NAB client Zenith Energy’s innovation is helping decarbonise the mining sector through providing efficient hybrid generation solutions in remote areas.

The markets lost some of their mojo today.

https://soundcloud.com/user-291029717/vaccine-optimism-dimmed-by-new-strain?in=user-291029717/sets/the-morning-call

Never gonna give you up, Never gonna let you down, Never gonna run around and desert you, Never gonna make you cry, Never gonna say goodbye… – Rick Astley

‘Never Gonna Give You Up’ was Rick Astley’s fist number one hit in the UK back in 1987. As part of the Stock Aitken and Waterman stable, he allegedly penned the lyric after listening to a three hour conversation between Pete Waterman and his girlfriend of three years. The weekend decision by EU and UK officials to keep talking on post-Brexit trade arrangements suggest that political leaders in the two regions are similarly determined not to give up until the very end (i.e. midnight on Dec 31st). This view, embraced by markets via a 1% gain in GBP on Monday morning and maintained offshore, together with the weekend news of the US FDA granting Emergency Use Authorisation for the Pfizer-BioNtech covid-19 vaccine, has seen risk on the front foot at the start of the week. This is now only timidly so, amid the covid infection backdrop that sees new circuit-breakers on activity being enacted, or about to be enacted, in New York, London and Germany. German chancellor Angela Merkel is currently being cast as the Grinch who stole Christmas.

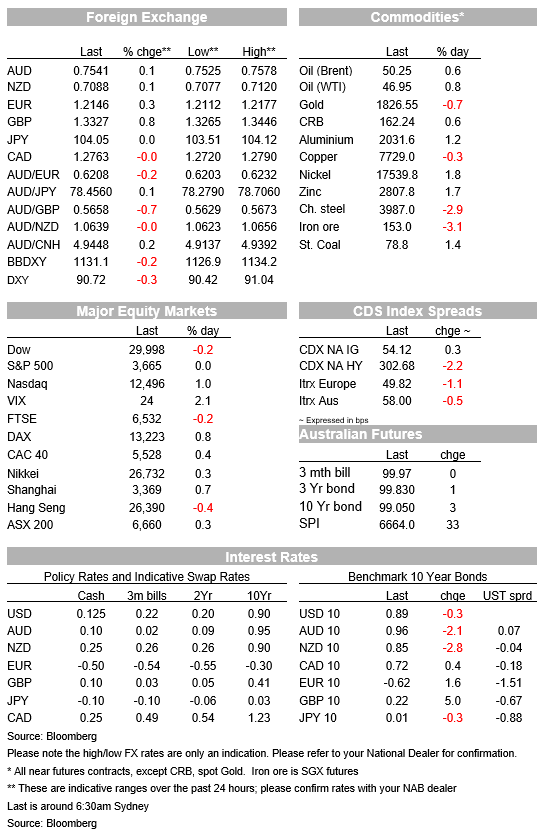

The S&P500 was up about 1% following the weekend news of FDA approval for the immediate roll-out of the Pfizer-BioNTech vaccine, together with the broader impact on risk sentiment from news that the UK and EU were to keep talking and so yet again ignoring a previously self-imposed deadline for agreeing post-Brexit deal. The mood music on the latter is certainly less negative than it was going into last weekend, with EU chief negotiator Barnier reportedly telling ambassadors that a trade deal could be reached this week while acknowledging that there were still issues to be overcome. Meanwhile, UK PM Boris Johnson’s spokesperson told media that a no-deal outcome was still “possible”, a downgraded warning from Johnson’s claim last week that it was “very, very likely.”

Also supportive of risk appetite was a Reuters report that the proposed US fiscal stimulus package might be split into two separate bills, to increase its chances of passing. One bill would include just the proposed $160b funding for state and local governments (a key Democrat demand) alongside liability protection for employers (a key Republican demand). The other bill would cover the remaining ~$750b spending proposal, for which there is a bipartisan consensus. The fiscal stimulus bill(s) are expected to be released in the next few hours, attached to a full-year spending bill, following which the reactions of House leader Nancy Pelosi and Senate leader Mitch McConnell will be crucial.

Sucking the air out of the earlier gains for risk assets has been the news that London and New York were set for tighter lockdowns. This follows news of a new national lockdown being announced in Germany following a weekend summit between Angela Merkel and the leaders of Germany’s 16 federal states. This will see most shops close until at least Jan 10 and tougher than earlier planned restrictions on Christmas gatherings (households limited to no more than four visitors over the age of 14 and only between Dec 24-26). In the UK, health minister Matt Hancock announced that London would move to a Level-3 lockdown from midnight Tuesday amidst an exponential rise in cases in the area. He also revealed a “new variant” of Covid had been identified, adding that the WHO had been informed. Hancock claimed it was “highly unlikely” a vaccine would not be effective against the new variant, but the news is still a fresh reminder that the battle against Covid is not over. In the US, New York’s Mayor warned residents that they should be ready for a full lockdown and asked employees to work remotely, if they could.

In this part of the world, the positive news yesterday was that of NZ prime minster Jacinda Ardern announcing plans for a trans-Tasman travel bubble in early 2021, subject to interim infection news and assuming acceptable contingency plans being first put in place. Note that while there are similar numbers of Aussie and Kiwis visiting their neighbouring country on holiday each year, Australian account for some 42% of all international tourist in NZ while New Zealanders account for only about 15% of Australian tourist arrivals; so on a relative basis the NZ economy stands to benefit the most. I’m dusting off the fly fishing rods as I type.

Economic news overnight has been limited to Eurozone October industrial production, up 2.1% on the month and don 4.2% on a year ago, up from -6.3% in September – much as expected.

Equity markets have seen the 1% early day gain for the S&P500 pared to just 0.1% with more than an hour of NYSE trade left, and a 1.4% gains for the NASDAQ pared to about half that. Earlier, European stocks ended mostly in the green save for the UK FTSE, which of late has been trading inversely with the British pound given the high dependence of so many listed UK stocks on overseas earnings.

Very little movement in bond markets, where US 10-year Treasuries are currently just under 1bp lower versus Friday’s close. The equivalent German benchmark gained 1.6bs while UK gilts were up 5bp on Brexit deal optimism (news that would reduce the pressure on the Bank of England to do more, including a possible move into negative policy rate terrain).

The DXY USD index is off just under 02% and BBDXY just more than 0.2%, both having been off by more than 0.5% when US stocks were at their early-day highs. Weakness is led by gains for GBP (currently +0.8%) and EUR (+0.3%). AUD/USD made a new post-June 2018 high of 0.7580 early in the New York session before paring gains alongside the fall-back in US stocks to be barely changed on the day at 0.7543 currently.

AUD has been little impacted by relevant commodity price news. This includes a 1.9% fall in Chinese thermal coal futures after China’s NDRC told representatives from 10 major power utilities ton Saturday they should pay no more than 640 yuan ($97.80) per ton for the fuel, state-owned Global Times reported. The agency also gave approval to power plants to import coal without restrictions, except for Australian supplies. And steel and iron ore futures process are both down +/-3% after reports yesterday that China was becoming concerned about possible speculative excesses behind recent sharp price gains (which, our commodities strategist suggests could see regulators increase futures trading margins on the main futures exchange, as well as other measures).

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.