Economic and financial market update

Insight

The story of the day was the softer US inflation numbers which saw yields pull back and helped stocks rise.

I can’t break through your world, ‘Cause you live in shades of cool – Lana del Rey

A lower than expected US CPI print provided markets with a cool breeze, allaying fears of an overheating US economy. The lower CPI weighed on UST yields and the USD, offering a risk positive start to the US equity session. The AUD recovered after soft Sydney close, China’s February credit data beat expectations and the BoC stood pat disappointing those looking for a tapering signal.

The headline US CPI for February printed in line with expectations at 0.4%mom, but the Core reading was softer than expected coming in at 0.1% versus 0.2% expected. On a yoy basis the US Core CPI eased to 1.3% from 1.4% in January, this was the third consecutive month of modest core CPI print. Thus for now there is nothing for the inflationistas to ring the alarm while at the same time it provides the Fed plenty of breathing space ahead its meeting next week.

The CPI data suggests the music will keep playing for some time with the Fed not even close to pondering the option of watering down the punchbowl. Of course, this are early days, but given what is already priced, the market will need to see a validation of its expectations for higher inflation. Base effects mean that annual inflation will naturally rise from March onwards, we also need to see how prices cope with the post pandemic recovery, affected by supply chain disruptions and a cashed-up consumer that has been deprived from being outdoors. Then we have to see if this expected surge in prices is just a function of a sugar rush or whether it will end up having a more lasting inflationary impact, the wages response will be a key factor in this regard.

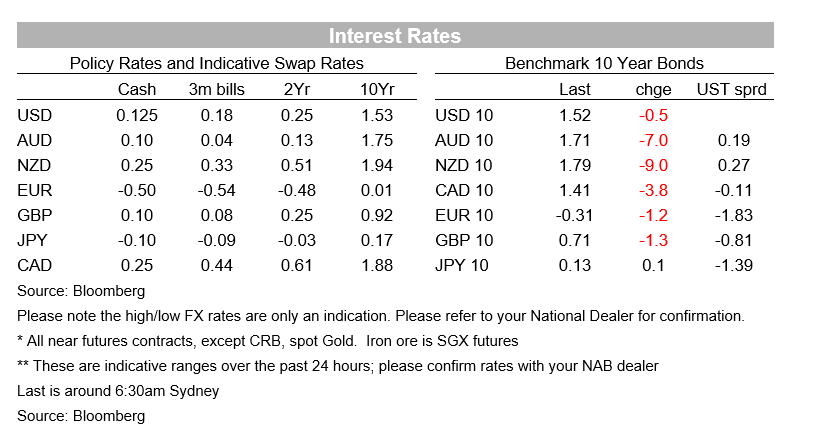

In the meantime, the lower than expected core CPI print eased some of the pressure on UST yields . The 10y Note was trading around 1.56% prior to the data release and now trades at 1.51%. After the poor 7y auction two weeks ago, the overnight 10y auction had an added interest factor and although the $38b auction tailed by 1bps (1.523% vs 1.513% pre-sale), a sign of tepid demand, the market took the result in its stride with the move up in yield short lived. Focus now turns to tomorrows 30y Bond auction, but results from the two auctions so far this week have helped ease concerns over another supply driven UST sell-off.

