We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

There was a lot of optimism in the markets overnight, driven by strong manufacturing numbers in the US and Europe.

Work it, Make it, Do it, Makes us

Harder, Better, Faster, Stronger– Daft Punk

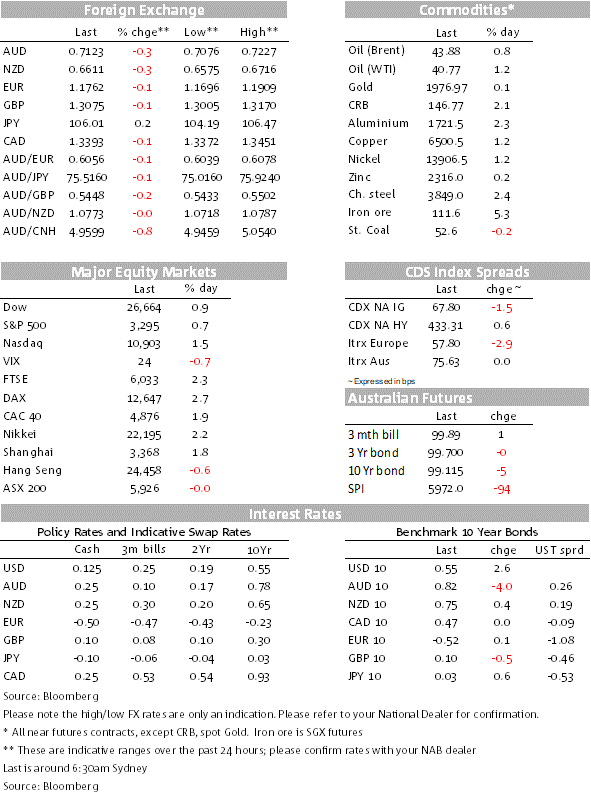

European and US equities have began the new month on a solid footing, tech share have led the move supported by better ( stronger, faster) than expected manufacturing data. Positive US virus news have also helped while the political impasse in Washington remains unchanged. Moves in FX have been modest, although the USD has extended Friday’s gains. After testing support overnight, AUD now trades at 0.7124.

European shares are the outstanding performers overnight with many regional equity indices recording gains over 2% while the Stoxx Europe 600 Index ended 2.1% higher, its biggest rise since June 16. Worth noting, however that as cyclical sectors enjoyed solid gains, supported by the better than expected economic data releases (more below), Banks underperformed after Societe Generale suffered its biggest loss in more than a decade, while HSBC’s earnings missed estimates.

The NASDAQ (+1.47%) has the led the move up in the US with Apple (still enjoying a bid after its impressive earnings report last week) and Microsoft the standout performers. After some uncertainty over Microsoft ability to buy TikTok operations in the US, its shares jumped 5.62% today as the company confirmed that is has gained approval by the White House to acquire the operations of TikTok in Canada, Australia and New Zealand as well as the US. President Trump said TikTok will have to close its US operations by September 15 unless the social media US operations are sold beforehand.

Better than expected manufacturing data in both Europe and the US helped boost sentiment at the start of the new week. As it has been the case in recent months, the Euro Area final manufacturing PMI showed a big improvement relative to its flash estimate. The Euro Area Markit’s manufacturing PMI came in at 51.8, beating a flash estimate and higher than June’s reading of 47.4. The means Europe’s manufacturing sector is now expanding for the first time in one and half years. Not so positively and a bit of a warning in terms of what to expect over coming months, EU companies in the sector continued to see backlogs of work decline and cut jobs for the 15th successive month.

The US ISM manufacturing index rose to 54.2, its highest level since March 2019, driven by new orders and production. The employment index barely increased to 44.3 and, taken literally, suggests that firms are still shedding jobs.

The US reported some 47knew cases of COVID19, the smallest daily increase in almost four weeks. Rolling averages give a better indication of trends and those continue to suggest that the “curve” has flattened, with 7-day averages of case numbers and hospitalisation rates flat to slightly lower over the past couple of weeks.

The only good thing we can say on the political impasse in Washington is that negotiations remain ongoing. CNBC reports that Nancy Pelosi, Chuck Schumer, Steven Mnuchin and Mark Meadows held what Pelosi called “productive” discussions, but Democrats said several issues are still outstanding with local governments a major sticking points in the talks. For now it seems that the market is travelling with the expectation that a deal will eventually bestruck, so it is a matter of when not if. That said, the WSJ reports that the White House has talked about taking unilateral action if congressional talks on the relief package collapse. Trump allies argue that the President has the authority to suspend the payroll tax if he declares a national emergency.

Moves since the start of the week have been relatively modest, but of note the USD has continued to edged higher. The BBDXY index is up 0.24% while DXY is up 0.18%. USD gains have been broadly based with CAD ( 0.19%) and SEK (0.38%) the two exceptions. AUD and NZD are a tad softer over the past 24 hours, notwithstanding the positive tone in equity markets. After testing support with its overnight low of 0.7077, the AUD now trades at 0.7124 (-0.24%) while NZD trades at 0.6611 (-0.21%), both antipodean currencies are seasonally weak in August, with nine falls in the past ten years for the month. EUR is around 1.1755, down 0.2% for the day after dipping below 1.17. Small net moves are also evident for GBP and JPY.

The 10y Note trades a 0.554%, 2.4bps higher while the 30y Bond is at 1.232%, 4bps higher. Solid IG issuance including from Google and AstraZeneca, helped yields grind higher while the expectation and eventual US Treasury issuance plan announcement might have also been a factor at play. The US Treasury expects to raise $947bn in debt over the three months through September to fund the huge fiscal spending surge needed to address the coronavirus crisis.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.