numbers . The latter sees annual growth also accelerating slightly, to 12.3% from 12.2% and goes some way to allaying fears that this year’s weakening China credit impulse is contracting further. The data also offers some reason for hope that this coming Thursday’s Q2 GDP data and June activity data are not going to spring significant downside surprises, though of course that remains to be seen..

The other notable data release Friday was Canada’s June labour market report showing a stunning 230,700 rise in employment, which although concentrated in part-time employment will only strengthen expectations the BoC will taper its bond further next week, bearing in mind too that the average of Canada’s three core inflation measures is running at 2.3%, so above its 2% target and in the upper half of the 1-3% target range.

Also, early in the US day, but not market moving, The Fed published its Monetary Policy Report to Congress, ahead of testimonies by Fed chair Powell on Wednesday (House) and Thursday (Senate). It notes that although the unemployment rate has moved down sharply from its pandemic high, broad measures of labour conditions continue to point to substantial slack in the labour market. It talks at length about maximum employment and the inability to measure it directly (remember the Fed’s assessment of this having been achieved is a stated pre-requisite for starting to lift rates). On inflation, the report re-iterates the view that the recent inflation surge will prove transitory, noting that “inflation has increased notably this spring as a surge in demand has run up against production bottlenecks and hiring difficulties. As these extraordinary circumstances pass, supply and demand should move closer to balance, and inflation is widely expected to move down.”

Earlier Friday, San Francisco Fed President Mary Daly told the Financial Times that the spread of the Delta covid variant poses a threat to the recovery, saying “If the global economy . . . can’t get . . . higher rates of vaccination really get Covid behind [us], then that’s a headwind on US growth. Good numbers on the vaccinations are terrific but look at all the pockets where that isn’t yet happening.”

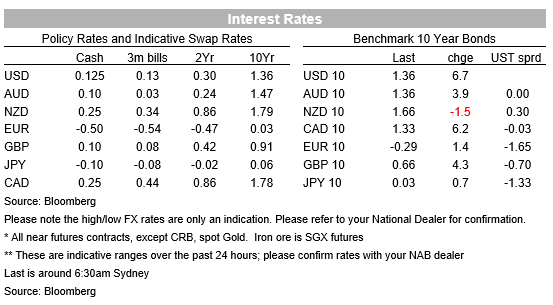

In the US Treasury market , after fair bit of head scratching regarding Thursday’s fall in 10-year yields to below 1.3%, but where observers have for the most part been content to point to ongoing positioning stress/unwinds and seasonal factors (including the lack of supply amid ongoing Fed QE) mixed in with safe-haven support, Friday saw a decent sized reversal. 10s were up over 6bps (as too the 30-year) with 5s + 4bps and 2s +2bps, so also a partial reversal recent curve flattening. Friday’s moves still leaves the 10-year 6.5bps lower on the week – and the Australian 10-year 12bps lower even after Friday’s 4bps rise. European yields also rose, but to a much lesser extent.

Curve re-steepening was a particular boon to the banking sector, +2.9%, was by far the best performing sub-sector of the S&P500 on Friday (+1.1% to a new record closing high). After banks, there were 2.0% gains for both Materials and Energy, the latter helped by a rebound in crude oil prices where Brent ended the day back above $75 (+$1.43 to $75.55). Almost all other commodity prices were also higher, in which respect a softening USD alongside improved risk sentiment and presumably some easing of China slowdown concerns given the RRR cut and better credit data were, at the macro level, all helpful to the cause (chart below).

In FX, USD indices lost 0.3-0.4% , in another sign that day-to-day moves in US bonds markets and cross-country relative yields, are currently irrelevant. Real 10-year yields, little changed at -0.91% at 10-years on Friday and much nearer the bottom than the top of the last year’s range, still point to USD weakness in our view. NOK remains the high-beta oil price FX counter, +1.3% Friday but AUD once again pulled back from the seeming abyss, 0.8% higher to 0.7488, having not quite cracked below 0.74 earlier in the day (low of 0.7410).

Weekend Sydney covid news, with 77 cases reported on Sunday morning after 50 on Saturday and which further confirms the likelihood of the current lockdown extending into August, isn’t doing AUD any favours at present, though we’d note that during the most recent sell-off, the NZD has fared just as poorly as AUD (and failed to bounce as much on Friday, up 0.4%). And CAD, which has everything going for it with the employment data, oil prices, etc, still couldn’t outpace AUD (but which is often the case when the USD is softening).

Weaker than expected May UK GDP of 0.8% failed to do GBP any harm. In fact it was the second best G10 currency Friday after NOK, perhaps anticipating the joy of an English Euro-2020 victory. This morning’s report is earlier than usual, to allow your scribe to go and discover whether that might actually come true, or whether 55 years of hurt is set to extend

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.