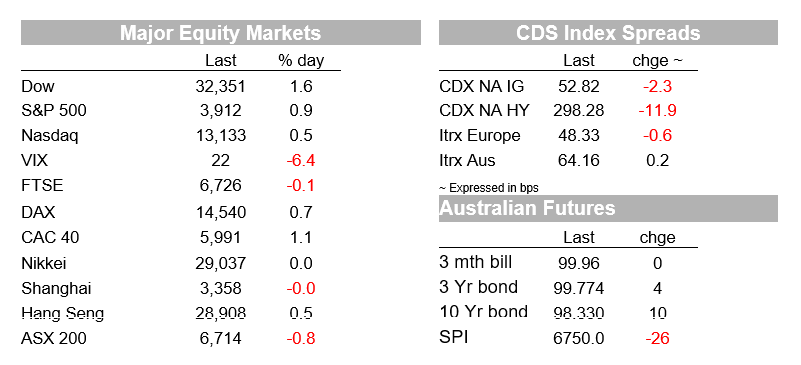

The soft CPI print also appears to have contributed to a positive start to the NY equity session. The S&P 500 gained close to 1% during its first hour trading and it has retained most of its gains, up 0.81% as I type. The NASDAQ also had a solid start to the session, but it has given back most of the initial gains, now trading at 0.23%. European equities rose for a third day and the Stoxx Europe 600 Index gained 0.4% closing at its highest level in more than a year.

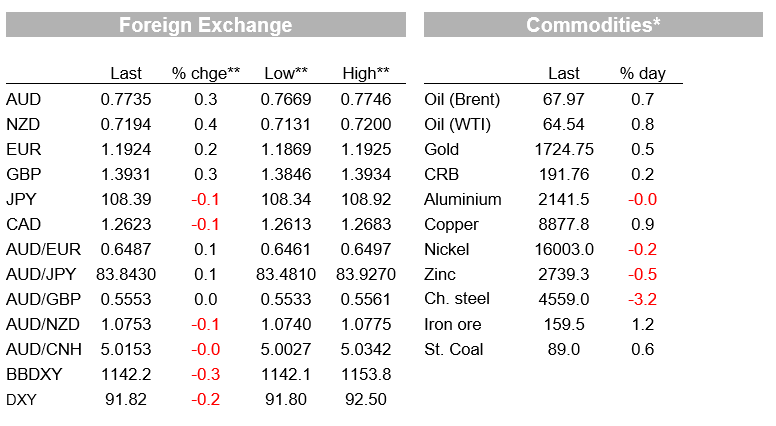

Moving onto currencies, the USD lost a bit of its mojo after the softer CPI print and move lower in UST yields. Prior to the data release, the DXY index traded to a high of 92.13, then it fell to a low of 91.79, and after a short lived recovery attempt it now trades at 91.82, down 0.1% on the day.

The NZD and AUD are at the top of the leader board, up 0.24 and 0.19% respectively. The NZD touched 0.7200 overnight and has settled back down to 0.7194, slightly higher from this time yesterday. The AUD now trades at 0.7735, following a low of 0.7722 after Sydney called a day. Yesterday RBA Governor Lowe reiterated his dovish missive that the cash rate is “very likely” to remain at 0.1% until at least 2024 adding that he didn’t share the market’s view of a possible rate increase as soon as late next year.

The AUD didn’t show an immediate reaction to the Governor’s comments, but it did trade lower later in the day. Perhaps reflecting a delay reaction to the move lower in AU bond yields, the 10y bond future is 7bps lower over the past 24 hours, outperforming the 1bps decline in 10y UST over the same period.

One factor that may have played into the recovery of the AUD was the better than expected China credit data. Aggregate financing in February was ¥1.71trn yuan ($263 billion), above the ¥0.91trn expected by the market and below the ¥5.17 trn in January. February is a traditionally slow month for lending because of the Lunar New Year holidays, but the good news was that the rise in lending was driven by corporate loans, suggesting easy credit conditions that are likely supporting the economic recovery.

The Bank of Canada left it policy settings and guidance unchanged, reiterating that its cash rate wouldn’t rise until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved, something not expected to happen until into 2023. QE will continue at a pace of at least $4b per week. Some in the market expected a slightly less dovish tone with a hint about future reductions in asset purchases, after the better dataflow of late, so there was a mild rally across the curve, but the impact on CAD was fairly minimal.

Lastly, early this morning, US President Biden’s $1.9 trn Covid-19 relief bill cleared its final congressional hurdle with the House passing the bill on an 220 to 211 vote, sending it to the president for his signature

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.