Total spending grew 0.9% in June.

There’s a lot of positive sentiment again today, with US equities on the up and the NASDAQ reaching a new high.

“I started a joke which started the whole world crying; But I didn’t see that the joke was on me oh no; I started to cry which started the whole world laughing” Bee Gees 1968

A positive night for risk sentiment with much stronger than expected European PMIs lifting hopes of a sharp rebound in activity. Also adding to the positivity was Trump’s quick clarification of the US-China phase one trade deal (“Deal is fully intact”) after Navarro’s “It’s over”, playing to the view that Trump needs the deal as much as China, and thus lowers trade war flare up risks this side of November. Speculation also continues around another US stimulus package by July. Against that positive backdrop, coronavirus numbers continue to rise in the US with markets still trying to grapple with the implications given the high bar to re-impose restrictions and little impact so far amongst consumers according to high-frequency data. How high that bar is came from Texas’ Governor on Monday who said “if we were to experience another doubling of those numbers over the next month…tougher actions will be required”. Germany in contrast has re-imposed restrictions in two districts after a spike in cases.

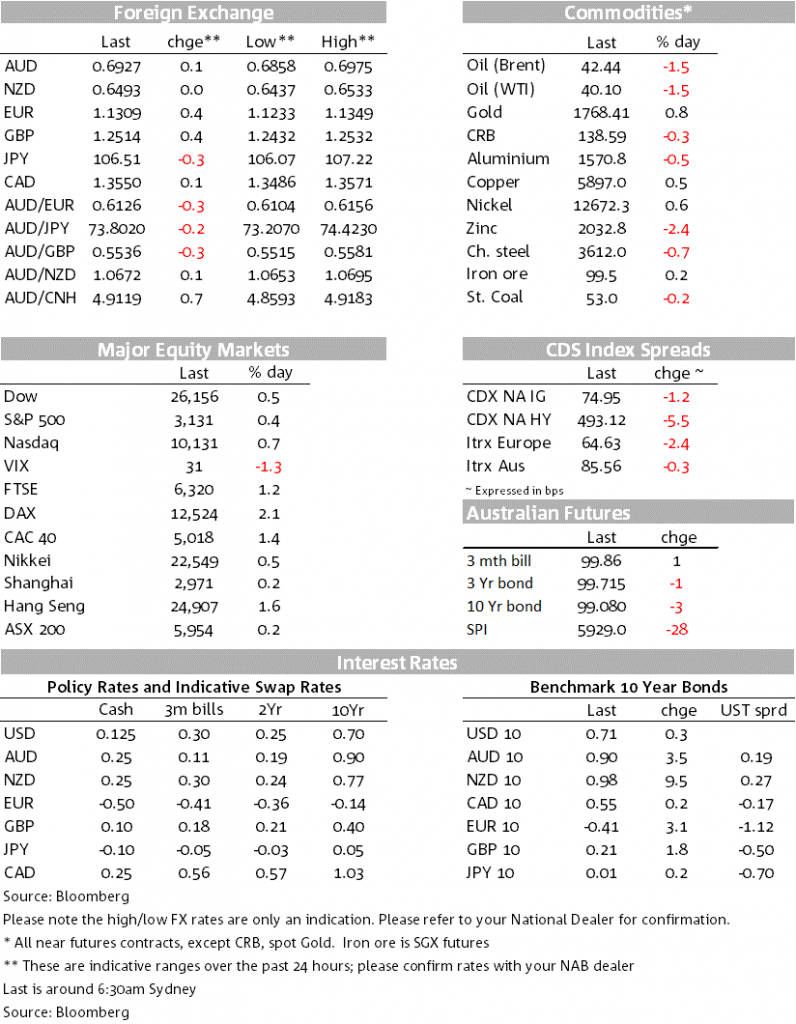

Equities rose with the S&P500 +0.4% and stronger gains were recorded in Europe with the Eurostoxx50 +1.8% and FTSE100 +1.2%.

The USD is on the backfoot amid the positive sentiment with the DXY -0.4%. The major driver of USD weakness continues to be a surging Euro with EUR +0.4% along with GBP in reaction to the strong European data overnight. Interestingly even with the positive risk sentiment, the Yen is up (USD/JPY -0.3%) along with gold (+0.7%) which is at its highest level since late 2012. Those two developments plays towards the secular USD decline story that has been pervading research desks over the past few weeks, re-iterated again overnight by the eloquent John Authers (A Weaker Dollar Is Just What the World Needs).

