We expect growth in the global economy to remain subdued out to 2026.

Insight

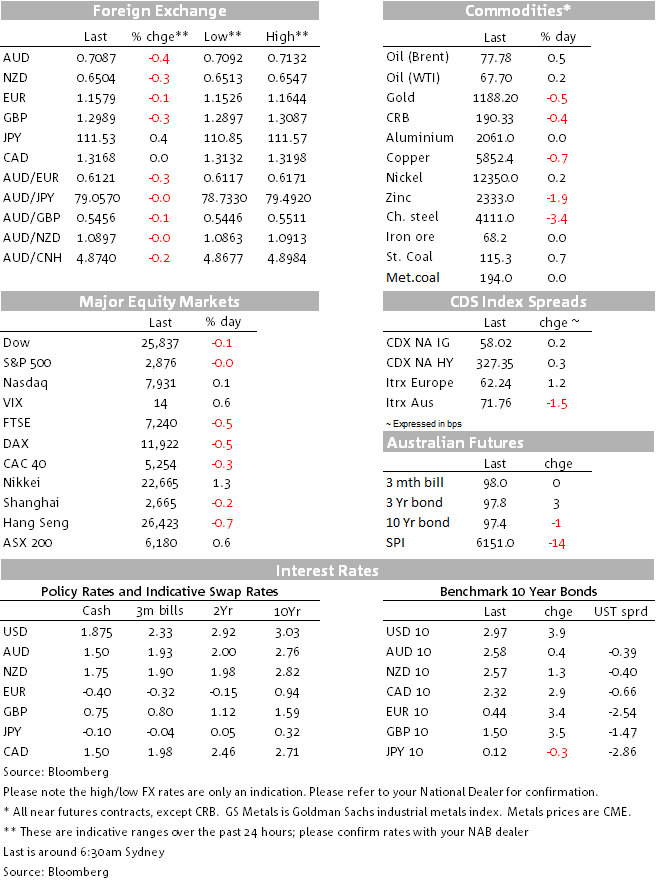

US 10 year Treasuries are closing in on 3 percent again, as expectations firm on two further rate hikes this year.

https://soundcloud.com/user-291029717/treasury-yields-fly-high-us-optimism-soars-plus-nab-business-survey-wrap

You sent me flying – Amy Winehouse

Solid US data and higher oil prices lift US Treasury yields across the curve with pricing of US Fed hikes expectations also increasing for 2018 as well as 2019. US equities close higher, dismissing the negative lead from Europe and the USD had a quite night in spite of the move higher in UST yields. NOK outperforms with data supporting expectations for a Norges Bank rate hike next week, while JPY is weaker weighed down by an increasing rate differential with the US.NZD and AUD make new intraday lows but recover handsomely amid an improvement in risk sentiment before the NY close

The round of solid US data release continued overnight with the NFIB small business survey printing it highest levels since 1945 while the JOLTS survey revealed a further pick-up in job openings ( see more below). Solid US data release alongside a rise in oil prices have lifted UST treasury yields across the curve by around 4bps on average, taking the 2y rate to 2.7438% and the 10y rate to 2.98%.

The US economic backdrop at present remains very supportive of further Fed tightening, and the market has upped its probability for a December hike to above 80% and increased rate hike pricing for 2019 to 42bps. In this environment, we would expect US Treasury yields to continue to grind higher.

Somewhat surprising given the move higher in UST yields, the USD is little changed in index terms. DXY trades at 95.073, fairly close to its level this time yesterday. That said is difficult not to be USD bullish as domestic data continues to vindicate the Fed gradual hiking path, forcing the market to come around to the idea that not only 2 more hikes should be expected this year, but also another 3 in 2019. In the meantime US equities remain unconcerned over the impact from an imminent new round of US tariffs on Chinese imports. The S&P 500 has almost fully recovered from the wobble at the start of the month while Europe and Asia continue to leak lower ( DAX is -4.19% month to date and Shanghai is -2.66%).

