Total spending grew 0.9% in June.

This week’s earlier optimism over a possible vaccine for COVID-19 has disappeared completely, with equities falling and bond prices rising.

https://soundcloud.com/user-291029717/markets-realise-theres-tumult-before-a-vaccine?in=user-291029717/sets/the-morning-call

We follow the same dotted line, Passing like ships in the night

Can we hang on? Can we hang on? – Cold War Kids

Well it’s probably fair to say that after a vaccine induced optimism at the start of the week, markets are having a bit of a reality check with Dr Fauci and Fed Chair Powel summing up the current state of affairs.

There are reasons to be optimistic about the global economic recovery and eventual pandemic submission over the coming year, but we are not out woods yet.

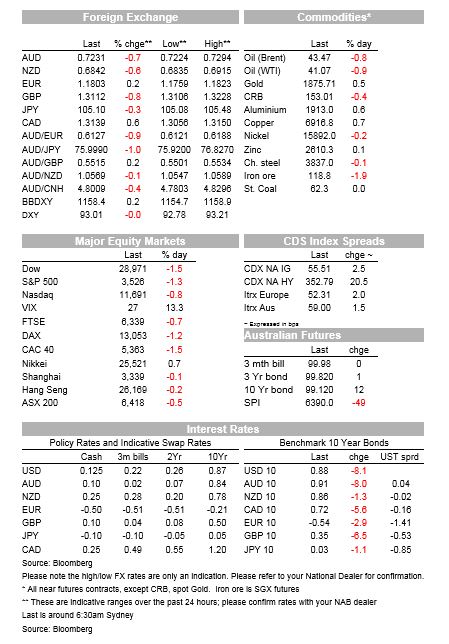

The next few months are going to be challenging and we just need to hang on. Northern Hemisphere equity markets have fallen overnight, core global bonds have caught a safety bid, the USD is steady but GBP and commodity linked FX are softer while JPY and CHF have outperformed.

European equities recorded their first daily decline of the week with COVID-19 news not helping the cause. Notwithstanding the introduction of more stringent social distancing measures, overnight the UK reported a new infection record.

The count of 33,470 new infections reported was alarmingly higher than the seven-day rolling average of 22,524. Meanwhile hospitalisation rates set a new record in France. The Stoxx Europe 600 index fell 0.9% while major regional indices fell between 0.7% and 1.6%.

New cases in the US hit a fresh record of 144k for the day, hospitalisation rate also printed a new high of 65k and fatalities were the highest since May. New York imposed a new restriction with bars, restaurants and gyms to close at 10pm and indoor gatherings limited to 10 people. NY Mayor also noted the city is preparing for the possibility of closing its schools again and Chicago issued an advisory urging resident to avoid leaving home except for work and other essential activities.

Dr Fauci, the US top health advisor, said that COVID-19 “it’s not going to be pandemic for a lot longer, because I believe the vaccines are going to turn that around,” adding that “What we’ve got to do is just hang on and continue to double down on the public health measures.”.

Speaking at the ECB virtual conference, Fed Chair Powell “We do see the economy continuing on a solid path of recovery, but the main risk we see to that is clearly the further spread of the disease here in the United States.”

The S&P 500 is currently down ~1.30 and the NASDAQ is -0.8%. Meanwhile, the rotation theme early in the week is now doing a big u turn with small caps underperforming, the Russell 2000 is down 1.80% as I type.

Sentiment has also been dampened by reports that the White House is stepping back from negotiations on a new stimulus package. This means that stimulus hopes now depend on the ability of Senator Majority Leader Mitch McConnell and House Speaker Nancy Pelosi finding a common ground. But, notwithstanding the prospect of the US economic recovery losing momentum as tougher social restrictions are introduced, hopes of a big stimulus don’t look great.

McConnell has continued to insist on a much smaller package of about $500 billion, pointing to signs of a continuing recovery including a slide in the unemployment rate. He has also pointed to encouraging news on a coronavirus vaccine.

The US core CPI was flat in October, undershooting market expectations, and driving inflation further away from the Fed’s target.

Initial jobless claims continued to trend lower, albeit at a pedestrian pace, even if it was a slightly better result than the market expected. At over 700k a week, the figure is still above the level seen at the depth of the GFC, indicative of a still very weak labour market.

The cautious market backdrop and weak CPI data have helped push the US 10-year rate down by 10bps relative to levels this time yesterday, the benchmark yield now trades at 0.8832%. Core yields in Europe have also traded lower with 10y Bunds down 3bps to -0.5390% and 10y Gilts off 6,5bps to 0.3460%.

The USD is little changed in index terms with DXY at 92.98 and BBDXY at 1158.59. In G10, NOK (-0.93%) and GBP are the notable underperformer, the latter down 0.83% to 1.3110, COVID-19 news more than outweighing the positive Q3 GDP print.

The strong rebound in UK GDP for Q3 was broadly in line with expectations but left the economy still a huge 10% smaller than pre-COVID levels. This of course all ahead of the recent new nationwide lockdown that was imposed, a view acknowledged by BoE Governor Bailey’s after the figures were released. He added that more information following UK-EU trade talks could affect the BoE’s policy decision next month. The Bank’s current assumption is that a trade deal will be agreed.

Other commodity linked currencies have also been affected by the souring in risk sentiment.

The AUD continues to find the air thinning above 73c and now trades at 0.7232, down 0.7% over the past 24 hours. In similar fashion the NZD has struggled to sustain its push above 69c and now trades at 0.6842, down 0.65%.

Now that we have the RBNZ and RBA policy announcements out of the way until next month, both antipodean fortunes are now more than ever going to be determined by developments offshore. Vaccine and COVID-19 development are the key risks to watch.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.