Our global forecasts are unchanged and we continue to expect soft global growth of only 3.0 to 3.1% between 2024 and 2026.

Insight

New highs on the NASDAQ and S&P500.

https://soundcloud.com/user-291029717/inauguration-day-highs?in=user-291029717/sets/the-morning-call

“You’re the voice, try and understand it; Make a noise and make it clear; Oh, whoa”, John Farnham 1986

“You’re The Voice” is Australia’s quintessential pub song, having been voted one of the top 10 in Triple M’s Ozzest 100 of all time.

This time though it was the BoC which seemingly spoke for the commodity currencies with the BoC upgrading their medium term outlook while keeping rates on hold (“With vaccines being rolled out earlier than anticipated, the recuperation in the Canadian economy is now more secure, and medium-term growth is forecast to be stronger ”) and disappointing some who had thought there was a chance of a mini-rate-cut given headwinds.

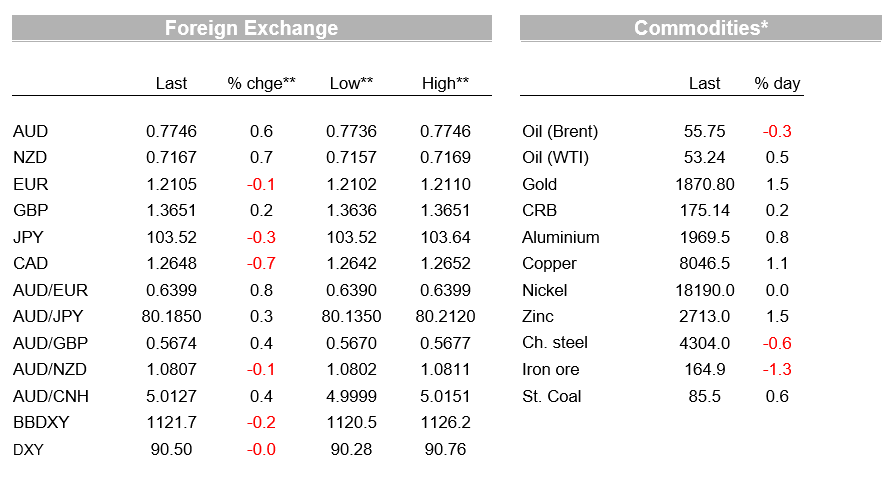

The Loonie rose swiftly in response (USD/CAD -0.7%), along with the AUD (+0.5%) and NZD (+0.6%).

Some read through of the more positive medium-term growth story is likely for both the RBA and RBNZ when they eventually meet.

Equities rose to another record high with the S&P500 +1.4%, partly driven by the tech (+2.1%) and the communications (4.1%) sub-sectors. Netflix which reported after the close on Tuesday is up some 16%, while Morgan Stanley’s earnings rose 51%. To date 88% of companies that have reported have beaten expectations according to FactSet.

Bonds on the other hand were broadly steady with US 10yr -0.8bps to 1.09%. Canadian bonds though did underperform a little with their 10yr yield +2.8bps 0.83% in reaction to the BoC,

While markets still expect the BoC to taper purchases in April given the BoC owns 36% of all Federal Debt outstanding and would be on track to own 50% of outstanding by the end of the year.

His office reported that he is going straight to work and is set to sign 15 Executive Actions by the end of the day, mostly unwinding Trump’s policies. From a market perspective the most relevant are the revoking of a permit for the Keystone XL oil pipeline, and in terms of the current pandemic pausing the accrual of interest and principal payments on student loans.

The Biden Administration is also set to re-engage with multilateral institutions, re-joining the World Health Organisation and Paris Climate agreement. President Biden is also said to be ordering executive agencies to review 103 Trump-era actions on the environment and pubic health. While forming some re-regulation, the market is still taking a sanguine view to tighter regulatory/tax risks given the narrow Senate Majority, while still expecting additional fiscal stimulus.

The Administration is still likely to take a tough line, though will try and drive a more multilateral approach. On Tuesday, Blinkin who is Biden’s Secretary of State pick said he believed that “President Trump was right in taking a tougher approach to China…[though] I disagree very much with the way he went about it in a number of areas but the basic principle was the right thing”. Emphaising the Adminsitration will take a more multi-lateral approach, Blinkin also said “ When we are acting alone against Chinese excess in commercial areas, we are about 25 per cent of world GDP. When we’ve got allies and partners with us, depending who it is, it’s 50 to 60 per cent. It’s a much heavier weight for China to ignore.”

Yellen who is Biden’s pick for Treasury Secretary also took a similar line, while also advocating for a big fiscal stimulus and arguing that the extremely low level of interest rates provided justification for the incoming administration’s plans to “go big” with its proposed $1.9 trillion fiscal stimulus, adding that spending more now would reduce the risk of a long recession

Vaccine news remains very encouraging with Israel reporting it has now given a first dose of the Pfizer/BioNTech vaccine to 24% of its population, and 6% of the population have received their second and final dose. Their rollout plan is being closely watched, with the first lesson seemingly being to minimise time between the first and second shots with people still being infected between the first and second doses.

Encouragingly Pfizer/BioNTech also released a study that suggests their vaccine is as effective against the UK variant (the study was a microstudy of 16 people).

Less encouragingly is the latest virus outbreak in China with one Beijing District put under restriction while some other areas of the country are under lockdown. For now markets are taking a sanguine view to this development given China’s quick control of previous virus outbreaks.

The reaction in the Loonie and bonds suggests a slightly hawkish meeting relative to expectations.

There had been some thought of a mini-rate-cut given headwinds, though policy was kept unchanged.

More interesting for markets was that growth expectations for 2022 were revised up with the BoC noting: “With vaccines being rolled out earlier than anticipated, the recuperation in the Canadian economy is now more secure, and medium-term growth is forecast to be stronger”.

Nevertheless, policy guidance was little changed with inflation “ not anticipated to return sustainably to its 2% target until 2023” rate will be on hold until that happens.

The QE program was also maintained, though did not the pace of net purchases will be adjusted as required. Markets are expecting the QE program to be tapered again in April given the BoC owns 36% of outstanding and is on track to own half of outstandings by the end of the year.

The Loonie rose swiftly in response (USD/CAD -0.7%), along with the AUD (+0.5%) and NZD (+0.6%). Some read through of the more positive medium-term growth story is likely for both the RBA and RBNZ when they eventually meet.

The other major currency pairs were little changed with EUR -0.1%, GBP +0.2% and USD/Yen -0.3%. The overall DXY was little changed on this time yesterday.

A big day ahead.

Domestically we have Employment/Unemployment data with NAB looking for another strong employment print of +60k and for the unemployment rate to tick down a tenth to 6.7% which is similar to the consensus. Offshore the BoJ and ECB meet, though no change is expected, Details below:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.