Online retail sales growth slowed in May following a fairly strong April

Insight

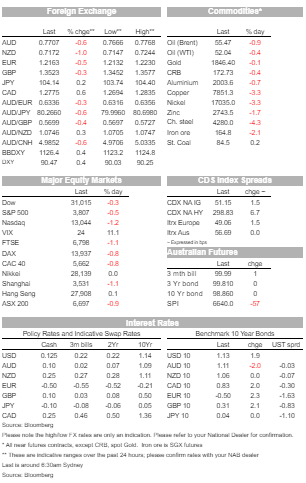

Bond yields continue to rise in the US as markets prepare for an expected multi-trillion dollar stimulus package from the President-elect.

https://soundcloud.com/user-291029717/how-much-stimulus-it-too-much?in=user-291029717/sets/the-morning-call

Some people say that he’s guilty (that he’s guilty), Some people say I don’t know (I don’t know), Some people say, give him a chance (give him a chance), Aw, some people say, wait till he’s convicted (till he’s convicted), Impeach the President, Impeach the President – The Honey Drippers (1965)

There hasn’t been a whole lot of price action across currencies, bond or equities since Monday’s APAC session drew to a close, save that in US Treasuries, closed during our time zone yesterday due to the Japan holiday, 10-year yields have moved up another 1.5bps or so to 1.13%.

This has been accompanied by a 1bp fall in inflation expectations as reflected in Treasury Inflation Protected Securities (TIPS) to see real yields a couple of basis points higher.

Copper is down over 3%, as is nickel (also steel rebar futures).

Commodity moves largely reflect the strengthening in the USD since last Thursday, in turn linked for the most part to the rise in US bond yields, rather than a serious rethink of the ‘reflation trade’ that has been the dominant theme in markets since the results of the Georgia Senate elections were known at the middle of last week.

The USD reversal is also the key driver of the relative weakness of NOK, AUD and NZD, that had been the three best performing currencies so far this year, up until last Thursday at least while the USD was busily extending its late 2020 losses.

The US House of Representatives moved closer to impeaching President Trump for a second time Monday, setting up a vote this week unless Vice President Mike Pence uses his constitutional authority to remove the president.

The impeachment resolution accuses him of inciting an insurrection against the United States government following the riotous invasion of the Capitol last Wednesday. The impeachment resolution says that by propagating the falsehood that the president lost the November presidential election due to widespread fraud, including during a speech outside the White House to his supporters minutes before the violence began, Trump “made statements that, in context, encouraged — and foreseeably resulted in — lawless action at the Capitol.”

The House is expected to vote on the impeachment article as soon as Wednesday. “There is strong support in the Congress for impeaching the president a second time,” House Speaker Nancy Pelosi, a Democrat from California, said in an interview with 60 minutes Sunday evening. “The president is guilty of inciting insurrection. He has to pay a price for that.” (Dow Jones reporting).

As of Sunday night, at least according to the Financial Times, no Republican Senator was said to be willing to convict the president in an impeachment trial, while moderate/conservative Democrat Senator Joe Manchin was also expressing reservations, saying he did not want this to distract from President-elect Biden’s first 100 days in office.

The weekend news of likely impeachment proceedings was a factor behind the roughly 0.5 percent losses in US equity futures during our time zone yesterday, losses which have been very slightly extended in the S&P500 (currently -0.6%) and more so in the NASDAQ (-1%)).

One consequence of the decision by Twitter and Facebook to ban President Trump has been to heighten speculation that regulation is coming to their sectors, on the basis that these platforms are now explicitly editorialising regarding content.

Twitter is currently down 6% on the day and Facebook -3.5%.

Since late last week it been a case of the ‘bigger they are the harder they fall’ with losses for G10 currencies amid a rising USD most acute in the NOK (-1.2%), NZD (-0.9% and AUD (-0.6%).

AUD at just above 0.77 is down from last week’s new cycle high of 0.7820.

There has been no noticeable impact on AUD from either confirmation yesterday of strong retail sales in November (7.1%) or the generally encouraging COVID news, in particular the absence of new cases in Greater Brisbane, bearing in mind this region accounts for almost 10% of the Australian economy. Nor too from the failure of the Aussies to skittle out the Indians yesterday in what has been one of the most enthralling test matches (and series) this scribe can remember.

GBP has been little impacted by comments on negative rates from the BoE’s Silvia Tenreyro, largely because she is already a known advocate of them. She says the Bank of England may need to deliver more stimulus to the U.K. economy, and it’s important for officials to maintain the option of pushing interest rates into negative territory.

Work at the central bank on the operational feasibility of taking U.K. rates below zero is still in progress, she said (results here are expected on February 4).

Her comments echoed those made by BoE Governor Andrew Bailey last week who said that it was important that the option of negative rate remains a “tool in the box”. When asked why the BOE didn’t consider negative rates sooner, Tenreyro replied, “We’ve all been brainwashed to think we can’t go there…It’s not too late to use them now”.

Nothing of particular note on the scheduled calendar, just Japan’s November Balance of Payments figures and in the US tonight, the December NFIB (small business optimism) survey and November JOLTS job openings.

We might get China December credit and money supply data at some point today, though if so this is typically only at the end of the China business day.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.