Our global forecasts are unchanged and we continue to expect soft global growth of only 3.0 to 3.1% between 2024 and 2026.

Insight

The markets breathed a collective sigh of relief that the Trump-Xi meeting at the weekend culminated in some sort of truce.

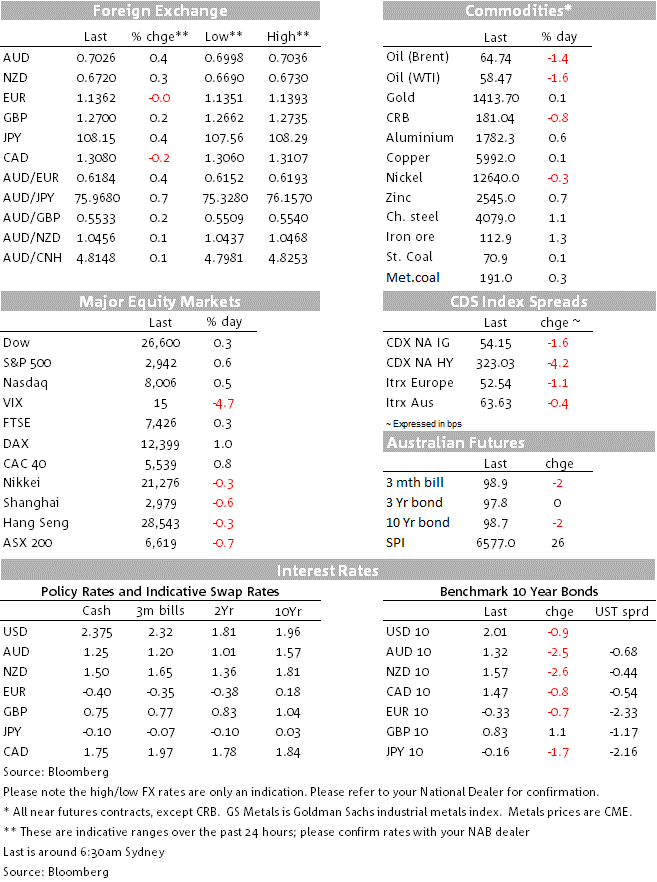

Mild positive reaction to the weekend’s US/CH trade war ceasefire with risk assets opening higher. USD/CNH is down around -0.5% to 6.8320, while there has been some reversal of the risk-aversion seen early last week with USD/Yen up some +0.3% to 108.21. The mild positive tone has seen both the AUD and NZD open higher by around 0.2% with the AUD now 0.7030. Cash bond markets are still closed, as are futures, though yields are also likely to open higher on the day as will stocks.

As for the Trade Truce, the US has agreed to postpone further tariffs, but to make no change to existing tariffs. There was though a mild positive surprise with Trump raising the possibility of allowing US firms to sell to Huawei – though this has been subsequently tempered by advisers with Kudlow stating that Trump wasn’t planning a “general amnesty” on Huawei and that export controls would remain in place for goods considered sensitive to national security.

Overall then it seems the outcome is very similar to the trade truce that existed prior to May – that truce unravelling as China allegedly backtracked on prior US demands and the US pushing aggressively for changes to China’s economic model. Consequently although a worst case outcome has been averted, the threat of tariffs remains and it is unlikely the truce gives much confidence to firms’ investment and hiring decisions. Chinese media have also largely interpreted it this way with the South China Morning Post headlining: “Despite Donald Trump and Xi Jinping’s G20 handshake, mistrust and disputes persist”. As such, it is likely that soft manufacturing conditions will persist until if and when a fuller agreement is fleshed out.

Data on Friday reinforced the hit that business is taking from tariffs. The US Chicago PMI weakened sharply to 49.7 against 53.5 expected and is now crucially below the 50 level that defines expansion/contraction. Interestingly in the Chicago PMI firms were asked about the impact of tariffs with “80% of firms…[stating] that they were negatively impacted, with tariffs raising prices of their goods leading to a pullback in orders” (see Chicago PMI report). The disappointing Chicago PMI also sets up the US Manufacturing ISM today to disappoint expectations (see Coming Up below). The US also had the Core PCE Deflator at 0.2% m/m and 1.6% y/y, while Consumer Inflation Expectations out of the Uni Michigan Survey were only revised slightly higher to 2.3% from 2.2% (note the long-run average in this measure is 2.8%).

