Firmer consumer and steady outlook

Insight

Australia needs a vast amount of capital to build out the utility-scale wind and solar projects to power a net-zero future by 2050. NAB’s Executive, Specialised Finance, Andrew Smith and Executive, Capital Markets, Sarah Samson explore potential debt funding options in market.

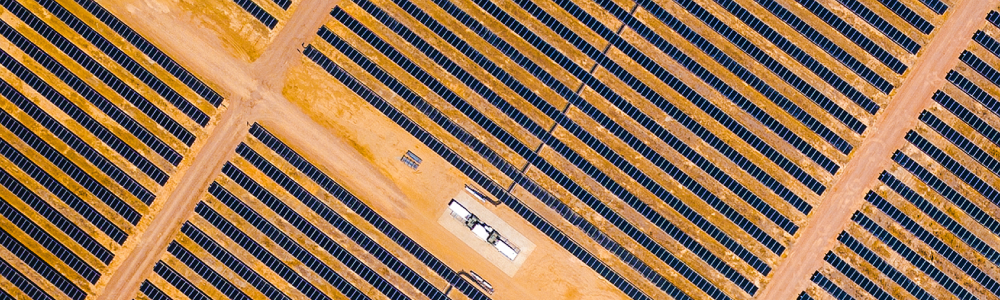

Decarbonising the energy sector is crucial to Australia’s successful transition to net zero by 2050, needing enormous and accelerated investment to expand capacity in renewables generation.

Recent estimates from Bloomberg New Energy Finance1 put the capital needed for utility-scale wind and solar photovoltaic projects to achieve the task at more than $300 billion combined. Assuming debt financing of 50-60%, there is potentially a significant opportunity to come for investors in debt capital markets.

To date, most debt finance for renewables in Australia has had a five-year loan tenor, been A$ floating rate, in bank format and sourced from project finance desks within commercial banks. While some debt has been provided by non-bank lenders, most remains on bank balance sheets. Other than the modest volumes issued into the private Institutional Term Loan and US Private Placement markets, alternate debt markets have not yet been a meaningful source of debt capital.

Given the scale of the debt task both domestically and globally, a key question is whether project finance bank balance sheets can scale in line with this unprecedented debt funding requirement or will alternate debt markets need to be more readily accessed?

Banks see the renewables build-out as an attractive opportunity and we should expect them to continue to provide balance sheet support throughout the transition.

But in terms of meeting future debt funding tasks, this could be better achieved with banks broadening their role to enable access to alternate debt markets.

As the renewables sector continues to scale and mature, we anticipate renewables to follow the path of large-scale infrastructure borrowers in accessing a range of private and public debt markets to diversify funding sources and best match debt capital with issuer funding objectives.

For borrowers with large debt books, we commonly see banks providing construction finance, M&A financing, bonding lines, working capital facilities, bridge facilities and some term debt, with the balance of term debt placed in alternate debt capital markets. While single name bank debt capacity is nuanced to each borrower, as a guide, we have historically seen bank debt capacity for investment grade borrowers cap out at $5 billion per borrower group, with these facilities provided by a broad lending syndicate.

Which debt markets borrowers may seek to access will be informed by a range of factors including debt issuance volumes and credit profile (credit rating). While not all alternate debt markets require an external credit rating, the deepest and most liquid capital pools require an investment grade rating from a major rating agency.

Given banks use internal risk models and don’t require external credit ratings, the rating agencies have been less active in the domestic (and global) renewables segment. Going forward, we anticipate their approach and methodologies will become increasingly more important as borrowers formulate their long-term funding plans, which will likely incorporate take-outs into alternate debt markets to refresh bank capacity.

Below we highlight a range of alternate markets which renewable energy investors may seek to access.

One market we are keen to further explore and potentially grow over time is the securitisation market, where NAB is a committed and leading participant2, and which we expect to see as a source of more funding for renewables. Good examples of this growth potential are from loans to assets like electric vehicles (EVs) and solar panels, which are readily securitised today.

Securitisation could potentially also be applied to the funding of other types of infrastructure (like digital data centres for example) to assist borrowers in diversifying funding requirements. This could be in debt markets, or in private warehousing vehicles.

NAB is the leading Australian bank provider of project finance to the global renewable energy segment3 and is approaching the milestone of successfully closing 200 renewable energy transactions globally and committing $15 billion since 20034.

Going forward we will continue to support our customers with balance sheet funding while also helping our customers access alternate debt markets to best meet their financing objectives.

1. BloombergNEF “Australia’s Net Zero Needs $413 Billion in Power Spending – May 29, 2023

2. KangaNews Awards 2022: institution and deal winners announced | KangaNews and League tables | KangaNews

3. 2023 Full Year Results Investor Presentation (nab.com.au)

4. NAB internal data

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.