Fiscal stimulus likely too late to boost 2024 growth, but may add some upside to 2025 forecasts

Insight

Philip Lowe, the Governor of the RBA, is talking this morning.

https://soundcloud.com/user-291029717/trump-talks-it-up-will-lowe-talk-it-down?in=user-291029717/sets/the-morning-call

It doesn’t have to be like this, All we need to do is make sure we keep talking – Pink Floyd

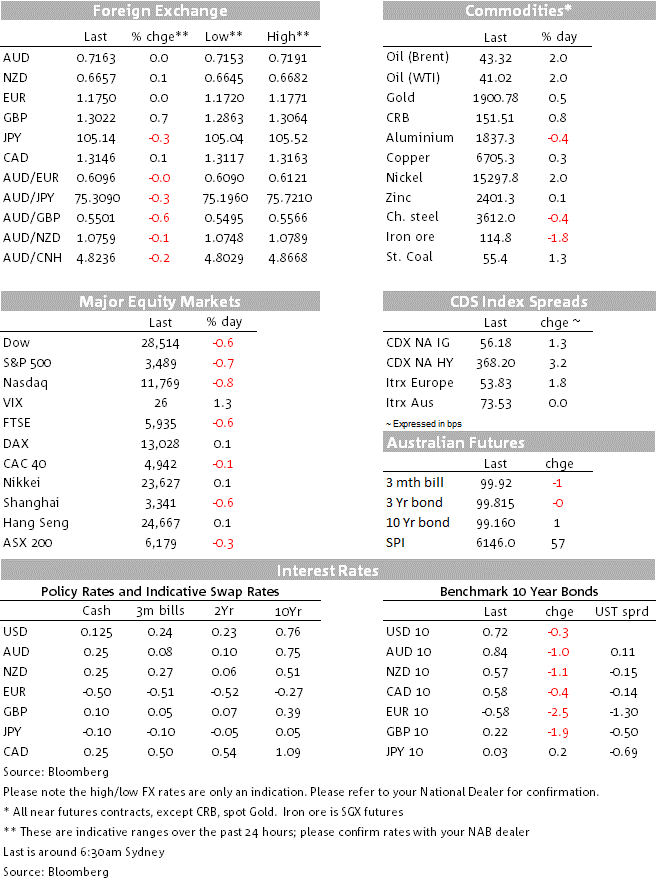

The S&P and NASDAQ both closing down 0.7%. Industrials, Materials and Energy are the only S&P sub-sectors in the green (the Energy sector helped by higher oil prices and M&A chatter (Conoco Phillips reported to be in talks to acquire Concho Resources). Financial (-1.1%) were lower following earnings reports from Wells Fargo, BAML and Goldman Sachs, while consumer discretionaries are the worst performing sector, down 1.4%.

Further fading of hopes for a pre-election US fiscal support bill looks to have weighed, with US Treasury Secretary Steve Mnuchin telling delegates to a Milken conference event that while he’s trying to reach a stimulus deal with House Speaker Nancy Pelosi, getting something done before the Nov. 3 election will be difficult. There continues to be progress on certain issues but stimulus talks are still far apart on others, Mnuchin said. For her part, a spokesman for Pelosi described Wednesday’s talks with Mnuchin as ‘productive’. The two sides have at least agreed to talk again on Thursday.

Wells Fargo fell more than 5% after posting a profit slump and warning that net interest income could “get a little bit softer” in 2021, while Bank of America fell 4% after reporting trading revenue that increased by much less than its competitors – most notably Goldman Sachs who reported a surge in fixed-income revenue that delivered a record EPS. Its stock rose by about half a percent.

More so in Europe than the US and where latest data showing virus infection rates in countries including France, Spain, the Netherlands, Belgium and the UK to be above 250 per million, higher than the US during its July peak, and spiralling infection rates in Germany, may be relevant. At least hospitalisations and death rates are lower than seen earlier in the year and distancing restrictions in most countries are more localised such that the economic fallout is, for now at least, less severe.

German 10-year Bund yields fell by 2.5bps to -0.585%, the lowest since the end of April while 10-year US Treasury yields dropped by a lesser 0.5bp to 0.72%, a move led by lower inflation break-evens (also -0.5bps, to 1.70%).

GBP stands proud at the top of the G10 leader board, this after Bloomberg reported a draft text of a post-EU Summit declaration that notes that while insufficient progress has made to enter final stage negotiations on a post-Brexit UK-EU trade deal, The EU’s Michell Barnier is instructed to continue talking with his UK counterparts. As we have long said, the end of October or the first couple of days of November is the real deadline before a ‘no deal’ Brexit might become a reality. GBP/USD is back above $1.30 and AUD/GBP back down near its recent lows of 55 British pence.

USD/JPY is back down near Y105 (-0.3%) on the combination of weaker stocks and lower US Treasury yields, with a not a lot of movement elsewhere.

The NZD continues to show immunity to the incoming uber-dovish commentary from RBNZ officials (latest from Assistant Governor Hawkesby, who late yesterday commented that all economic scenarios included very weak inflation pressures and, while some data had surprised on the upside, the economy was still on life support and continued policy support will be required. He added some fuel to the negative rates debate, suggesting that he had no concerns of them being problematic for banks and the negative rates option was “not a game of bluff”.

Fonterra has lifted its 2020/21 milk price forecast range to $6.30 to $7.30 (from $5.90 to $6.90 previously) – so the mid-point up to $6.80 from $6.40. As BNZ’s Doug Steel notes “ this follows some better GDT auction results and a contained NZD. It fits with the upside risks we have been highlighting. So not a major surprise, but certainly positive and a vote of confidence for the season’s revenue”. NZD unmoved on the news.

At 0.7165 ahead of a speech from RBA Governor Lowe this morning.

Though AUD has suffered a little this week from the snap-back in USD/CNY following the weekend PBoC pronouncements, it has failed to draw support overnight from a strengthening in CNH (USD/CNH down to near 6.71 from 6.74.

We had strong China September credit and money supply numbers overnight, with new Yuan loans up Y1,900bn (1,700bn expected), Total Social Financing up Y3,480bn (3,000bn expected) and annual M2 money supply growth up to 10.9% from 10.4%.

US Producer prices came in at 1.0% in core year on year terms, up from 0.6% in August but below the 1.2% expected.

For further FX, Interest rate and Commodities information visit com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.