Eurozone data was mildly positive with the Flash Core CPI coming in at 1.1% y/y against 1.0% expected. Despite the small beat, it is unlikely this will alter views of the need for further ECB policy stimulus. There has been though one push back for monetary stimulus in both Europe and the US with BIS head Carstens urging central banks to preserve their ammunition for more serious economic downturns: “We would stress that it is important to preserve some room for manoeuvre for more serious downturns” with “Monetary policy should be considered more as a backstop rather than as a spearhead of a strategy to induce higher sustainable growth,”

While cash bonds are yet to open, on Friday US 10yr yields remained around 2.00%. The trade truce on the weekend should see US and global rates higher and some steepening. However, given weakness in manufacturing indicators it is likely market expectations of a Fed rate cut in July will remain – though could be pared back – markets priced 1.3 cuts as at Friday’s close). The more important driver for yields will likely be Friday’s Payrolls where consensus looks for a print of 160k, up from last month’s +75k.

Also out on the weekend was China’s Official PMIs. The Manufacturing PMI remained in contractionary territory at 49.4, against 49.5 expected and 49.4 previously. All components of the PMI declined in the month apart from Raw Material Inventory. The less widely cited Non-manufacturing PMI was in line with expectations at 54.2 (though did edge lower from 54.3) and suggests most of the trade war impact to date has been contained to the manufacturing sector. With both Manufacturing and Non-manufacturing edging, the overall Composite PMI fell to 53.0 from 53.3. There was one mild positive surprise though, New Orders in the PMI sub-sectors of Construction and Steel rose in June, pointing perhaps to recent stimulus measures gaining traction. Nevertheless, given manufacturing still remains soft overall, further stimulus may be required.

Finally, for Australia Housing Indicators are starting to show some tentative signs of stabilisation. Weekend auction clearance rates are likely to be above 60% for the third consecutive weak with Sydney having a prelim clearance rate of 72%, compared to 49.7% last year – volumes though are still 20% lower than last year.

Datawise, a fairly light APAC session ahead. RBNZ’s Bascand speaks on “Macroprudential policy: past, present and future”. Australia has House Price data for June will be under focus amid some early tentative signs of stabilisation – the past six months have seen more moderate rates of decline while the daily house price data has recorded very mild house price rises for the past three weeks. China has the Caixin Manufacturing PMI – expected to be little changed at 50.1 from last month’s 50.2 (note the official Manufacturing PMI came in at 49.4). Japan also has the Tankan survey where conditions are likely to have deteriorated for both large and small firms.

Europe sees the final-versions of the Manufacturing PMI along with Unemployment data. The UK also gets its first and only read on the Manufacturing PMI with markets looking for another subdued print of 49.5, little changed from last month’s 49.4. The Bank of Finland is also hosting a conference on “Monetary Policy and Future of the EMU” with both PBoC’s Yi and the Fed’s Clarida speaking.

The US has the Manufacturing ISM with the consensus looking for 51.0, down from May’s 52.1. NAB’s models suggests some downside risks here based on the regional indexes so far – the Chicago PMI on Friday surprised sharply to the downside at 49.7 against 53.5 expected (see preview note in your inbox). Fed vice-Chair Clarida also speaks, but is in Finland at an confidence on “Monetary Policy and the future of the EMU”. As such we may have to wait for any side media interviews he does in Helsinki to learn much about his views of policy following this weekend’s G20 meeting. No doubt there will also be a few other Fed officials who may be prompted for media interviews in the coming days.

Further out in the week, Australian focus will be on the RBA meeting on Tuesday and the post-meeting dinner speech by the Governor. NAB sees the RBA cutting rates to 1.00% with 18/26 economists also tipping a rate cut. Overseas focus will be on US Payrolls on Friday and whether this justified a July Fed rate cut.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.