Coming in for landing in a heavy cross wind

Insight

Lots of economic data to digest on Friday but none of which had a major impact on markets, while Saturday’s China official PMI data showing a further (and bigger than expected) fall in its Manufacturing Index threatens to play with the grain of recent AUD underperformance.

https://soundcloud.com/user-291029717/has-china-fallen-out-of-love-with-aussie-iron-ore?in=user-291029717/sets/the-morning-call

Friday/Saturday Data Highlights:

France Q2 GDP 0.9% vs 0.8% expected

Germany Q2 GDP 1.5% vs 2.0% expected

Eurozone Q2 GDP 2.0% vs 1.5% expected

Eurozone June CPI 2.2% from 1.9% vs 2.0% expected

Eurozone June Core CPI 0.7% from 0.9% vs 0.7% expected

US Q2 Employment Cost Index 0.7% vs 0.9% expected

US June Personal Income 0.1% vs -0.3% expected

US June Person Spending 1.0% vs 0.7% expected

US June PCE Deflator 4.0% y/y from 4.0% and 4.0% expected

US June Core PCE Deflator 3.5% y/y from 3.4% and 3.7% expected

US: Chicago PMI, Jul: 73.4 vs. 64.1 exp

US Final UoM Consumer Sentiment 81.2 vs 80.8% preliminary and expected

US Final UoM 5-10yr inflation expectations 2.8% from 2.9% preliminary

US Final UoM 1yr inflation expectations 4.7% from 4.8% preliminary

China July Manufacturing PMI 50.4 from 50.9 and 50.8 expected

China July non-Manufacturing PMI 53.3 from 53.5 and 53.3 expected

China July Composite PMI 52.4 from 52.9

Lots of economic data to digest on Friday but none of which had a major impact on markets, while Saturday’s China official PMI data showing a further (and bigger than expected) fall in its Manufacturing Index threatens to play with the grain of recent AUD underperformance.

Iron ore captured a lot of headlines on Friday . Singapore iron ore futures fell 8.8% to $US173.80 a tonne and Dalian futures 9.4 per cent after spot iron ore fell to $US194 on Thursday, down 17 per cent from a record high of $US233 a tonne in May. This is after Beijing raised export tariffs on some steel materials and removed rebates on cold-rolled products last week, after China’s steel production rose 12 per cent in the first half of 2021, despite attempts to cap steel output below last year’s record high. The implication, if China is serious about restricting output over the whole of 2021 to no more than 2020 levels, is that steel production will need to contract by 12% in the second half of the year.

