We expect growth in the global economy to remain subdued out to 2026.

Insight

First to US wage data overnight. The Employment Cost Index (ECI) is closely watched by the Fed as it compositionally adjusts wages growth..

“I know, I know what you must be thinking; That we are powerless to change things; But don’t, don’t give up; ‘Cause we got love, ’cause we got love”, Jessica Mauboy 2018

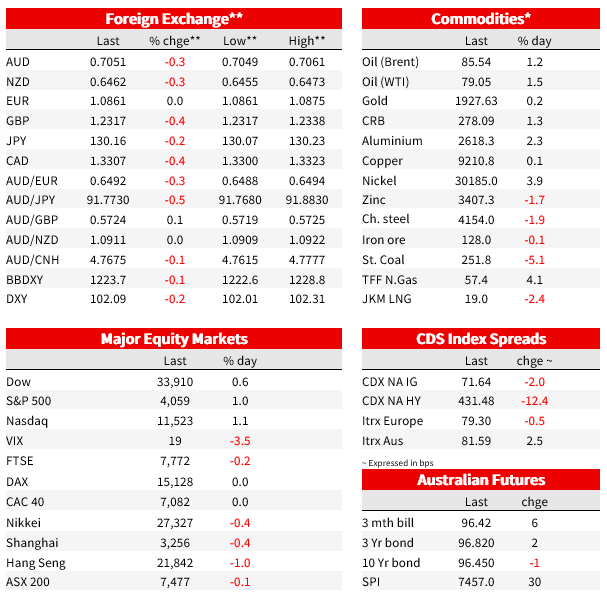

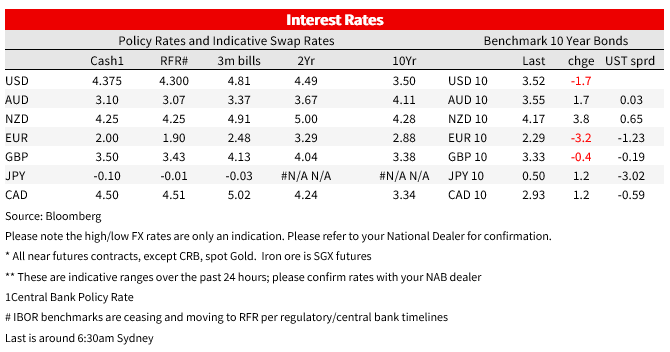

A softer than expected US wages (ECI) print helped risk appetite improve last night. The ECI was 1.0% q/q against 1.1% expected and 1.2% previously. Even more encouraging was the sub-component most watched by the Fed – wages and salaries for private sector workers excluding incentive paid occupations – which rose 0.9% q/q from 1.2% previously. Importantly a figure around 0.9% q/q is getting closer to being consistent with at target inflation. The biggest reaction has been in equities with the S&P500 so far +1.0%, reversing the weakness seen in futures which were down -0.8% at one point. The USD (DXY) also reversed its initial gains of 0.2%, to be -0.2%. Treasury yields in contrast were less moved ahead of the FOMC with the 10yr -1.7bps to 3.52% and the 2yr -3.0bps to 4.21%. Fed Funds pricing very marginally edged lower; a 25bp hike is fully priced tonight, an 80% chance of a follow up in March, a peak in the Fed Funds Rate of 4.92% by June 2023, and 43bps of cuts thereafter in H2 2023.

First to US wage data overnight. The Employment Cost Index (ECI) is closely watched by the Fed as it compositionally adjusts wages growth, unlike other more timely measures (indeed Fed Governor Brainard said recently “I will be watching to see whether the employment cost index data at the end of this month show the deceleration from the third quarter continuing into the fourth quarter ”). Overnight the Headline ECI did decelerate to 1.0% q/q, down from 1.2% previously, and was also one tenth below the 1.1% consensus. While the annual y/y rate is still high 5.1%, the quarter annualised rate is clearly slowing. More important for the Fed is one of the subcomponents, the wages and salaries for private sector workers excluding incentive paid occupations, which rose 0.9% q/q from 1.2% previously. A notable deceleration and in quarter annualised terms would be equivalent to 3.6-3.7%. That is close to being consistent with at target inflation if repeated next quarter. (see also WSJ’s Fed whisperer Timiraos: Cooler Pay Gains Add to Debate on When Fed Might Pause Rate Hikes).