For now JPY is the only currency seemingly affected by the move higher in UST yields (USDJPY is -0.46% to ¥111.60), but if we are right and UST yields continue to push higher, we wouldn’t be surprise to see the AUD and NZD also succumbing to higher UST yields pressure.

After making new intraday lows (AUD down to 0.7085 and NZD down to 0.6501), both antipodean currencies managed a decent recovery before the NY close. The improvement in US risk sentiment appears to have been the driver here, but unless this improvement becomes broad based particularly in Asia/EM, sell on rallies remains the theme for both the AUD and NZD.

NOK recorded its third consecutive daily gain against the USD with a business survey overnight confirming an outlook for solid investment growth. After a solid CPI print, the market is now becoming increasingly confident of a Norges Bank hike next week.

The GBP is holding above the 1.30 level against the USD amidst a more positive tone to Brexit negotiations. The Times reported that the UK believed EU chief negotiator Michel Barnier’s position on Chequers had shifted in recent weeks and the government was “very confident” a vote would pass through parliament. Separately, the European Research Group, comprised of Eurosceptic MPs, abandoned the publication of its 140 page post-Brexit plan yesterday, based around a Canada-style free-trade agreement. Supporters of a softer Brexit claimed that Brexiteers still could not come up with a workable alternative to the Chequers agreement or a “Plan B” they could agree on. UK economic data continues to have limited impact on the market, although the labour market report showed a larger than expected increase in wage growth to near its post-crisis highs, at 2.9%.

The S&P500 recovered from earlier losses sustained after China applied to the WTO to retaliate against the US in relation to a 2017 anti-dumping dispute (i.e. pre-dating this year’s trade escalation). The energy sector led the gains in the S&P500 on the back of decent gains in oil prices (see more below).

Meanwhile Europe and Asia had a mixed nigh, the STX Europe 6000 closed -0.07% and Chinese equities also closed lower. Notably too, Hong Kong’s Hang Seng index fell into bear market territory closing 20%below its cyclical high in January.

Oil prices are over 2% higher supported by a trifecta of Hurricane Florence, Iran supply concerns and news of lower US oil production in 2019.

There is a strong possibility hurricane Florence moves to a Cat 5 storm before it hits land and it is already a major disruptor on the US east coast gasoline market as mass evacuations stretch supplies and Florence’s heavy rains endangers major fuel pipelines. Meanwhile, France and South Korea are barring Iranian crude with Japan in negotiations with the US to do the same. Finally an EIA report expects US domestic oil output to average 11.5m barrels a day next year, down from a previous estimate of 11.7m a day. The agency also lowered its outlook for production this year.

Coal prices managed to record modest gains, but downward pressure in other commodities remain the theme with metal prices posting the largest decline overnight. LMEX fell 1.54%, aluminium declined 2.43% while copper and iron ore were down 0.57% and 0.33% respectively.

The German ZEW survey for Sep found the current situation sentiment picked up marginally to 76 from 72.6, remaining subdued. The expectations survey improved to -10.6 from -13.7, also remaining below +20 levels recorded early in 2018.

UK labour market data was strong with wages +2.9% ex-bonus (3M y/y) above the 2.8% consensus and from 2.7%. Headline wages +2.6%. Both measures are above 2.5% CPI. The ILS jobless rates remained at its multi-decade low of 4%, while employment rose to a new high of 32.397mn.

US NFIB small business optimism rose to a new high of 108.8 in Aug from 107.9 in Jul – better than the 108 consensus and a 45-year high. Six of its ten major components rose, though the biggest gain came in inventories. That said NFIB said job creation plans and unfilled job vacancies both set new records and owners saying it is a good time to expand tied with the May 2018 all-time high.

BoE Governor Mark Carney has confirmed he will extend his tenure at the bank from Jul 2019 to end 2020.

The IMF managing director told the Financial Times that her staff does not yet see “contagion” spreading to multiple countries beyond those currently fighting investor flight.But she warned that “these things could change rapidly” and cited the “uncertainty [and] lack of confidence already produced by the threats against trade, even before it materialises”, as one of the main dangers facing the developing world.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.