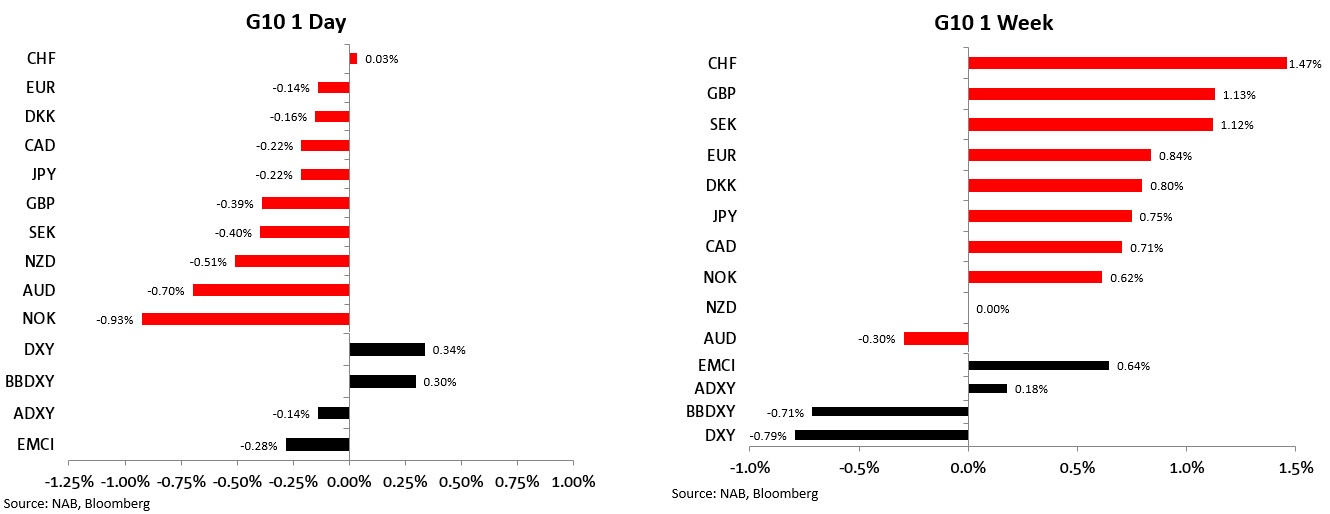

While the Australia dollar has been studiously impervious to the relentless rise in ion prices in the last year or more, the speed and extent of its decline of its May highs doesn’t look to have been completely lost on the foreign exchange market, alongside the (negative) growth implications of the NSW (and now Queensland) lock-downs, with AUD/USD Friday’s second worse performing G10 currency and the only one down in a week that saw the USD lose between 0.7% and 0.8% in index terms.

Of the myriad economic data released Friday and summarised above, perhaps the highlight was the ‘flash’ estimate of Eurozone GDP, coming in at 2%, so faster than the US (and about the same if we ex-out the depressing impact of a fall in inventories on the US numbers). The better than expected result (market 1.5%) was because of strength in the Euro-periphery, with Portugal +4.9%, Spain 2.8% and Italy 2.7% (also Austria 4.3%) against just 0.9% for France and 1.5% for Germany, the latter 0.5% less than expected. Italy’s Q2 performance is a sight to behold, after having endured the worse covid experience of any major country in the early stages of the pandemic, now growing almost twice as fast as Germany, and last night adding the men’s high jump and 100 metres Olympic golds to last month’s Euro-2020 victory. Viva Italia! Remember too, Italy is soon to be the biggest recipients of EU Recovery Fund hand-outs.

Of the various US number, we would highlight the Q2 Employment cost index, at 0.7% below the 0.9% expected , but this was on lower benefits not wages, which grew at 3.5% in the year through June (wags developments likely key to the ‘largely transitory’ – or otherwise – nature of the current inflation spike). The stronger than expected personal spending in June (1%) explains the stronger than expected consumption component in last Thursday’s GDP report. The core PCE deflator meanwhile was a little softer than expected in June, 3.4% down from 3.7% in May. i

Post Friday’s close, Fed Governor Lael Brainard said the U.S. jobs market still has some ways to go before it improves enough to satisfy the Federal Reserve’s criteria for beginning to reduce its asset purchases. She suggested that the recent surge in inflation is likely to prove temporary (though she is ‘attentive’ to the risk of broader or more persistent price pressures) and said that she saw both upside and downside risks to the economy, the latter from the spread of the Delta variant of Covid-19. Earlier (during Friday’s session) St. Louis Fed President and erstwhile hawk James Bullard says he hopes a taper decision will come at next meeting in September and that he wants the Fed to start to slow down its bond purchases this fall and finish by March next year. He says his base case of for a Q4 2022 interest rate increase. He is currently being ignored by markets.

Equity markets suffered an across the board down-day on Friday and on the week , Friday’s moves led by japan and the week’s by China (and Hong Kong), the Shanghai Composite -4.3% (and Hang Seng -5%). Following what has been a torrid week for Chinese equities, particularly tech companies with US listings, the US SEC on Friday said China-based companies will have to disclose more about their structure and contacts with the Chinese government before listing in the US. Gary Gensler, the chair of the US corporate and markets regulator, has asked staff to ensure greater transparency from Chinese companies following the controversy surrounding the public offering by the Chinese ride-hailing group Didi Chuxing. The SCMP reported that Chinese firms will henceforth be required to divulge the listing of shares held through shell companies outside China, a loophole that has been used for years by China’s large tech firms.

