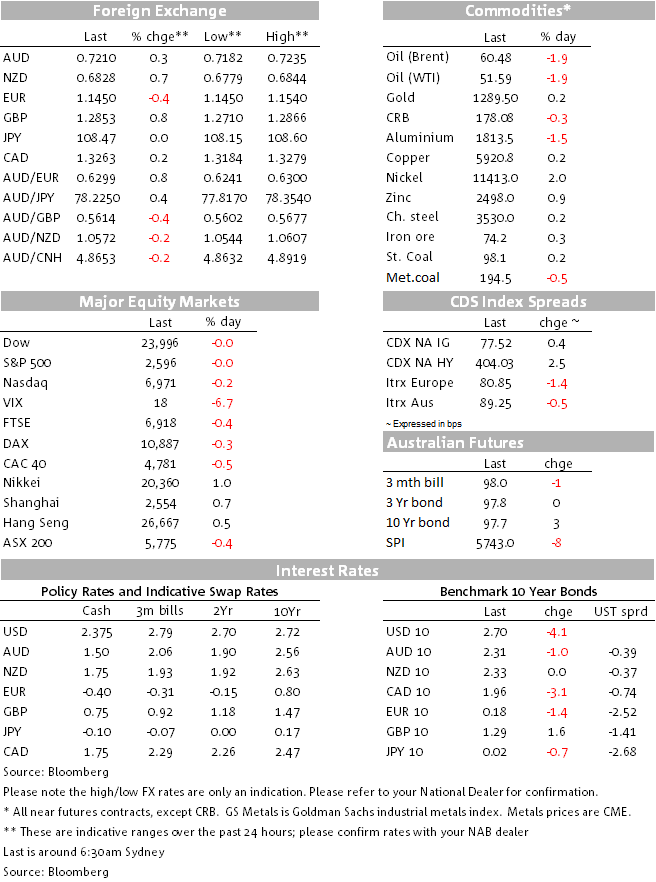

| Following five up days in a row commencing on Friday 4th January, the US equity rally ran out of steam Friday, the main indices all ending (just) in the red, albeit the NASDAQ is still showing a 5% year to date gain and the S&P500 is up over 3.5%. The VIX is nevertheless continuing to leak lower, off more than a point Friday and now back on an 18 handle, half the level seen either side of Christmas Day. This, together with a generally weaker dollar and smartly higher Chinese Yuan, has driven gains of about 1.5% in both the AUD and NZD over the course of last week (see FX below)

We can only speculate whether the ongoing US government partial shutdown, now in its 24th day, the longest in history and with no signs of early resolution, is starting to gnaw at otherwise positive sentiment. The latter has been driven by the soothing words from Fed officials in the last week or so and rising optimism that the US and China will resolve a chunk of their trade differences before the 90-day moratorium on further US tariff action kicks in (March 1st). Encouraging in this respect was news Friday that China’s Vice premier, Liu He, will be visiting Washington on Jan 30-31st for further trade talks.

US CPI came in on the screws in both headline and core terms on Friday (headline -0.1% on lower oil prices, core at 0.2% for an unchanged 2.2% annual rate) and wasn’t a market factor.

The US dollar closed slightly higher Friday despite modestly low US Treasury yields, mainly thanks to more poor Eurozone economic data, this time courtesy of Italy’s November industrial production, -1.6% and following similar sized falls in both Germany and France in the last week or so, the latter undermined by the ongoing Gilet Jaunes protests in France and which appear to have ratcheted up a notch over the weekend.

FX

NZD/USD and GBP/USD were the start turns in G10 FX on Friday, both up about ¾%, following by the AUD/USD, where the 0.4% gain brings its rise on the week to 1.43% (just pipped to first place by the NZD, +1.49%). The key driver last week was not so much a softer USD dollar, albeit that helped with the DXY and broader BBDXY indices both off by more than 0.5%, as the strengthening in the Chinese Yuan. The CNY rose by over 1.5% on the week and intra-day rises in AUD earlier in the week and NZD later on seemed to follow the falling USD/CNY almost tick for tick.

GBP’s good showing Friday came despite negative UK economic surprises in the form of industrial and manufacturing production figures, which at -0.4% and -0.3% respectively undershot expectations for gains of 0.2% and 0.4% respectively. Helping the pound higher was a report that UK Foreign Secretary Jeremy Hunt was warning Brexiteers that rejection of PM May’s Withdrawal Agreement this week could mean no Brexit and other reports that a request for an extension of the Article 50 deadline (March 29) was likely (something to which the EC is only likely to accede in the context of the possibility of a 2nd referendum).

The UK Guardian reported Friday that EC President Junker is to issue a letter Monday – ahead of Tuesday’s vote – offering further assurances to UK MPs that the Irish backstop, should it be triggered, would keep the UK in a Customs Union only temporarily. If so, it’s unlikely this will make a jot of difference to the vote, where May’s deal is set to be comprehensively rejected.

Bonds

US Treasury yields were lower across the board Friday, by between 3 and 4 basis points (2s -3.5bps to 2.543% and 10s -4.1bps to 2.702%). On the week though yields are higher, someone ironically on the improvement in risk sentiment brought about in large part by the Fed’s assurance that rates aren’t going up again in a hurry (albeit China trade optimism is also a factor here).

On Friday, Fed Vice Chair Clarida noted the softening in global growth and tightening in financial conditions and said “if these crosswinds are sustained, appropriate forward-looking monetary policy should seek to offset them to keep the economy as close as possible to our dual-mandate objectives of maximum employment and price stability”. Some interpreted the reference to “offset” as implying a willingness to cut rates. Meanwhile, Chicago Fed President Evans noted that the Fed “can easily wait six months to kind of look at the data and see how things come in”, reinforcing the notion that the Fed is unlikely to hike rates in the first half of this year, if at all.

Commodities

Oil gave back over $1 (WTI) and $1.20 (Brent) of its strong intra-week gains on Friday, but this still left WTI crude up over 7.5% on the week and Brent +6%. Evidence of reduced OPEC+ shipments and improved sentiment toward demand on prospects for Sino-US trade deal look to be the main supportive influences, and too lower US yields and what that is doing to the US dollar.

Aside from coal, with both grades off over 1% last week, it was generally a good week for other commodities. The LMEX index of base metals is up by 0.6% and iron ore 1.5% higher. Gold ended the week $4 higher, consistent with the slightly weaker USD. |