A private sector improvement to support growth

Insight

Janet Yellen surprised the markets uggesting it might be necessary to raise interest rates to stop the economy from overheating.

https://soundcloud.com/user-291029717/yellens-rates-call-surprises-rba-ups-forecast?in=user-291029717/sets/the-morning-call

“Don’t you know it’s going too fast (ooh, to fast); Racing so heard you know it won’t last (ooh, won’t last); Don’t you know why can’t you see; Slow it down, read the sign”, Spice Girls (1997)

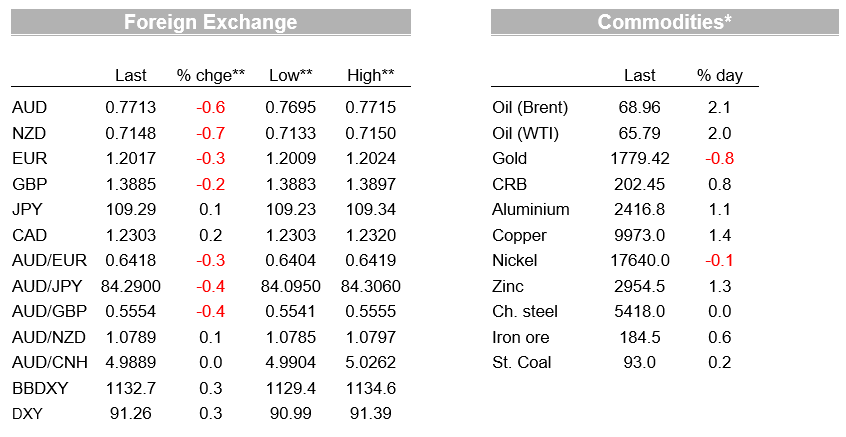

Risk sentiment weakened overnight as equities fell on both sides of the Atlantic, driven in the US by a large tech-selloff (NASDAQ -1.9% vs. wider S&P -0.7%). While it may be just a case of the old adage of ‘sell in May and go away’ after a very strong November to April, a hawkish tilt by a number of central banks globally reinforces that time-based forward guidance will evolve in line with realised economic outcomes. US Treasury Secretary Yellen added to that hawkish tilt overnight with red headlines of “it may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat ” from the stimulus, though reaction was paired back as the reading of the intent and timing of the comments was watered down. Yields in contrast were little moved with the US 10yr yield -1.1bps to 1.59%. Meanwhile the USD found support amid the negative risk sentiment with BBDY +0.3%, while the AUD (-0.6%) and NZD (-0.7%) lived up to their correlation with equities, both underperforming and at the bottom of the G10 FX.

The key question for markets out of the overnight session is how should we interpret Yellen’s comments? And does that add to views the Fed may need to hike sooner than their dot plot suggests? Delving into Yellen’s remarks, its not clear whether she actually said anything new, particularly given infrastructure stimulus is likely to be a slowburn issue given Senator Manchin’s reservations. Yellen’s exact comments were: “ It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat, even though the additional spending is relatively small relative to the size of the economy”. A subsequent WSJ interview suggests her comments were also nothing new, with Yellen having previously stated that she doesn’t expect inflation to be a problem and that tools are available if inflation does pick up. Being a former Fed Chair, she would also be wary of speaking about rates.

For your scribe, the more relevant headline came from the Fed’s Kaplan (non-voter) in his comment that his business contacts are less sure that the lift in inflation will be transitory (“a number of them are a little less sure now. The time frame is getting pushed back ”). Similar sentiments were reflected in Monday’s ISM which is part of the reason why US 10yr inflation implied breakevens are at 2.43%, having risen by 47bps since the beginning of the year. Kaplan also restated his views of the need to talk about asset tapering and that he is worried about excessive risk taking. On the other side of the FOMC, the Fed’s Daly pushed back on tapering talk, stating that such discussion will only occur “when we are much closer to achieving our dual mandate goals than we are now… We have an optimistic outlook, a long way to go, and we are not out of the woods yet… we have only had a couple of months of really good data. ” More Fed talk will percolate the week with Mester, Evans, Rosengren and Barkin all hitting the speakers circuit.

