Robust growth for online retail sales observed in June

Insight

There have been big falls in US equities overnight after higher than anticipated jobless claims, showing its not a smooth recovery for the US.

https://soundcloud.com/user-291029717/us-equities-fall-pound-rises-ahead-of-boris-escape-plan?in=user-291029717/sets/the-morning-call

Boy, you gotta carry that weight

Carry that weight a long time – The Beatles

The S&P 500 looks set to join the Eurostoxx 50 index on its third day of consecutive negative returns with the move up in core longer dated yields seemingly denting investors confidence. Disappointing US jobless figures didn’t help the cause either while in Europe underwhelming earnings reports also weighed on sentiment. 10y UST had another look above 1.30%, before retreating again, the USD is broadly weaker with GBP outperforming. AUD is little changed notwithstanding a solid night for commodities excluding oil.

The S&P 500 is currently down -0.33%, the NASDAQ is – 0.50% and the Dow is -0.29%. As it stands the Dow today will be ending its four-day winning streak while the S&P 500 and NASDAQ will be recording their third consecutive day of negative returns . The recent move up in longer dated core yields appears to be weighing on equity investors mind, the S&P 500 opened the overnight session lower trading down to a low of -1.18% following underwhelming data releases, but in the last hours of trading it appears to be attempting a recovery.

Meanwhile in Europe all main regional indices ended the day in the red with the FTSE 100 leading the decline, -1.4%. The Eurostoxx 50 close -0.51% and the broader Stoxx 600 Europe Index fell 0.82% with the energy and banking sectors spearing the decline. Barclays shares fell amid an uncertain outlook for 2021, notwithstanding news of a return to dividends. Credit Suisse Group slipped after posting its first quarterly loss in three years.

Expectations of a broad global economic recover aided by vaccine roll outs and official support has buoyed the equity market, but recent data releases and earnings reports are suggesting this positive outlook is still facing some near-term bumps. Indeed, the gloomy start to the US overnight session was not helped by a mixed and mostly underwhelming set of data releases.

US initial jobless claims rose to 861K, well above the consensus, 773K, disappointingly as well the prior week’s reading was revised up to 848k from 793k. The prospect of a massive US fiscal stimulus plus a successful vaccine roll out are solid arguments to bet on a US recovery this year. But the overnight jobless claims data serve as a reminder of the unevenness of the recovery so far, some companies and sectors in the economy are back above pre-pandemic levels, but the US labour market is still in dire straits it is likely to deteriorate further before we see a material improvement. This week’s jobless claims release falls within the survey period for the monthly US employment report due for release March 5, and bearing in mind the freezing weather, the report is unlikely to paint a positive picture.

January US housing starts fell 6.0% to 1,580k, below the consensus, 1,660k. This was the first fall in five months , the US housing market remains very buoyant, may be the rise in prices is starting to bite, althouh it is more likely the weather has played a part in the housing starts January pullback. Supporting this view, building permits soared 10.4% to 1,881K, well above the consensus, 1680K. Meanwhile, the February Philly Fed index (23.1 vs 20 exp and 26.5 prev.) remained consistent with a nationwide ISM manufacturing reading around the respectable 60 mark.

Moving onto the rates market, core global yields have pushed up across the board, with Germany’s 10-year rate up 3bps to minus 0.34%, its highest close since June; the UK 10-year rate was up as much as 8bps to a 10-month high of 0.65% this morning, ending the day 5bsp higher at 0.62%. Bond issuance in Europe may have played a role in the move up in European yields overnight, but Gilts underperformance can also be attributed to comments from BoE Saunders noting “the scope to cut interest rates is very limited”. Money markets trim BOE rate cut bets, pricing less than 2.5bps of cuts in December compared to 4bps on Wednesday and 10bps at the start of February.

The US 10-year rate has traded a 1.27-1.32% range overnight and is currently up 1bps to 1.28%. My BNZ colleague Jason Wong noted that there have been five cases over the past few sessions where UST10s have broken above 1.30%, but in each case the yield has fallen back down – a sign of some consolidation in the market, but too early to judge that the recent sell-off has ended. The other interesting dynamic is the move up in the real 10 UST yield, up again last night by to -0.8970%. A week ago, the 10y real yield was trading at -1.0380%, that is a 14.4bps move up and a supporting factor for the USD.

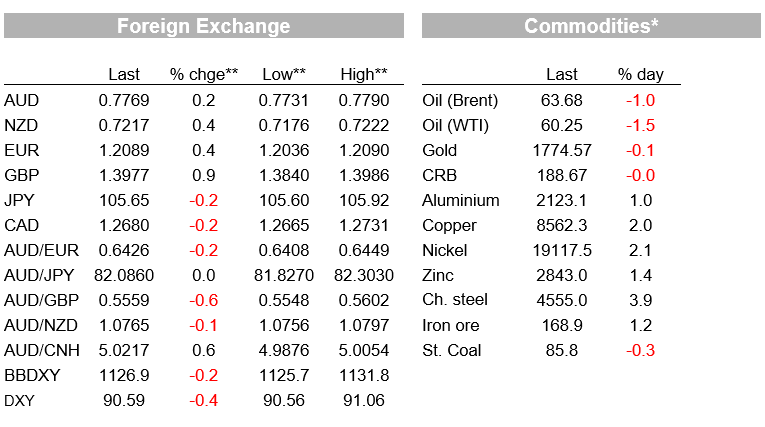

The USD is broadly weaker, but in small magnitudes. The DXY index is down 0.40%, largely reflecting European currencies outperformance while BBDXY is down 0.2%. Looking at G10, GBP is at the top of the leader board, up 0.86% and now trading at 1.3975, after printing an overnight high of 1.3986. The success of the vaccine roll out continues to support the pound, where 16.5m people have already been jabbed, PM Johnson will be announcing its exit strategy from the current lockdowns on Monday and there is certainly a positive feeling in the UK air. BoE comments (see above) have also helped GBP.

NZD and AUD have been bystander overnight with the kiwi now trading at 0.7217, up 0.36% over the past 24 hours, but still well within the 0.7150 to 0.7250 range which has contained the pair over the past month. The AUD is a tad higher at 0.7769 , with another strong employment report yesterday having minimal impact. The unemployment rate fell another couple of ticks to 6.4% and the outlook for the labour market continues to be positive, given forward indicators such as job ads and job vacancies.

Elsewhere, EUR and JPY show modest gains against the USD, the former up to 1.20855 and USD/JPY down to 105.70,

Finally looking at commodity prices, oil prices have consolidated recent gains (Bret $63.66, WTI $60.19) while copper has continued its decent run, up 2.35% and the LMEX index is up 1.65%. Iron Ore also had a good day up 1.6%.

For further FX, Interest rate and Commodities information visit com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.