Consumer spending is up 5.6% over the past 12 months.

Insight

It was far from a quiet Christmas period, with volatility driven by data, trade concerns, a government shutdown and a very different attitude coming from the US Fed.

https://soundcloud.com/user-291029717/a-choppy-new-year

It would be easy to dismiss Friday’s US payroll’s report as a backwards looking indicator. Certainly last Thursday’s manufacturing ISM report – in particular the slump in the new orders sub-index – is a worry, revealing a clear linkage with the sharp slowdown in Chinese imports revealed in November’s trade data and subsequent manufacturing PMIs. There is also the no small matter of over 800,000 US public servants currently furloughed by the failure of the administration and the newly sworn in Congress to strike a deal that would get a large swathe of the government back to work.

Yet there can be no denying that the US economy ended 2018 with strong positive momentum, a fact acknowledged by Jay Powell in his conversation alongside Janet Yellen and Ben Bernanke on Friday. US payrolls rose by a 312k in December (plus there were 58k worth of upward revision to October and November). Average earnings rose by 0.4%, also higher than expected and pushing annual growth up to a new cycle high of 3.2%.from 3.1% previously. Sure, the unemployment rate rose, from 3.7% to 3.9%, but only because of a surge in the labour forced (+419k) which served to pull the participation rate up by 0.2%.

Prior to the employment report and soon after Australia went home on Friday, China announced a 1% cut to the Reserve Requirement Ratio, applicable to all banks and to be enacted in two stages but very close together (Jan 15th and 25th). Last year’s RRR cuts were only in 50bp increments (four in total). This year we might reasonably expect to see as many as four 100bp cuts and in the absence of capital outflow pressures on the currency, quite possibly cuts to the benchmark 1-year lending rate as well (currently 4.35%).

Of course, if the US and China shortly strike a comprehensive trade deal – in which respect the Q4 slump in the US stock market appears to be crystallising the US President’s mind, this might not be necessary. Either way, China is showing its intent to shore up growth.

Post the US payrolls report, Fed Chair Powell confirmed a more cautious 2019 Fed outlook and stated he is “listening carefully” to markets. Echoing Dallas Fed President Kaplan yesterday, Powell stated “muted inflation” gives the Fed room to be “patient and see how the economy goes”.

How long could such a pause last for? Chair Powell drew a parallel to the 2016 Fed pause where the Fed went on hold for three quarters following a tightening in financial conditions that started to spill over to growth. Powell also sought to calm markets, noting that the hard data was on track to sustain good momentum into the New Year and gave a shout out to the strong Payrolls data today. He did though acknowledge that financial markets were sending other signals, particularly around China and on policy uncertainty out of Washington and that the Fed is “listening sensitively to the messages markets are sending”.

In other economic news earlier in our evening Friday, Eurozone inflation undershot expectations coming in at 1.6% in December down from 2.0% in November and 1.7% expected, though the core measure was steady at 1%, as expected.

