We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

The US President declares the economy is roaring back following 4.8 million new jobs in June.

https://soundcloud.com/user-291029717/roaring-back-a-bit?in=user-291029717/sets/the-morning-call

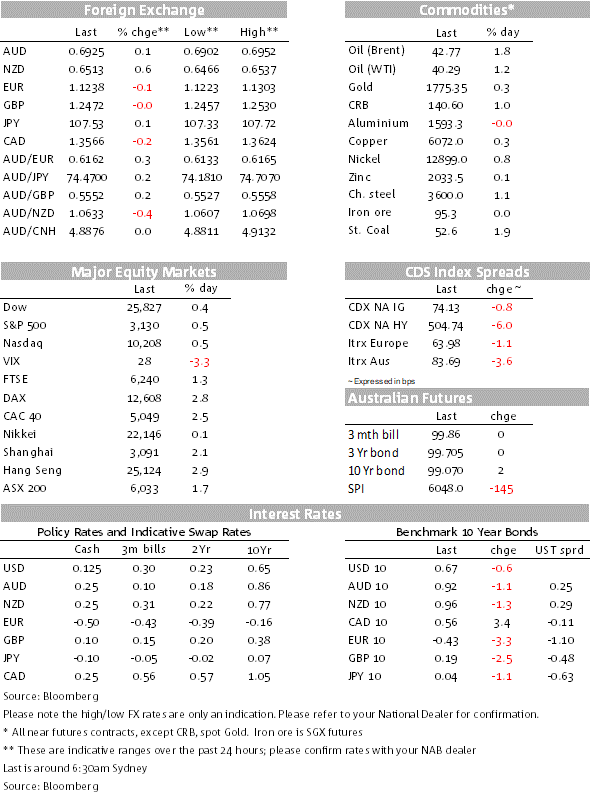

After a solid start, helped along by a better than expected non-farm payrolls report, US equities have closed the day with modest gains. Increase in US virus infections and an unhappy Larry Kudlow on China curbed the market’s enthusiasm. USD and UST yields are little changed, AUD has an up and down overnight session and NZD is the G-10 outperformer, now back above 65c.

The unusual holiday induced (Independence Day) release of US non-farm payrolls and jobless claims at the same time delivered contrasting images of the state of the US labour market. Payrolls rose by a more-than-expected 4.8m in June after an upwardly revised 2.7m gain in the prior month. The data which is based on a survey run half way through the month also showed a better than expected improvement in the unemployment rate, declining to 11.1% from 13.3% in May vs. 12.5% expected. The Bureau of Labor Statistics (BLS) noted that if a correction to misclassified respondents was applied the June unemployment rate would have been about 1% higher than reported – or 12.3%, compared with a similar adjusted number of 16.4% in May. So encouragingly “The degree of misclassification declined considerably in June,” BLS noted.

Jobless claims based on last week’s data (so a more timely reading), revealed initial applications for unemployment benefits remained extremely elevated at 1.43m new applications, vs 1.48m in the previous week and against expectations for a decline to 1.35m. Continuing claims (i.e claims for ongoing unemployment benefits) rose slightly to 19.3 million in the week ended June 20, from a revised figure of 19.2 in the previous week.

So while June data reflected a big improvement in the US labour market, the recent sharp acceleration in new virus cases plus the prospect of an end to unemployment benefits by the end of July are two big layers of uncertainty. Congress may well extend the benefits, but the acceleration in US virus infection suggest this headwind for the labour market could linger for longer.

US virus news wasn’t great. Florida’s Covid-19 cases and hospitalizations jumped by the most on record (up 6.4%, from a day earlier, compared with an average 5.6% in the previous seven days) and deaths climbed the most in a month. Cases in the US virus cases jumped the most since May 9 and Houston reported a 4.3% jump in intensive-care patients, and may need to tap extra beds in less than two weeks. Adding to the gloomy news, Dr Fauci, the US infectious disease researcher supremo, said COVID-19 may be mutating in a way that may make it easier to spread.

Speaking to Fox Business Network, White House economic adviser Larry Kudlow, noted the US is very unhappy with China’s “hacking” into the government and private corporations, he then went on to say that “We are very unhappy with China. And yes, there are going to be export restrictions, particularly with respect to military, national security and some sensitive high technology,”

Equity markets liked the non-farm payrolls report, helping European indices end the day with solid returns and boosting US equity indices at the NY open. The Stoxx Europe 600 Index closed the day just below 2%, with all sectors in the green. The S&P 500 gained over 1.5% in the first hour of trading, but virus news and comments from an unhappy Larry triggered a reversal in the early gains. The S&P 500 ended the shorter US working week at 3130, up 0.45% on the day ( US celebrates Independence Day today). The Dow closed +0.36% and the NASDAQ was 0.52%.

The USD is little changed on the day. The US labour market data weighed on the USD as the positive equity reception erase some of the safe haven demand for the greenback. DXY traded down to an overnight low of 96.815 following the data release, but as the US virus news hit the screen and the equity market gave back some of its early gains, demand for USDs return and the DXY closed the session at 97,232, up 0.05% over the past 24 hours (BBDXXY at 1215, -0.07%).

The AUD traded in higher beta but mirror image to the USD. It recorded an overnight high of 0.6952 after payrolls and then a low of 0.6902 after the Florida virus stats. AUD now trades at 0.6924, 0.12% up over the past 24 hrs. NZD on the other hand has had a better night, steadily rising to an overnight high of 0.6537 and ending the day above 65c for the first time sine June 24 ( the pair now trades at 0.6510, +0.52%).

Global rates initially moved higher after the payrolls release, but the reaction soon faded, leaving 10-year rates flat-to-lower on the day. The 10-year Treasury yield rose 4bps to 0.71%, but it is back down at 0.6693% as we write. Rates markets continue to imply far less optimism about the global recovery than equity and commodity markets.

Oil prices are up around 1% and steam coal is up just under 2%. Iron ore gained 0.95% while copper and gold added around 0.40% to their recent gains.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.