Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

The pound has already recovered the losses it made on Friday, when Brexit rhetoric was ramped up on both sides of the English Channel.

https://soundcloud.com/user-291029717/gone-fishing?in=user-291029717/sets/the-morning-call

You’re simply the best, better than all the rest – Tina Turner

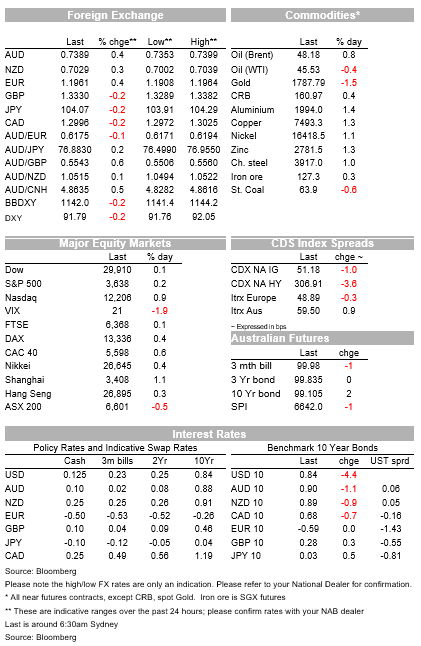

European and US equity markets edged a little bit higher with the latter enjoying a shortened trading session after Thanksgiving on Thursday.

Still, November has been a great month for equity investors, the S&P 500 and MSCI World index printed new record highs on Friday and the latter looks on course print its best month on record.

The risk positive equity backdrop weighed on the USD with pro-growth currencies leading the gains. Copper and metals led the gains on Friday with oil prices consolidating ahead of OPEC’s meeting today.

In contrast, the narrative in the rates market was more subdued, with tthe UST curve bull flattenning on Friday.

A positive vibe was certainly evident in Europe and US equity markets on Friday. All EU regional indices ended the higher with the Stoxx 600 index gaining 0.4%, while on the other side of the Atlantic, the S&P 500 finished up 0.2%, the Nasdaq rose 0.9% and the Dow climbed 0.1%.

The NIKKEI led the gains, up 4.38% with the NASDAQ was not too far behind, up almost 3%. Chinese equity markets recovered later in the week with the Shanghai Composite finishing 0.91% higher on the week.

November looks set to be an awesome month for equity investors with European equities leading the charge at a country/regional level, the Euro Stoxx 50 index is up almost 20% month to date, the Nikkei is 15% higher and main US equities indices are up between 11% and 13%. US small cap are the big winners with the Russell 200 up 20.6%.

The risk positive backdrop on Friday resulted in the USD losing a bit more of its safe-haven appeal . In index terms the USD was down 0.16% (BBDXY) and 0.21% (DXY) and against G10 the USD was weaker across the board with GBP the one exception.

Cable fell 0.5% to 1.3310, UK -EU trade talks are approaching crunch time with the market getting nervous as the risk of no deal rises the closer we get to the end of the year deadline (UK-EU trade will fall back to WTO trading rules unless a deal can be reached in time).

Both UK PM Johnson and EU highlighted there were “substantial and important differences to be bridged”, with the two sides reportedly still at loggerheads over fishing rights.

But over the weekend the UK Telegraph is suggesting an important breakthrough in the negotiations could be likely , suggesting Brussels has accepted a British proposal for a transition period on fishing rights after January 1, but there is no agreement on how long it should last or how it should work. The article also notes UK senior Government figures believe that tentative compromise is a prelude for the EU to yield on other British demands. GBP has opened higher this morning, effectively reversing Friday’s loses and now trading at 1.336.

The NOK gained another 0.4% on Friday, notwithstanding a consolidation in oil prices (more below) and the EUR increased 0.4%, taking it up to 1.1960 and again within sight of the psychologically important 1.20 level.

The AUD has been unaffected by Friday’s news that China would impose anti-dumping duties on Australian wine, of between 107% and 212%. The move wasn’t a huge surprise after China launched an investigation in mid-August. The new tariffs on Australian wine are the latest in a series of measures taken by the Chinese government recently as tensions between the two countries escalate.

The AUD appreciated 0.3% on Friday to close the week at 0.7385, near its recent highs. Like the AUD, the NZD made modest gains on Friday, rising 0.3% to 0.7030. That’s the highest closing level for the NZD since June 2020.

Consistent with the risk positive backdrop in equities and solid commodities gains, FX performance month to date has been a story of broad USD weakness with pro- growth currencies outperforming.

NOK (+7.35%) has benefited by the big gains in oil while NZD (6.21%) and AUD (5.31%) have again shown their high level of sensitive to risk appetite ( VIX traded sub 20 on Friday, after reaching 41 on October 30th ).

GBP and EUR ( up ~2.70/2.80%) have also made some decent gains as the market is slowly but surely becoming more confident on both a UK-EU trade deal and EU Recovery Fund ratification eventuating before year end.

Metal prices led the gains in commodities on Friday with copper (2.61%) stealing the headlines after trading above the 3400 mark for the first time in nearly seven year .

Oil prices gains during November has been the big story in commodities (up 27%/28%), but ahead of the OPEC today and OPEC and Friends meeting tomorrow, oil prices consolidated on Friday as the market awaits confirmation over the supply plan ahead.

Gold was the underperformer on Friday, down 1.31% on the day and -5.21% month to date.

In contrast the risk positive picture depicted in other markets, price action in the US Treasury market was more cautions on Friday with longer dated yields leading a flatting of the curve . Perhaps the bond market is showing more concern over the virus story with one eye on the likely Fed QE tweak at the next FOMC meeting on December.

Bloomberg notes, New York City reported the most daily cases since May, passing 1.5k for the second consecutive day, based on a seven-day average. The US recorded more than 200k daily infections for the first time, as some states resumed updates following the Thanksgiving holiday. The UK and Italy continued to show signs their outbreaks are slowing, but Germany is at risk of extending its restrictions with German Chancellor Angela Merkel implored citizens to wear masks and stick to distancing measures

Doubts have been raised about the AstraZeneca trials and the company now plans a new global study, which will delay the regulatory approval process and its distribution. But on a more positive note, the UK is poised to become the first country to approve Pfizer/BioNTech’s Covid-19 vaccine, ahead of a long line of countries waiting for protection from the coronavirus.

The 10-year Treasury yield fell 4bps from Wednesday night’s close to finish the week at 0.84%. Global rates have been range-bound the past few weeks despite the positive vaccine developments and repricing in other asset classes.

For further FX, Interest rate and Commodities information visit com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.