Other US data was not seemingly market moving. The Chicago PMI was 44.3 against 45.0 expected, suggestive of downside risks to tonight’s Manufacturing ISM (consensus is 48.0). Consumer Confidence (Conference Board measure) also disappointed at 107.1 against 109.0 expected. Across the pond, the Eurozone Q4 GDP surprised at 0.1% q/q against -0.1 expected. While it does raise the hopes that recession may be avoided, Italian GDP was weaker at -0.1% q/q, along with German GDP at -0.2% q/q with the possibility of downward revisions given German retail sales for December printed at -5.3% m/m yesterday against -0.2% expected. The next big data point for the Eurozone are CPI figures tonight with upside risks after Spanish figures earlier in the week, though French figures overnight were as broadly as expected (French headline 0.4% m/m against 0.4% expected).

On the positive side the IMF raised its 2023 world GDP growth forecast to 2.9%, up from 2.7% forecast last October, supported by China’s reopening. China is now expected to grow by 5.2% in 2023 (see IMF WEO Forecasts for details). Speaking of China, the PMI figures bounced strongly with Non-Manufacturing at 54.4 from 41.6; 52.0 expected. The Manufacturing side also rebounded to 50.1 from 47.0; 51.0 expected. The exception in the G7 to the growth upgrades was the UK which is expected to contract by -0.6% in 2023. There were also plenty of negative news headlines flying around regarding the UK with Bloomberg estimating the cost of Brexit at £100bn per year (4% of GDP) and UK politics also remains dire. It is perhaps for this reason that GBP didn’t manage to rally on USD weakness and is down -0.4% over the past 24 hours to 1.2317

Elsewhere in FX there has been little net movement over the past 24 hours. The USD (DXY) did move marginally higher before the wage data, but quickly reversed to be down -0.2%. The AUD has been a little more volatile, dipping on the weaker than expected retail data yesterday and then again as global risk appetite softened to hit a low of 0.6984, before recovering to sit at 0.7054. A similar reversal is seen across most pairs with EUR taking a leg down towards 1.0802 before turning and extending gains to be around 1.0865 as the USD weakened. USD/JPY also initially dipped under 129.80 post the US wage data, but reversed to be little changed. Across the ditch the NZD dipped under 0.6420 overnight, before USD weakness returned NZD back above 0.6450. A 3.2% lift in whole milk powder prices at the GDT Pulse auction overnight can only have helped.

In Australia, retail sales fell a sharp -3.9% m/m in December (consensus -0.2%; NAB -1.0%), following an upwardly revised November to 1.7% m/m (from 1.4%). Interpretation is difficult given shifting seasonality associated with Black Friday/Cyber Monday, with large falls also seen in Dec 2021 (-3.7% m/m) and Dec 2020 (-3.3% m/m). Taking the average of November and December in seasonally adjusted terms, over September and October, suggests retail spending in nominal terms was broadly flat at a -0.0 m/m pace, but was still 26.6% above pre-pandemic February 2020 levels. For the RBA, the retail data may suggest the consumer is starting to react to real income declines and to higher rates, which could make the RBA more confident that inflation should ease despite Q4 trimmed mean inflation surprising by four-tenths (6.9% y/y vs. 6.5% as pencilled in the November SoMP). The debate at the upcoming February Board meeting is likely to be 0 vs. 25; and we think the RBA will lift rates by 25bps in February and March, before pausing thereafter.

Coming up:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.