Long-term signal vs. Short-term noise

Insight

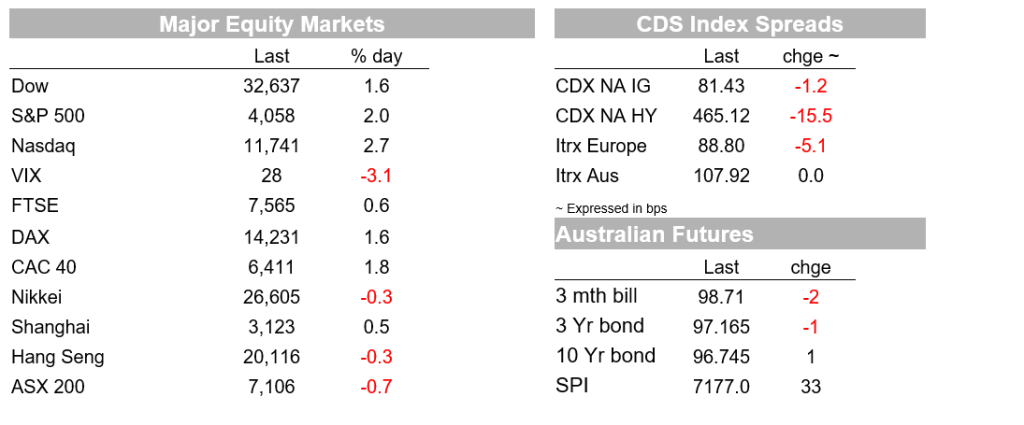

US equities had a strong night with the S&P500 +2.0% and NASDAQ 2.7%.

https://soundcloud.com/user-291029717/equities-and-bonds-markets-divided?in=user-291029717/sets/the-morning-call&utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

Positive earnings from retailers helped assuage concerns of a greater than expected slowing by consumers (Macy’s reported robust sales and lifted its guidance, while discount chains Dollar General and Dollar Tree also beat). Equities are also sitting in the glow of the FOMC Minutes on Wednesday where it appears markets have interpreted them as opening up the possibility of a Fed pause in Q4 2022, while some note the front loading of hikes may have tightened financial conditions sufficiently. With all rallies in bear markets, positioning has likely amplified moves.

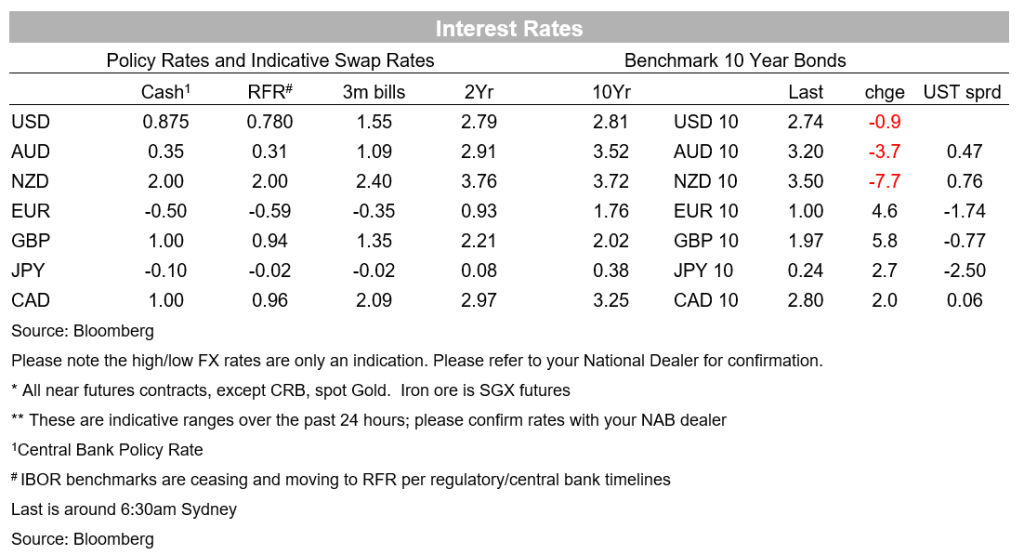

The lift in equities hasn’t split over to other asset markets with yields broadly steady – US 10yr -0.7bps to 2.74% (though the 10yr did get as high as 2.80%). The 2-year rate is flat at 2.49%. Given the Minutes, markets have pared Fed Funds pricing a little, now expecting a rate around 2.63% by end of year from 2.67% on Tuesday. FX moves have also been relatively calm, though there is a hint of broad USD weakness, which continues the trend seen over the past few weeks, DXY -0.3%. The AUD is +0.5%, making similar gains as the EUR (+0.6%) and GBP (+0.5%).

The Chinese yuan has been the weakest currency on our watchlist, with USD/CNY up 0.7% for the day to 6.74. Analysts has been busy revising down GDP growth forecasts to well below the government’s 5.5% growth target for this year. In yesterday’s report we noted the bleak outlook provided by Premier Li Keqiang. Achieving the growth target, or anywhere near it, is impossible given the zero-COVID strategy driven by President Xi. Shanghai will reopen schools after a three-month shutdown, but there are lingering fears over Beijing’s fate as a small number of COVID19 cases continue to be found in the community and in-person school classes remain suspended.

Mixed data flow was not marketing moving. US Q1 GDP was revised down a tenth to -1.5% annualised from -1.4%. Initial jobless claims as broadly as expected at 210k against 215k expected. The housing market continues to feel the heat from higher rates with pending home sales -3.9% m/m against -2.1% expected. Given the recent consolidation in yields the 30year fixed mortgage rate was fallen to 5.10% according to a statement from Freddie Mac, from a recent peak of 5.57%, though of course is still well up from the 3.11% level that rates began the year.

In the UK, Chancellor Sunak announced a 25% windfall tax on oil and gas companies, expected to raise £5b, sweetened by a small tax break on investment for the industry. The sum raised will go towards a support package worth £15b for low-income households in Q4 when they will face another ramp up in their household energy bills. The economy is on the verge of economic recession, and this policy will help at the margin to take some pressure off that developing scenario. An expansion of the fiscal cushion may mean the BoE will have to lift rates higher.

Finally, oil price continue to rise, up 3.1% on the day with Brent at $117.60. Ahead of the US driving season, gasoline inventories declined to the lowest seasonal level since 2014. And US natural gas prices continue to climb higher ahead of the air conditioning season, up 25% for the month to date and up 142% for the year to date.

Coming up:

Market Prices

Read our NAB Markets Research disclaimer. For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.