The new rules were triggered by Beijing’s announcement earlier this month that it would tighten restrictions on overseas listings, including stricter rules on what happens to the data held by those companies. On one matter at least, it now seems the US and China are finding some common ground, even if they are coming to the matter from different angles.

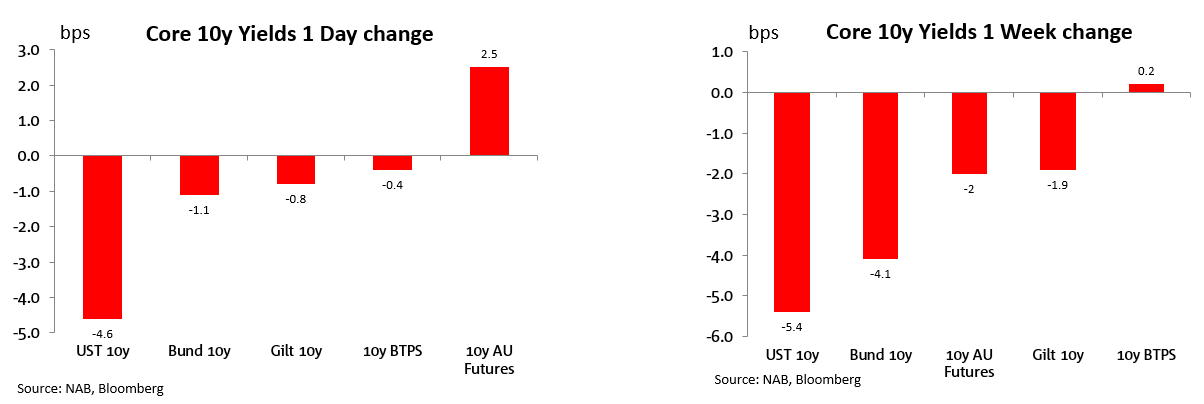

Friday’s equity weakness, bond market rally and firmer USD might all have had something to do with month-end. Over the whole of July, the standout feature of the bond market has been the renewed plunge in real US bond yields, off 29bp at 10-year to a new record low of -1.16% on Friday, a level that suggests: 1) the market believes the inflation spike will prove transitory; 2) the Fed will play it long (re tapering and tightening) and 3) that the peak in the Fed Funds rate, as and when the Fed does embark on a tightening cycle, will be no higher than about 1.5%. The fall in real yield also leads to the observation that US equity market valuations are, at least just in relation to real bond yields, starting to look cheap!

The latest fall in real (and nominal) yields looks to have had something to do with the renewed weakening in the USD (off by 0.7% in BBDXY and 0.8% in BBDXY terms last week. This to some extent disguises an ongoing demand for safe haven currencies, of which the USD is one, with outperformance by the CHF and JPY mechanically depressing the USD in index terms, though last week also saw decent gains for GBP, EUR, CAD, SEK and NOK, just not so NZD (flat) and AUD (-0.3%).

The commodity complex was dominated by the plunge in iron ore last week, aside from which it was a good one for base metals (LMREX up 2.26%) as well as oil.

Finally, in the last couple of hours Senators Susan Colins and Joe Manchin have said the text of the proposed $1 trillion bipartisan infrastructure bill ($579bn net new spending beyond existing budget capex provisions) could be released as soon as Sunday afternoon. Collins told CNN’s “State of the Union” on Sunday that the language of the bill would be finalized and some amendments considered on Sunday. She said she hoped and expected that the bill would be finished by the end of the week.

US Payrolls dominate the week given how tied the decision to taper is to making substantial further progress on the labour market. Payrolls are currently 6.8m below their pre-pandemic levels. Consensus is for 925k jobs, a little faster than June’s 850k. Should payrolls print around 1 million that would boost expectations for a taper announcement (advance warning thereof) as early as the next (September) meeting. Before Friday we get the ISM Manufacturing (today) and ISM Services (Wednesday).

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.