Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

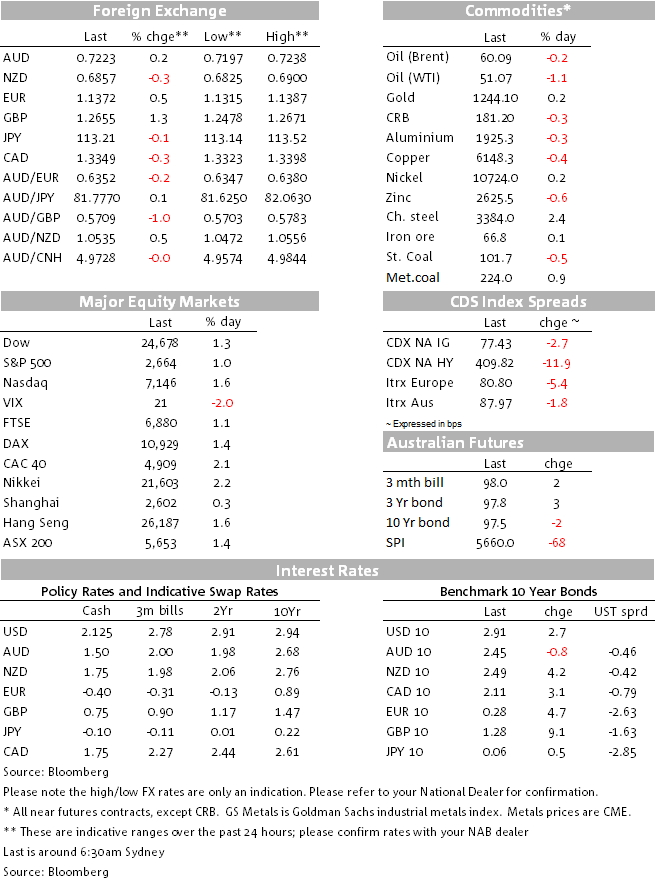

US equities have had a shot in the arm following a Wall Street Journal report that China might open up access to their domestic markets for foreign companies.

https://soundcloud.com/user-291029717/torys-vote-on-mays-leadership-china-to-open-up-market-access-to-foreign-firms

Yesterday President Trump said it would be “foolish” for the Fed to raise rates again next week, demanding help in his trade fight with the US. The plea rightly fell on deaf market ears with no shift in pricing for a rate rise next Thursday. This currently stands at 91% on our calculations, assuming that the Fed only moves up the interest rate it pays banks on excess reserves (IOER) by 20bps. This would be designed to push the effective Fed Funds rate back closer to the middle of the Fed’s quarter point-wide target bands from nearer the top at present. CPI overnight came in as expected, so did nothing to impact Fed expectations.

Far more relevant for markets has been the sharp improvement in sentiment towards the US and China settling a good chunk of their trade differences in coming months and which has culminated in China expressing willingness to revamp its so called ‘Made in China 2025’ policy. In the scheme of things and were this to prove true, this is far more relevant than China agreeing to restart purchases of American soybeans, or even reducing the tariff on US car imports from 40% to 15%, as has been indicated in the last 24 hours.

Meanwhile the leadership challenge to UK PM Theresa and what this means for Brexit continues to be a sideshow outside of the UK, save that the EUR has drawn some support from the stronger pound (May is expected to see off the challenge), helped too by sharply lower Italian bond yields as the EU and the Italian government comes tantalisingly close to agreeing on a budget deficit target for 2019 (in the order of 2%).

Risk sentiment was buoyed during the APAC session yesterday by a variety of comments, including President Trump himself, indicating progress on trade talks, a willingness to suspend further tariff action until it became clear whether a deal can be done and even expressing willingness to intervene in the Huawei case if this would help progress trade talks. Plus, media reports indicate that China’ economic czar Hui told US Treasury secretary Steve Mnuchin on Monday that the tariff on US car imports would be cut to 15% from 40%.

Overnight, the WSJ has reported that China was drafting a replacement for the Made in China 2025 policy. It has become perhaps the main sticking point in the US-China trade war, and a change in direction from China on this front would increase the chances that the two sides come to an agreement next year. According to the WSJ, China was considering delaying some of its targets to 2035 and put more focus on improving industry standards, with the new policy planned to be rolled out early next year.

With an hour of trade to go all the main US indices are showing gains of more than 1%, the NASDAQ currently on top at +1.5%. Gains are fairly uniform across the S&P 500 sectors, save that defensive stocks are low (consumer staples, utilities) and interest rate sensitive sectors underperforming (real estate).

November Core CPI inflation came in line with expectations at 0.2% m/m. The annual core rate was 2.2% y/y and also as expected. Mapping CPI onto PCE (the Fed’s preferred inflation measure) suggests Core PCE for November will be subdued at 0.15% m/m and 1.8% y/y. Overall this suggests a more stable inflation outlook, which gives the Fed scope to pause its hike cycle if needed next year.

The USD is weaker by about a third of a percent, gains in the DXY driven by the 1%+ rise in GBP on indications UK PM may will comfortably defeat the confidence vote against her party leadership (results expected anytime). This really does nothing to clear the Brexit fog still hanging over UK markets, and indeed doesn’t diminish the chances that the current political fiasco could end up in an early General Election. But markets are trading the view that risk of a no deal ‘crash out’ next March are lower in so far as May is not about to be replaced by a ‘hard Brexiteer’ from the right wing of the Tory party.

EUR/USD has been caught in the slipstream of the GBP rally, up 0.4%, but which is also a function of a sharp (15bps) narrowing in Italian BTP/German Bund spread with Italian 10s back below 3% for the first time since late September. The EU and Italy seem close to agreeing 2019 budget deficit target that will be very close to 2% of GDP. French President Macron’s fiscal response to the yellow shirt protests and which now sees France projecting budget deficits back above 3% next year, is seen playing into Italy’s hands in its battle with the European Commission.

The AUD has been supported by the improved Sino-US trade mood music, to be up 0.14% on Tuesday’s NY close at 0.7217, but NZD is lower (-0.39%), perhaps reflecting some unwinding of short AUD/NZD positions and which had driven the cross from above 1.06 to below 1.05 this month (1.0530 now)

The better risk tone and absence of downside CPI surprises has lifted US Treasury yields, 10s +2.0bp to 2.90% and 2s up 0.2bp to 2.766%. 10yr Bund yields needed 4.6bps higher in front of tonight’s ECB meeting (the main offshore event).

Iron ore futures are flat while base metals are mixed despite the improved Sino-US trade backdrop, with copper -0.5% and aluminium unchanged while nickel lead and tin are all higher.

Oil was initially higher on news that US crude inventories fell by 1.2 mn. barrels last week but has since fallen back again with WTI 40 cents down and Brent about unchanged on 24 hours ago.

US weekly jobless claims are due tonight which are of increased importance in so far as the recent uptick prefaced last Friday’s weaker than expected rise in US payrolls.

The main event offshore though is the ECB meeting, where we expect the Governing Council to confirm at end of the Asset Purchase programme (APP) this month. Growth forecasts are likely to be cut by 0.1-0.2 ppts (2018 likely 1.9% from 2.0%; 2019 1.6-1.7% from 1.8%). Headline Inflation forecasts may also be lowered by 0.1 ppts or so due to the fall in the oil price but confidence is likely to be maintained in inflation heading up next year driven by wages.

The ECB’s forward guidance on rates (rates expected to rise after the summer of 2019) but a dovish emphasis is likely in the press conference to provide assurance that accommodative policy is set to remain for a good while yet.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.