The AUD was little changed overnight on net, but yesterday’s intra-day volatility caused by Navarro’s “it’s over” comments and Trump’s quick clarification (“deal is fully intact”) reinforced the effective range for the Aussie of 0.6750‑0.7050 (AUD/USD went from 0.6920 to 0.6860, moves that were fully retraced once the denials came through and the AUD is currently at 0.6927). As we wrote in our latest Global FX Strategist, a big move will be required to shift it out of its range and there is little on the Australian or global calendar today.

Yields were little moved with US 10yr +0.3bps to 0.71%, though ultra-long curves continue to steepen with the 5/30s curve steepening by 3bps. The Fed’s Bullard pushed back against the possibility of yield curve control citing both the experience of the US in WW2 and more recently Japan (note Japan’s cap is on the 10yr and the US WW2 experience had caps throughout the curve all the way up to 30 years). Bullard said “I think there are a lot more questions than answers around YCC right now,” “The U.S. had YCC during WWII and then after the war the exit was very difficult, so it kind of ended in tears”. The latest US 2yr note auction suggests relatively strong demand for the front end of the US Treasury curve. Also in rates but not market moving was Moody’s reaffirming Australia’s AAA credit rating with a stable rating.

PMIs are fuelling hopes of a quick rebound in activity. The EZ Composite PMI rose to 47.5 against the 43.0 consensus and well up on the 31.9 previously. Interestingly the rebound in activity is being seen in both the services side of the economy and the manufacturing side (Services PMI 47.3, Manufacturing PMI 46.9). The recovery in services is a big distinction to the experience seen in China and important for advanced economies which are more heavily weighted toward the services side in general. While the obvious caveat for the PMIs is that they are a net balance and do not say anything about the magnitude, high-frequency data is suggestive of a pick-up in the level of activity (e.g. Open Table Restaurant bookings in Germany are tracking similar levels to last year). Amongst the EZ economies to report, France’s PMI is above 50 (French Composite PMI 51.3 v 46.8 expected) and Germany is below (German Composite PMI 45.8 v 44.4 expected). Across the channel the UK also saw a sharp rise in the PMIs with the composite at 47.6 v 41.2 expected. The US PMI was lightly below expectations, but not meaningfully so and more emphasis is placed on the ISM which are out next week (US Services PMI 46.7 v 48.0 expected).

Is a notion that US-China trade war risks are lower after Trump’s quick clarification to Navarro’s “It’s over” comments that sent risk sentiment in a spin yesterday in Asia. S&P futures drop a quick 1.6%, USD/CNH went rom 6.06 to 6.0880 and AUD/USD from 0.6920 to 0.6860, moves that were fully retraced once the denials come through. Trump quickly tweeted “The China Trade Deal is fully intact” and plays to the view of Trump needing the trade deal as much as China, if only to shore up the stock market in the lead up to November, which he places a lot of stock in. Navarro also quickly clarified his comments had been “taken wildly out of context.” “They had nothing at all to do with the phase-one trade deal, which continues in place,” “I was simply speaking to the lack of trust we now have of the Chinese Communist Party after they lied about the origins of the China virus and foisted a pandemic upon the world.”

COVID-19 case numbers continue to rise in the US, but for now markets are having trouble with the implications given the high bar to re-imposing restrictions. Over 30 states are seeing an R0 figure of above one and California reported a record number of new daily cases (over 5000). How high that bar is came from Texas’ Governor on Monday who said “if we were to experience another doubling of those numbers over the next month…tougher actions will be required”. Germany in contrast has re-imposed restrictions in two districts after a spike in cases. US health expert Fauci told lawmakers that we are seeing a “disturbing surge” in new cases across the US and he urged officials to increase testing, contradicting President Trump’s weekend advice to slow testing to reduce case numbers. He also noted that at least one vaccine candidate was set to go into a phase 3 trial next month and others would quickly follow. On a positive note, Italy reported the lowest number of new cases since late February (122).

While even across the ditch the RBNZ Decision is expected to be unexciting. Its also quiet offshore with the BoJ Minutes, German IFO and a few Fed speakers. Key releases in detail below:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.