Closer to home a similar theme is playing out at the RBA. In NAB’s view the RBA Statement yesterday clearly signalled a shift in its unconventional policy settings via its forecasts which sees core inflation at the bottom of the 2-3% target band by mid-2023 and unemployment at 4.5% by the end of 2022 (previously 5.5%), which is at the bottom end of model-based NAIRU estimates (NAIRU is pegged around 4.5-5.0%). In the February 2020 (pre-Covid) SoMP, the RBA’s low forecast for unemployment was 4.8%! The forecast upgrades confirms our view that the RBA will not extend their 3yr yield target from the April 2024 bond to the November 2024 bond, while we also now expect the RBA to announce a tapered QE3 ( see NAB’s RBA view here).

Journos who are well-connected with Martin Place also share similar views to NAB. Mr Kehoe in the AFR writes “If the recent run of outstanding jobs growth continues post-JobKeeper, there will be a weaker case to extend the three-year yield target of 0.1 per cent from April 2024 to November 2024 ”, while also hinting at a tapering for QE3. While the RBA’s cash rate guidance remains the same in that the RBA will not hike rates until actual inflation is sustainably at 2-3%, the likely shift away from calendar-based YCC forward guidance the Bank to become more responsive to economic developments. Kehoe notes there is “…the possibility of a rate rise in 2023 if the economy keeps massively outperforming expectations” (see AFR: RBA’s future moves hinge on jobs and wages for details). McCrann also adds to this view, penning a piece that states “ The Reserve Bank was behind the curve in understanding the strength and speed of the economic recovery which raises concerns about the timing of the next interest hike” (see Herald Sun: Will the RBA have to hike earlier than expected? for details)

As for the equity sell-off overnight, while the S&P500 has fallen by -0.7%, the pivot to cycles was still there with Industrials (+0.4%), Materials (+1.0%) and Financials (+0.7%) in the green. Instead the sell-off was largely Tech driven (S&P500 IT -1.9% and the NASDAQ does a similar -1.9%). There were some very large falls amongst the large tech stocks with Apple down -3.5%, Alphabet -1.6%, and Tesla -1.7%. The main theme in equities remains around whether inflation is temporary and whether the Fed would react to that – moderate inflation and a slow moving Fed would continue to be supportive, but inflation and a reactive Fed may prove to be a negative for valuations. Either way yields and equities are likely to be in a dance as much better than expected economic data continues to challenge central banks rates guidance.

In FX, the USD got support amid the mild weakening in risk sentiment with the USD (BBDXY +0.3%), CHF (USD/CHG +0.2%) and JPY (USD/JPY +0.1%) at the top of the leaderboard, although thrown into the mix is GBP (-0.2%) as well, recovering from its bottom-ranked showing for the month of April.

The AUD and NZD have significantly underperformed, currently down 0.6% and 0.7% respectively, from this time yesterday. The underperformance highlights the correlation with equities that the AUD has, while fundamentally, there doesn’t seem to be anything to be worried about, with commodity prices still performing well, with most of them that make up Bloomberg’s commodity price index showing gains overnight.

There was little in the way of data overnight with only the US Trade Balance which came in line with expectations at -74.4bn, but is the highest ever in the series that dates back to 1992. Key to the blowout is likely stimulus buoying households amid virus restrictions that has a pivot to consumer goods and away from services. As the economy re-opens, a pivot back towards services is very likely, which may also alleviate supply chain concerns in the US in H2 2021.

A quiet day in Australia with only Building Approvals. Offshore it is very busy. Across the ditch is key labour market data, along with the RBNZ Financial Stability Review. Meanwhile in the US ADP Payrolls will be watched closely for any read through to official payrolls. Details below:

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.