We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

The US Federal Reserve has cut interest rates as expected.

https://soundcloud.com/user-291029717/fed-cut-and-hold?in=user-291029717/sets/the-morning-call

Is this it? Is this it? Is this it? – The Strokes

Some mornings the biggest challenge is what song line or title can I find in order to capture the market mood from the overnight session, but on rare occasions you are spoilt for choice. Today it was hard to get past The Strokes’ classic tune Is this it?, but Crowded House Don’t dream is over was a close call, and after a chat with one of my colleagues before leaving home yesterday even Dannii Minogue This is it was a consideration (only for half a second!). Anyway, the much anticipated event from the overnight session was the FOMC policy decision and as expected the Fed lowered the funds rate by 25bps, but signalled a pause was now likely. The USD went up and then down post the announcement and Powell’s press conference. The UST curve bull flattened with the 30y tenor leading the charge and after marking time prior to the Fed decision while US equities have ended the day higher. CAD has been the underperformer as BoC stood pat as expected, but surprises the market by admitting discussing the merits of an insurance rate cut.

The FOMC lowered the Fed Funds rate by 25bps to 1.50% to 1.75% as expected (the IOER was also lowered by 25bps). Fed George and Rosengren dissented for the third straight meeting, preferring no rate cut, while Fed Bullard voted with the majority after dissenting in favour of a 50bp rate cut in September. The FOMC statement was little changed, but notably the Fed replced its previous pledge to “act as appropriate to sustain the expansion” with a commitment to “monitor the implications of incoming information for the economic outlook as it assesses the appropriate path of the target range for the federal funds rate” . So the Statement left us with a sense that, after three rate cuts, the Fed is now done with its mid-cycle adjustment, shifting to a wait and see mode. Further easing from here will require the data to signal weakening in the economy or a deterioration in the global economy.

Fed Chair Powell reinforced the idea that the Fed is now on hold for a while saying that “ We see the current stance of monetary policy as likely to remain appropriate as long as incoming information about the economy remains broadly consistent with our outlook of moderate economic growth, a strong labor market, and inflation near our symmetric 2% objective. We believe monetary policy is in a good place to achieve these outcomes.”. As usual Powell’s statement had the caveat that if the outlook turns out softer than expected, the Fed will be ready to act appropriately.

Price action pre and post the Fed and Powell’s speech was initially consistent with the notion of a hawkish rate cut. The USD went up and 2y rates spiked higher as market participant pushed out the expectations of further easing in 2020. This move however reversed in the latter part of Powell’s press conference as the Fed Chair noted that the US was not exempt from global deflationary pressures. Powell said “We just touched 2% core inflation to pick one measure. Just touched it for a few months and then we’ve fallen back,” adding that the US was not exempt from global disinflationary pressures.

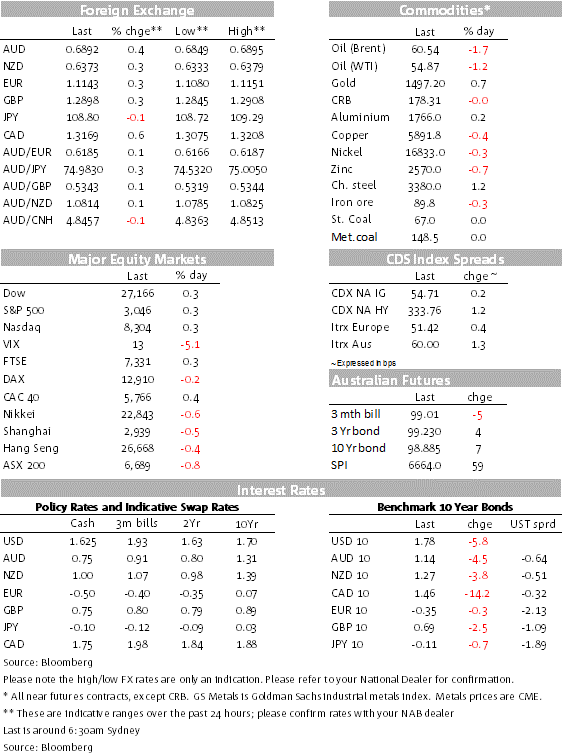

To your scribe the deflationary comment appears to have triggered an acceleration in the decline in longer dated UST yields enhancing the flattening of the curve that was already evident post the FOMC announcement. Relative to opening levels the 30y bond ended the session 7.2bps lower at 2.263%, the 10 year note fell 5.8bps to 1.78% while the 2y rate closed at 1.606%, 3.9bps lowered.

The USD initially jumped higher on the hawkish rate cut interpretation ( DXY trading to an overnight high of 97.99), but as the UST curve continued to bear flattened the USD reversed its course , ending the day broadly weaker with DXY now trading at 97.46.

Down 0.57% as the BoC surprised the market by signalling an easing bias. The BoC kept its cash rate on hold at 1.75%, as expected, but revised down its growth forecasts and made reference to the strength in the Canadian dollar and the “worsening global situation.” Signalling that it had moved towards an easing bias, the Bank said it had considered whether an insurance cut was appropriate at this meeting, although it decided against it. The Bank said it would be “monitoring the extent to which the global slowdown spreads beyond manufacturing and investment” in evaluating whether to cut rates in future meetings. The BoC’s shift to an easing bias has led to a large (0.7%) fall in in the Canadian dollar and an 11bp fall in the 10 year Canadian government bond yield. The market has increased its probability of a rate cut at the BoC’s next meeting in December to 30% and a rate cut is now fully-priced by late next year. The BoC statement is a reminder that while financial markets have recently shifted towards a more optimistic view on US-China trade relations and global growth, central banks will be more cautious and slower to move.

The AUD and NZD essentially marked time ahead of the FOMC, but the broad USD weakness that ensued at the Powell press conference boosted the antipodean currencies. AUD has been the biggest beneficiary of the two, now top of the leader board, up 0.48% and notably finally breaking above the September 12 high of 0.6889. The AUD now trades at 0.6899 and technically it now has a clearer path to make further gains. NZD now trades at 0.6382. up 0.42%.

US equities ended the day higher after meandering before the Fed event. The S&P 500 and NASDAQ closed +0.33%, surging higher after Powell said inflation would have to be at a “persistently high rate” above its 2% target in order for the central bank to hike rates.

US GDP beat expectations slightly, coming in at an annualised rate of 1.9% in Q3 vs. 1.6% expected. The upside surprise was due to slightly stronger consumption growth, which increased 2.9% (annualised) on the quarter. The year-on-year rate of growth fell to 2%, its slowest pace since the end of 2016 and consistent with the moderation in a broad range of US economic indicators this year. There was also a small upside surprise to the ADP employment index, although this indicator has had a mixed track record with forecasting recent payrolls results. The Bloomberg Consensus is for an 85k increase in payrolls in October (data released on Friday night), with the General Motors strike likely having subtracted around 50k jobs from the headline result.

Chile called off the APEC Summit that was due to take place next month due to the ongoing street protests. Presidents Trump and Xi had been planning to sign the Phase-One trade agreement at APEC. The market moves were reasonably modest, with a US spokesperson later saying that it expected to finalise Phase-One “within the same time frame” and Treasury Secretary Mnuchin quoted by the New York Times as saying a deal was likely to be signed in November.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.