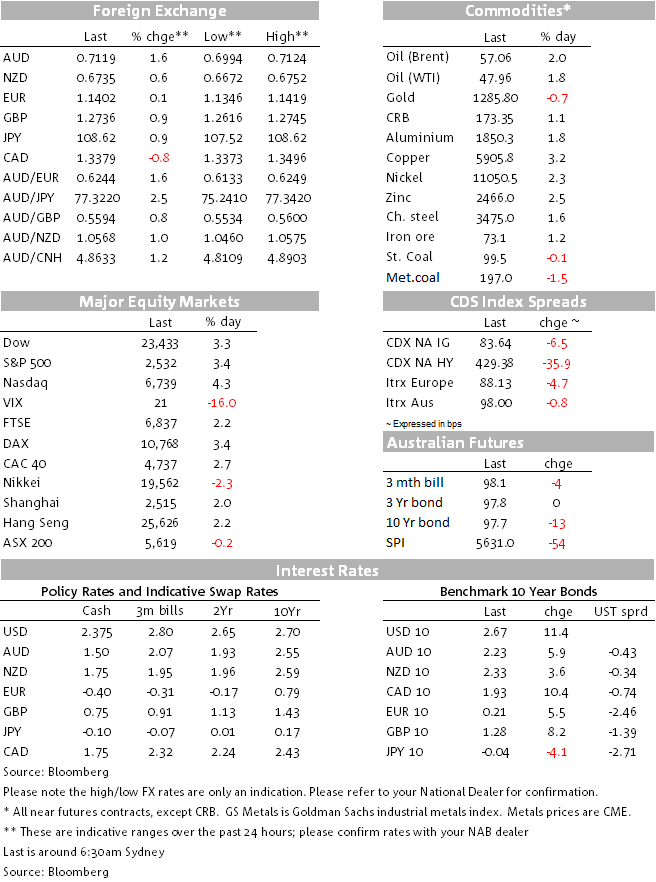

The US stock market loved the strong payrolls report, and loved the empathy Jay Powell showed to markets even more, having patently failed to do so out of the Dec FOMC meeting. Indices added around 2% at the open, post the payrolls and China RRR curt ness, and then added about the same again post Powell. The S&P ended the day 3.4%$ higher, the NASDAQ 4.3% and the Dow Jones 3.3%. Gains for European stocks weren’t too far behind. These gains now put all US indices into positive year-to-date territory, the S&P by 1% and NASDAQ 1.5%. IT was the best performing sector Friday, +4.4% within the S&P.

The VIX index, having been above 35 on both sides of Christmas day, is now back at 21, the lowest since mid-December.

The wild ride for US Treasuries in late December and early January will have bucked many a bond trader off the horse Thursday and Friday. From a low of 2.54% during our time zone on Friday (and which followed the weak manufacturing ISM report on Thursday and the various FX ‘flash crashes’ that produced a very large if temporary spike in bond futures. 10-year yields ended Friday at 2.67%, so 15bps higher on the day. The 2-year note added 7bps to 2.49% – so bull steepening early last week as the market moved to price in Fed rates cuts before the end of 2019, gave way to bear steepening on Friday.

If ever there was a case of a currency going from zero to hero in the space of 24 hours it was the AUD between Thursday and Friday. AUD/USD was Friday’s best performing currency by far, adding 1.5% to close above 0.71 for the first time since 20th December. The sharp revival in risk appetite typified by the fall-back in the VIX and a smart recovery in commodity prices (base metals, oil and iron ore all higher – see table below) readily accounts for the move up.

As for Thursday’s ‘flash crashes’ that at one point saw AUD/USD down to 0.6730 and AUD/JPY below ¥71, we are convinced that the rush for the exit on (underwater) short JPY positions by Japanese retail accounts on a day when Tokyo banks were on holiday, was the initial culprit. FX futures volume data for Thursday, published on Friday morning, showed more than three times the prior day’s volume in the five currency pairs that are most active on the Tokyo Futures Exchange (USD/JPY, TRY/JPY, AUD/JPY, ZAR/JPY and GBP/JPY); they were some four times the November daily average.

The JPY was the weakest G10 currency on Friday and only one to fall against an otherwise weaker US dollar; the latter saw the DXY index down about 0.1%it’s currently just over 1.5% off its mid-December highs, the sharp reassessment of Fed policy prospects triumphing over heighted risk aversion and so safe haven support in late December.

Most Emerging Market currencies rallied sharply on Friday, the JPM EMCI up over 1%. A key factor here (and also behind the AUD’s gains earlier in Friday’s session) was confirmation that trade talks between China and the US will be resuming in Beijing today.

Commodity market couldn’t help liking the combination of news of China-US trade talks, strong US payrolls and soothing words from the Fed chair. In the base metals, copper rallied by over 3% and aluminium just under 2%, iron ore rose over 1% and Brent crude 2% (WTI +1.8%).

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.