We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

The markets have spun around again,with renewed optimism and not much lingering concern from Apple’s revenue warning yesterday.

https://soundcloud.com/user-291029717/apple-warning-forgotten-as-markets-do-an-about-turn?in=user-291029717/sets/the-morning-call

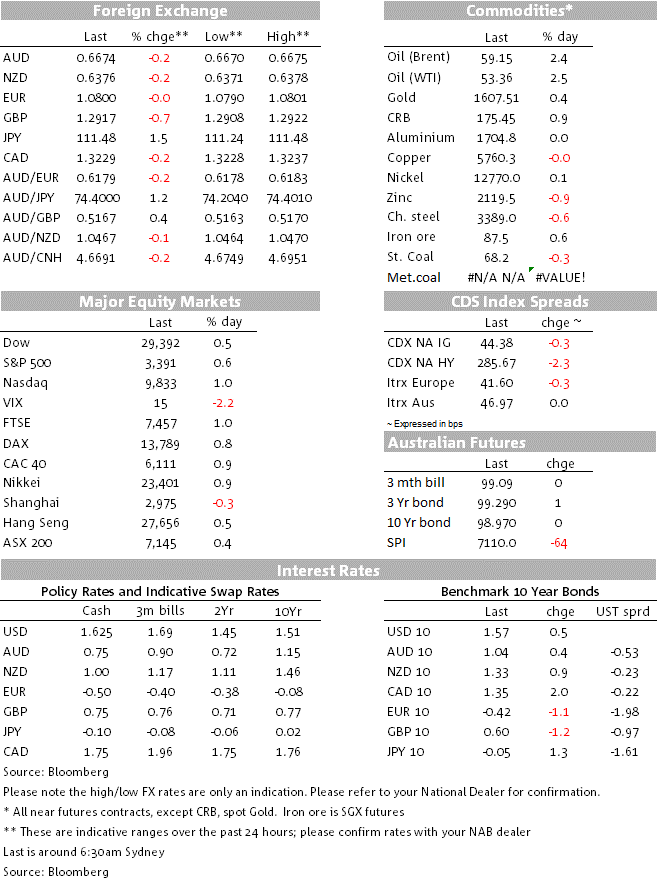

Markets are back with a positive tone with the S&P500 +0.6% overnight and more than reversing yesterday’s Apple-led swoon. Helping sentiment is the track for COVID-19 cases which continues “tracking the right way” with the number of new recoveries now exceeding the number of new cases and suggesting the virus may be close to peaking in China (see chart below). China is also starting to ease up on containment measures with reports of provincial governments taking pro-active measures to bring migrant workers back to factories on the east coast (see SCMP for details), while there has also been various headlines of stimulus measures being drawn up to bolster activity – note the PBoC meets today to set the loan prime rate. Commodities are also being boosted with WTI oil +2.4%. Bond markets are trading a little more cautiously with yields little moved with US 10yr Treasury yields +0.9bps to 1.57%.

G10 FX has seen a continued bid for the USD with the DXY +0.3% to 99.716, a new 2020 high and the highest since May 2017. The USD remains supported by its carry advantage given the Fed has the second highest policy rate in the G10 and its relative economic outperformance to Europe and Japan. Data out overnight again highlighted that outperformance with Housing Starts (1567k v 1428k expected) and Permits (1551k v 1450k expected) both beating expectations and Core-PPI higher than expected (1.7% y/y against 1.3% expected). Mapping the PPI (and CPI) to the Fed’s preferred PCE inflation measure suggests core-PCE will rise 0.2% m/m in January to be 1.7% y/y (from 1.6%) and inching closer to the Fed’s 2% target.

Yields though brushed off the better than expected data with US 10yr Treasury yields little moved at +0.9bps to 1.57%. The FOMC Minutes just out contained little in the way of new information, reiterating that the “current stance of monetary policy was appropriate”. There was some acknowledgment of the possible impact of the coronavirus, though it was an uncertainty for now. There were also a number of Fed speakers overnight, including uber-dove Kashkari who underscored the base case of the Fed being on hold: “If I were to guess, I’d guess we’re probably going to sit here for the next three months, next six months, maybe longer,”; but importantly that the next move would be more likely down not up: “But if I were to guess what the next move would be, my best guess is the next would be down rather than up, because we are pretty close to neutral today, and there are any number of shocks around the global economy that could hit the U.S. economy and call for lower rates.” Markets continue to price around 40bps of rate cuts by the end of the year.

The biggest FX mover was the Yen, weakening sharply amid the risk-on tone with USD/JPY +1.5% to 111.47. The move in Yen also comes at a time of fears of a potential recession that increased further yesterday after weaker than expected December Core Machine Orders (-12.5% m/m against -8.9% expected). Domestically in Japan the government is also cautiously tightening policy as the number of COVID-19 cases grows – Japan has reported 74 cases, the third highest behind China and Singapore. Highlighting the potential hit to activity, weekly LNG imports into Japan are running cumulatively 21% lower than this time last year.

GBP was the other big mover, down -0.7% to 1.2912 despite stronger than expected CPI figures (core CPI was 1.6% y/y v 1.5% expected). The market remains concerned about the difficulty of negotiating the future trading relationship with the EU with the UK continuing to insist it should have the right to diverge from EU standards but the EU insisting that there should be a ‘level playing field’. GBP has now given up all the bounce it saw after Rishi Sunak was appointed Chancellor late last week. EUR for its part was flat, skirting around the 1.08 level but not yet making a clear break below. Commodity currencies outperformed with EUR/NOK -0.5% and USD/CAD -0.2%.

The AUD was the exception to the commodity currencies, down -0.2% to 0.6675. The weakness in the AUD comes despite the recent improved market sentiment around COVID-19. The AUD had been trading lockstep with CNH, (illustrating its China proxy role) until early February where the correlation has since broken down (see second chart below). Employment data later today will be key for the AUD given the RBA’s explicit tying of balancing the need for further easing against potential financial stability concerns. Yesterday’s Q4 wages had little impact on the AUD with the data as expected at 0.5% q/q and 2.2% y/y. It is worth noting though that annual wages growth will edge lower unless quarterly wages growth picks up soon give six-month annualised growth is running at 2.0%.

Aussie job will dominate domestically given the RBA’s explicit tying of further rate cuts to the trajectory of the unemployment rate. The consensus looks for the unemployment rate to tick a tenth higher. Internationally it is relatively quiet with only the PBoC loan prime rate decision (cut likely) and UK Retail Sales of note.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.