We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

The UK and the US are well ahead of Europe on vaccine rollouts, and that seems to be the major focus of markets right now.

https://soundcloud.com/user-291029717/us-and-uk-blossom-as-euro-struggles?in=user-291029717/sets/the-morning-call

I got that sunshine in my pocket, Got that good soul in my feet…

I can’t stop the feelin’ , So just dance, dance, dance – Justin Timberlake

The equity market resurgence has continued overnight with Europe recording its fourth day of consecutive gains and the US set to do the same in the next hour or so. Solid earnings reports, fading concerns over retail trading disturbances and better than expected US jobless claims contribute to the positive vibes.

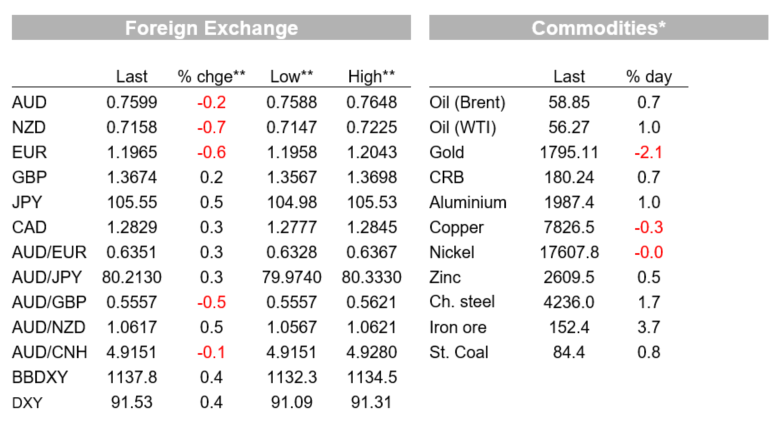

The USD recovery continues with EU currencies the big underperformers, improvement in risk appetite not enough to arrest USD strength against pro risk currencies such as the AUD and NZD.

Corporate earnings results have helped keep the positive vibes in the equity markets space on both side of the Atlantic with banks doing well in Europe (Danske Bank and Nordea ) and in the US.

The move up in EU core yields has fuelled expectations of further curve steeping, another factor aiding the gains in financial shares (steeper curves are typically supportive of bank net interest margins).

10y Bunds climbed 1bps to -0,456%,10y UK Gilts rose 6.8% to 0.438% while 10y UST yields are little changed at 1.137% .

EBay and PayPal also recorded gains after beating analyst expectations.

Netflix gained on news it plans raise the price of its service in Japan.

Concerns over retail traders market disturbances continue to ease with GameStop currently down over 30% on the day, although news media reports suggest retail interest has moved toward small drug developers, thus keeping the Reddit driven volatility to a small corner of the market for now.

The Stoxx Europe 600 Index climbed 0.6% and all major European equity indices ended the day with positive gains, although the UK FTSE 100 was an exception, closing marginally in the red (-0.06%) weighed down by gains in GBP after an upbeat BoE (more below).

The NASDAQ is 0.93% and the S&P 500 is up 0.84%. Materials is the only S&P 500 sector down while financials are leading the gains up 1.94% and IT 1.16%. The VIX has fallen back to 22, around where it was before the GameStop saga erupted.

A positive sign for the labour market and a trend which should continue as vaccination allows COVID-related restrictions to be gradually pared back.

The nonfarm payrolls report is released tonight, with the market looking for a bounce-back in employment growth, to +100k, after last month’s surprise fall.

The USD tends to lose some of its safe haven appeal when equity markets embark on an uptrend. That is not the case at the moment with FX dynamics dominated by vaccine developments, major currencies are being rewarded by positive news on vaccine roll outs while those lagging behind are being punished .

Bloomberg reports that by their own estimates the US is on pace to vaccinate 75% of its population against COVID-19 this year. The UK and Israel are also on track to deliver a two-dose vaccine programme this year. Meanwhile at the current pace, Europe would need a few years to realise the same feat.

This means that for now medium-term USD headwinds such as low negative rates and the prospect of a widening of US twin deficit are back on the back burner.

USD indices look set to record their fourth gain in five days with BBDXY up 0.39% and DXY up 0.44%.

European equities are the major underperformers with the Euro down 0.63% and now trading below the 1.20 mark for the first time since the end off November last year.

GBP is the only G10 that has managed to keep pace with the USD following an upbeat BoE policy meeting .

The BoE meeting ouctomes were in line with expectations with no change in policy settings i.e. 0.10% and £895bn inc £20bn corp bonds. Policy stance remains appropriate. Unanimous decision. No intent to tighten policy until ‘significant’ progress, mirroring the Fed. F/cs show (as expected) weaker Q1, 2021 GDP at -4% due to the restrictions. Total 2021 GDP now seen at 5% from 7.25% in Nov. CPI expected to rise sharply in spring as higher Brent and energy price hikes feed through.

On its negative rate review the BoE (also as expected) says it’s intention is not to signal negative rates are imminent, but to ask regulators to ensure banks begin preparations for such an event if necessary. Logistically the BoE says it is too risky for banks to implement neg rates without doing 6m prep, even though most could implement within this timeframe.

Ahead of the meeting cable was under pressure trading down to 1.3567, post the meeting it traded to a high of 1.3710 and now it has settled at 1.3674.

The AUD has been relatively steady, although in the second half of the overnight session the Aussie was unable to resist the USD resurgence, trading down to an overnight low of 0.7588 and now is toying with a move back above 76c ( 0.7599 as I type).

The NZD has given back its post-HLFS gains overnight amidst the stronger USD. The NZD is back towards 0.7150, down about 0.8% in the past 24 hours, as it remains locked within its recent 0.7100 – 0.7250 trading range.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.