We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Equities have climbed higher in the US and Europe on the hopes two deals will be struck this week.

https://soundcloud.com/user-291029717/hope-springs-external-on-both-sides-of-the-atlantic?in=user-291029717/sets/the-morning-call

It’s on a rumour mill, word is on the street, I

I love you so, the feeling’s bitter sweet – Rudimental

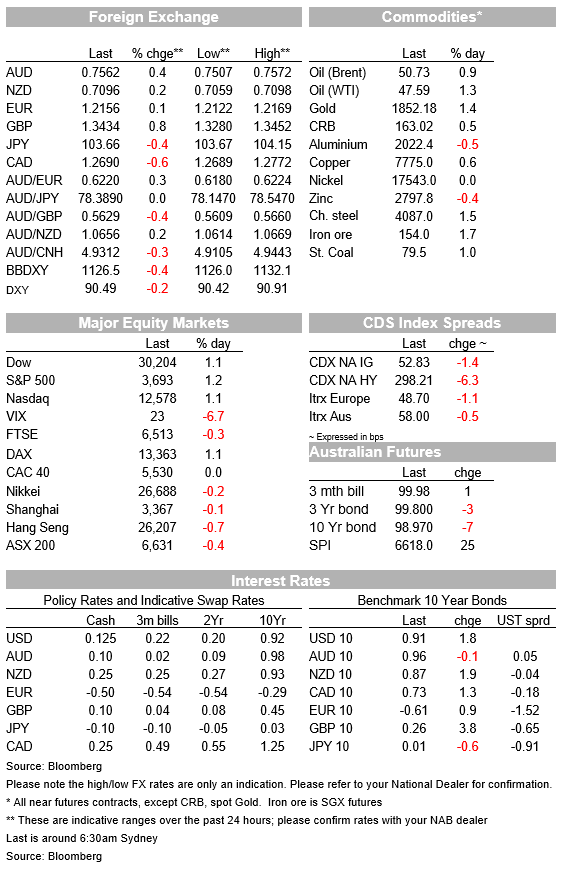

Positive smoke signals on US fiscal stimulus and Brexit negotiations have lifted sentiment overnight, prompting an end to the mini rout in US equities with all major US equity indices smartly higher on the day. Also boosting the mood, the US regulator says Moderna Vaccine is safe and effective paving way for imminent approval. UK Gilts have led the move up in core global bond yields and the USD is broadly weaker with the pound leading the charge against the greenback. Prospect of stricter lockdowns in Europe and US not enough to derail the positive vibes.

After four days of negative returns with a cumulative loss of around 1.5%, the S&P 500 is up over 1% as I type boosted by an increase in investors confidence US politicians will finally agree on a new fiscal stimulus package. Over the next hour House Speaker Nancy Pelosi is set to meet Senate Majority Leader Mitch McConnell and there is an increasing sense that both parties are very close to finding a compromise an agree on a bill based on a $748 billion bipartisan proposal. The tech heavy NASDAQ index is also having a good day up 1.03% with the Dow also joining the party, up 1.24%.

Meanwhile in Europe, the Stoxx Europe 600 Index climbed 0.3%, recording a second day in a row of gains. All major EU regional indices barring the UK FTSE 100 recorded gains overnight, the latter likely impacted by the strong rise in GBP (more on that below).

Playing with the positive vibes, the US FDA found Moderna’s COVID19 vaccine to be “highly effective”, paving the way to get approval and ready for use by next week. This follows the beginning of the widespread use of the Pfizer/BioNtech vaccine and encouragingly the vaccine rollout continues in the US without any major issues so far.

Tech shares showed little negative reaction to news of an EU draft legislation that would allow it to heavily fine or break up “Big Tech” if companies engaged in anti-competitive behaviour . Furthermore, the firms would have to take more responsibility for illegal behaviour on their platforms. However, there is expected to be a long delay before the new rules come into force, at least two years, as the proposal gets pushed through the EU Parliament. And for the US, increased regulatory risk for Big Tech would require, at a minimum, the Democrats to win the Georgia state run-off early January.

COVID negative news have been unable the shake the positive vibes. New York looks set to follow London into another round of more severe restrictions with city’s mayor telling residents to prepare for a shutdown of all but essential businesses soon after Christmas. For now, the positive vaccine news and US fiscal stimulus hopes are keeping sentiment buoyant, but the impact from more restrictions is likely to result in a further loss of momentum in the EU and US recovery. PMI releases later today are set to give us a taste of what is yet to come.

Moving onto the currency market, the USD is on the back foot yet again, with dollar indices down in the order of 0.2-0.3%. Cable has led the charge against the greenback, up 0.83% in the past 24 hours and now trading at 1.3424. After yesterday’s comments from EU’s chief negotiator, Michel Barnier, noting that trade deal with the UK could be completed as soon as this week, even though there are still significant differences to be bridged, hopes over a trade deal agreement were further boosted overnight following a tweet from a BBC reporter remarking the “big buzz” among Tory MPs is that the UK is heading towards a Brexit deal with the EU and that the Eurosceptics in the party were being reassured they will be happy. We have long expected a deal, and ignored the political posturing, and a positive outcome would see further strength in GBP.

The euro is up 0.12% to 1.2156, so not quite showing the same degree of enthusiasm as GBP, that said as we approach the festive season, is worth noting the euro volatility overnight with the pair suddenly dropping about 40pips to 1.2222 with no apparent reason close to midnight. So may be a bit of a warning that air pockets could become a more regular occurrence as investors look to take a break over Christmas and New Year.

Yesterday the AUD looked like it was about to make a test of the 75c mark breaking below its recent 0.7520 to 7574 range, but in the end the move proved short lived . After trading to a low of 07507 during our session yesterday, the pair is now trading closer to the top of the recent range at 0.7560. The China news confirming a formal ban Australian coal imports, leaving more than 50 coal ships in the area with nowhere to offload their cargo, may have been a factor for the move lower in the AUD. Still, the AUD remains well supported by the improvement in risk sentiment and the fact that China is still buying Australian iron ore.

On this score, yesterday’s China monthly activity data for November met market expectations, showing further evidence of economic recovery, with both industrial production and retail sales increasing to their highest annual growth rates for the year. Notably too, US industrial and manufacturing production for November were on the positive side of expectations

The NZD has been tightly bound trading roughly between 0.7060 and 0.7095, currently at the top end of that range and still reluctant to push sustainably above the 0.71 mark for now. The latest GDT dairy auction didn’t surprise with its 1.3% price gain, with whole milk powder up 0.5%.

Core global yields are a few bps higher with 10year Gilts up 4bps to 0.258% and 10y UST yields up 2bps to 0.91%. Hopes of an EU-UK trade deal and agreement on fiscal stimulus no doubt have played a role on the move up in yields with investors also keeping an eye on the outcome of the FOMC meeting early tomorrow morning ( more below).

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.