Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

The pound is riding higher on the back of optimism.

https://soundcloud.com/user-291029717/pound-higher-on-brexits-midnight-mercy-dash?in=user-291029717/sets/the-morning-call

The Peter Lee surveys are now taking place. If you have appreciated NAB’s research support please let your company’s representative know.

There’s a fair bit going on elsewhere, but Brexit news continues to hog the headlines, perhaps the most electrifying of which overnight has been the one reading “EU, U.K. negotiators closing in on draft Brexit deal’.

The EU Summit commences tomorrow remember and runs through Friday. Michel Barnier, the EU’s chief Brexit negotiator, has been demanding a legal text of any agreement by midnight UK time, giving Wednesday to determine whether a deal is fit to be put to the EU summit for consideration. On the basis that it is and gets in-principle approval – two very heroic assumptions at this stage – the UK parliament is due to have a special sitting on Saturday to see if a deal can achieve parliamentary approval (remembering that October 19th is the date by which the Benn Act legally compels the UK government to seek a Brexit extension through January 31st 2019 if there has been no deal by then). Watching the UK news channels last night, the arithmetic for achieving said approval is challenging to say the least. Meanwhile the UK Times has carried a report saying that Germany has warned that Brexit will need to be delayed until next year even if European Union and British negotiators agree a new deal over the next 12 hours.

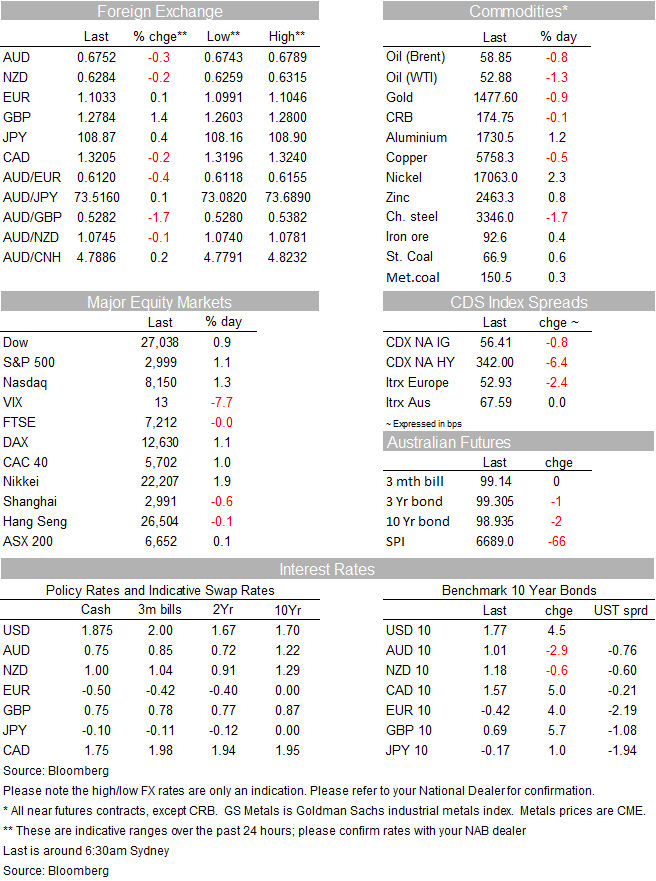

So much to play for still, with Sterling having the potential to quickly give back a chunk of the last week’s gains – or instead push up to well above $1.30 on GBP/USD if the positive news flow continues, in which respect note that AUD/GBP has pushed below its March and May lows of around 0.5300 overnight. Under a ‘deal’ Brexit scenario it could well fall back to 0.50 (bring on that two dollar pound, your scribe with a couple of quid still in his UK bank account is thinking to himself)

UK economic news has been summarily ignored, in particular a 56k drop in UK employment in the three months to August. Average earnings, excluding bonuses, slipped to 3.8% from 3.9% but this was above the 3.7% expected and sill implies decent real earnings growth, unlike Australia. Here, yesterday’s RBA minutes repeated the line that the Board “was prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time”. It also addressed, then dismissed the argument that “some monetary stimulus should be kept in reserve to address any future negative shocks”. Importantly, the Bank notes that the level of the cash rate is the “more important determinant” of the impact of policy on demand, rather than the changes in the cash rate. This is something we addressed in our Australian Markets Weekly on Monday (link)

News overnight has not been positive, even though President Trump has just been out tweeting about a Phase-two deal including banking. In particular, a Bloomberg source story saying that China will struggle to buy $50 billion of U.S. farm goods annually unless it removes retaliatory tariffs on American products, and doing so would require reciprocal action by President Donald Trump(“people familiar with the matter said”). It also pretty apparent that President Xi is not going to put his signature to a Phase-One deal next month unless or until the US rescinds the threat of imposing additional tariffs on China on December 15.

The latter news hasn’t negatively impacted market, with CNH still trading comfortably below 7.10. On the positive side, the September credit and money supply numbers were out last night and showed significantly stronger gains than expected (New Yuan loans at ¥1,690bbn against 1360bn expected, Aggregate Financing at ¥2,270bn vs. 1900bn expected and M2 money supply growth edging up to 8.4% from 8.2% against 8.3% expected). Recent monetary policy easing, including RRR cuts, seems to be working in improving the flow of credit to the economy.

US stocks have had a stellar day, with the main board indices closing plus or minus 1%, gains led by financials after JOP Morgan. Citicorp and Wells Fargo exceeded their earnings numbers (Goldman Sachs the exception after write-downs on a number of its equity investments).

Global bonds yields continue to move higher on the back of the positive Brexit vibes, afterglow (still) of Friday’s US China news and stronger equities. US 10s have added another 4bp to 1.77% and 2s 3bps to 1.62%. European bond yields were also higher overnight but only by 1-2bops on average. The German ZEW survey offered mixed news, current conditions down again and by more than expected, but expectations falling but only just and by less than expected.

Its really been all about Sterling and where its 1.4% gain has been the main driver of the further 0.15% in the narrow DXY dollar index.

Coming up

Inflation readings from New Zealand, the UK, Eurozone (latter final figures) and Canada are all due today. The US has retail sales. It’s the day before the EU Summit (Thursday-Friday) so a reminder that if there’s a Brexit ‘deal’ to be considered at the Summit, the EU Commission wants the legal txt to be ready by mid-night GMT.

BNZ expects that inflation looks set to beat the Reserve Bank’s August MPS forecasts, at least over the nearer term. We believe Wednesday’s Q3 CPI will start to show this with a quarterly increase of 0.7%. While this would lower the CPI’s annual rate of inflation to 1.5% from 1.7% in Q2, the RBNZ was expecting a deeper dip to 1.3%, predicated on a quarterly move of 0.5%. Importantly, a good part of the upward CPI surprise for the Bank will likely come in the non-tradable element, suggesting an upward bias also for the range of core inflation estimates on the day. The August MPS figured on annual non-tradables inflation slowing to 2.7% in Q3 from 2.8% in Q2, whereas we anticipate a pick-up to 3.0%.

Potentially more market moving than the various CPI figures will be US September retail sales (remembering that tariffs on some $110bn worth of additional Chinese imports – including various consumer goods – came into effect on September 1st). Consensus is for a 0.3% headline print, 0.2% for sales ex-autos and 0,3% for the ’control;’ group’ reading that feeds the consumer spending component of GDP. Remember these are value not volume figures though we know from last week’s (benign) CPI data that there was no noticeable upward impact on prices from the new tariffs last month. So if the numbers are stronger or weaker than expected, it should be more volume than price driven.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.