Online retail sales growth slowed in May following a fairly strong April

Insight

More inflation signals with the RBNZ moving towards rate rises. NAB’s Gavin Friend says there are no signs that other central banks will be following in a hurry.

https://soundcloud.com/user-291029717/more-inflation-rbnz-moves-first?in=user-291029717/sets/the-morning-call

It has been a mixed night for equities with energy and financials underperforming. A sharp decline in oil prices was one culprit while a theme of shrinking loan books is an emerging theme within US banks. Fed Chair Powell reiterates the economic recovery still hasn’t progressed enough to begin QE tapering. The US economy is travelling in the right direction, but the standard of substantial progress is far away and is not within sight. The UST curve bull flattens reversing yesterday’s CPI induced bear steepening and the USD is broadly weaker. NZD retains post RBNZ gains, AUD recovers a bit ground but still trades below 75c and CAD struggles after the BoC disappointed many expecting a hawkish guidance.

After trading in and out of positive territory the S&P 500 has ended the day up by just 0.12%. Energy (-2.94%) and Financials (-0.49%) are the main underperforming sectors while Consumer Staples (0.92%) and Real Estate (0.89%) outperformed. The decline in the energy sector is linked to the decline in oil prices (Brent -2.34% at $74.46 and -2.39% WTI @$72.73) following news of an increase in US gasoline and distillate inventories and reports suggesting Saudi Arabia and the UAE could be close to resolving their standoff. The breakthrough would involve a higher output quota for the UAE, but it would need to be approved by all OPEC+ members before it can take effect. If approved, the agreement would pave the way for a gradual increase in oil supply over coming months.

Bank of America shares closed -2.5% lower after second-quarter earnings failed to impress investors, while Wells Fargo shares gained 3.98%, after the bank eat analysts’ estimates for second-quarter profit, revenue and expense. That said after a few Q2 bank earnings reports (Morgan Stanley, US Bancorp and BNY Mellon report tonight) there seems to be a common emerging of weak demand for new loans. Bank of America reported loans and leases in the consumer banking unit declined 12%, Wells Fargo’s lending book tumbled by a similar amount and yesterday JPMorgan said consumer lending was down, though total loans were flat from a year ago.

Fed Chair Powell testified before Congress overnight and reiterated the economic recovery still hasn’t progressed enough to begin QE tapering. The US economy is travelling in the right direction, but the standard of substantial progress is far away and is not within sight. When asked about what constitutes “substantial progress”? Powell said, “It’s very difficult to be precise about it,” however “We will provide lots of notice as we go forward on that.”. Powell also noted that inflation is likely to remain high in coming months before moderating give temporary factors were mostly to blame. The Fed Chair then added that if the Fed thought inflation pressures could prove persistent “we would absolutely change our policy as appropriate.”

The UST curve has essentially reversed the post CPI steepening with the curve bear flattening during the overnight session. The 2y note is 3bps lower at 0.223%, the 10y Note now trades at 1.348%, 7bps lower while the 30y bond is down 7.6bps to 1.971%. The move lower in yields began before Powell testimony, but it continued after with the decline in oil prices likely also providing a helping hand.

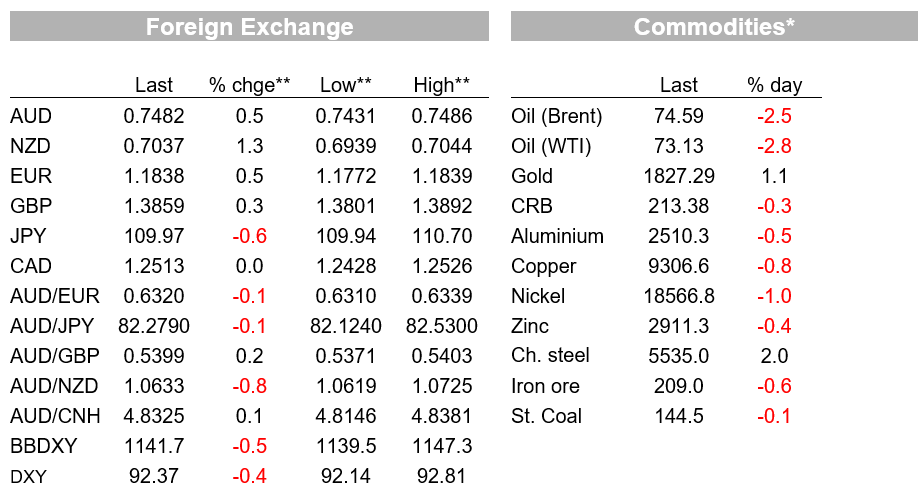

Moving onto to currencies, the USD is broadly weaker with yesterday’s post CPI gains almost fully reversed (BBDXY -046% and DXY is ~0.37%). The move lower in UST yields certainly a factor at play, but there have also been dynamics playing into the performance of some currencies. NZD for one has retained its post RBNZ gains and CAD has struggled a bit after the BoC disappointed many expecting a hawkish guidance.

Yesterday the RBNZ kept the OCR at 0.25%, as universally expected, but announced it would stop buying bonds under its LSAP programme next week. The RBNZ gave no indication around the timing of possible OCR hikes, so it is not locked into any course of action, but the market moved swiftly to bring forward the expected timing of tightening. Pricing for the August meeting moved from 0.31% to 0.42%, implying around a 70% chance of a rate hike next month, with around 1½ hikes now priced by the November meeting. Our BNZ colleagues also moved their call for a hike from November to August. The NZD has been the clear G10 outperformer over the past 24 hours, up 1.2% from this time yesterday and now trading at 0.7033.

The AUD also managed to edge up a little, up 0.43% over the past 24 hours and now trading at 0.7481. Yesterday Sydney’s lockdown was extended for another two weeks, until “at least” 30 July, with the state recording a further 97 Covid-19 cases yesterday. Concerningly, there were seven new cases reported in Melbourne, one of whom had attended an AFL match at the MCG, raising a clear risk of a lockdown there as well, given the high infectiousness of the delta variant. The news didn’t impact the AUD at the time, but the pair did struggle during the European session, trading down to an intraday low of 0.7431 just after 7pm Sydney time. The broad decline in the USD during the overnight session helped the AUD recover.

The Bank of Canada delivered its Monetary Policy Report overnight, keeping its cash rate unchanged, at 0.25%, and tapering its bond buying from $3b/week to $2b/week, as expected . Like in April, the BoC alluded to a cash rate hike in the second half of 2022, when it forecasts spare capacity to be absorbed, although this evidently disappointed a market looking for more hawkish guidance. Canadian interest rates declined, although the first 25bp hike is still priced for around the middle of next year, while the CAD is around 0.5% weaker since the statement was released. Noa trading at 1.2513.

UK CPI surprised on the upside for the second month running, with core inflation now running above target, at 2.3%. In a subsequent speech, Bank of England MPC member Ramsden added there was a risk that inflation peaks around 4%, much higher than the BoE’s current projections. Ramsden, a known hawk, added that he could see the BoE tightening policy earlier than previously indicated given the “rapid pace of developments since we published our May forecasts and the shift in the balance of risks.” The GBP hasn’t been much affected by either the CPI release or Ramsden’s comments, cable now trades at 1.3859, up 0.27% relative to this time yesterday.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.