Rising artificial intelligence could see as much as half the work being done today automated within 20 years and organisations need to know how to get ready, an AI expert tells NAB’s Transaction Banking customer event series.

Article

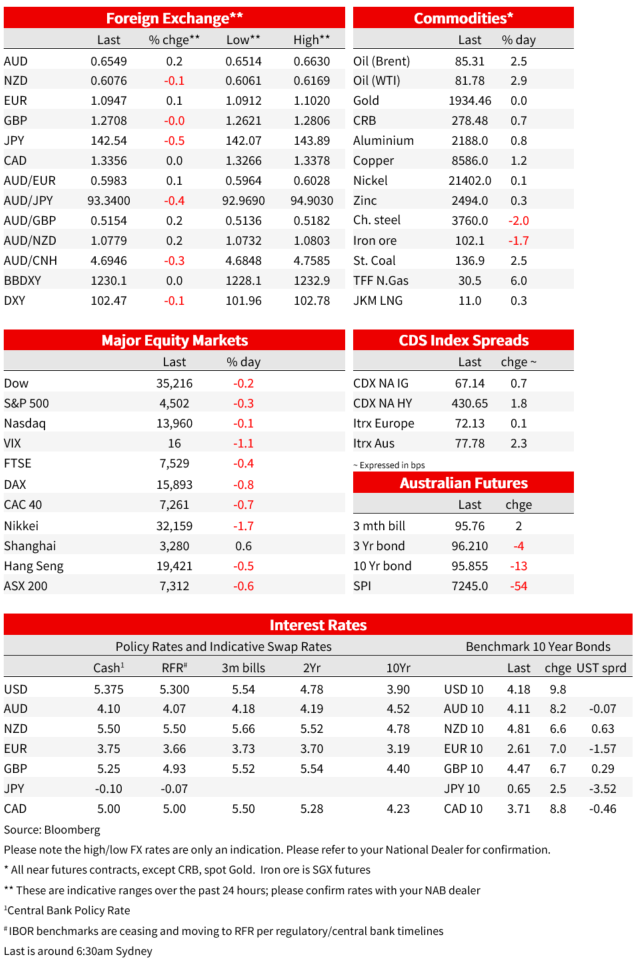

BoE lifts Bank Rate by 25bps to 5.25% as expected, to limited market reaction. US payrolls tonight

For a pom forced to endure more than 50 years of hurt following the travails of the England men’s football team, forgive me a touch of schadenfreude this morning at the overnight news of Germany being dumped out of the group stage of the World Cup for the first time its history. What a shame South Korea’s stellar performance holding Germany to draw, after being one-nil up, comes too late to see them through to the knockout stages. Go the Matildas on Monday (versus Denmark) and the Lionesses (against Nigeria).

To markets and it’s being a relatively quiet night, with limited reaction both to the Bank of England’s ‘as expected’ 25-point Base Rate hike, to 5.25%, and the slightly softer than expected US ISM Services headline but which is accompanied by an unwelcome rise in the Prices Paid sub-series. Extention of this week’s US Treasury market sell-off and accompanying (bear) curve steepening is the main feature of overnight markets, despite which US equities haven’t come to much harm (at least not in front of Apple and Amazon’s post-NY close earnings reports) and the USD is actually a smidge lower. All this in front of tonight’s July US payrolls report.

For the BoE, given pre-BoE market pricing ascribing about a 25% chance to the Old Lady raising rates by 50bps rather than the consensus expectations for 25bps, the knee jerk (algo-driven) response to the quartesr point hike was a small-scale sell-off in all things GBP, but which was fully revered within a couple of minutes. The vote was 6-3, with Jonathon Haskel and Catherine Mann wanting +50 and Swati Dhingra no change.

The accompanying BoE narrative and updated Inflation forecasts offered no real comfort for those hoping this rise, to 5.25%. could be the last in the cycle, through money markets have pared back their pricing for the peak in rates to around 5.70% from 5.75% pre-announcement. On inflation, the Bank now forecasts it to be around 5% by the end of 2023, and an at-target 2% only by mid-2025 (previously by end-2024). These forecasts are though conditioned on a market-implied path for Bank Rates rising to a peak of 6% (the 15-day average up to July 25) and to average of 5.5% over the next three years, versus an average of just over 4% for the equivalent period at the time of the May MPR.

BoE Governor Bailey , speaking after the decision, said that it’s too early to see victory on inflation and that “in order to get inflation back to target, we are going to have to keep this stance of policy”. Of perhaps some comfort, he added that rates might be close to a peak and that there was ‘more than one path’ that could bring inflation sustainably back to target We’d conclude from all this that another quarter point hike to 5.5% is more likely than not in September, but not necessarily beyond that. UK 10-year gilt yields were a couple of basis points lower in the hour following the MPC decision, but have finished the London day 7bps higher, which is much in line with benchmark bond yield changes elsewhere across Europe and driven largely by higher Treasury yields (see below).

To the US data and the key ISM services index fell 1.2pts to 52.7 against a consensus expectation for a slightly smaller fall (53.1). There were falls in the employment index (50.7 from 53.1) and new orders (55.0 from 55.5). The prices paid index rose 2.7pts to 56.8, but which can’t obscure the fact price paid have been on a steep trend decline since Q2 2022. Elsewhere on the US data front, weekly initial jobless claims rose 6k last week to a still-low 227k. Challenger job layoff announcements fell sharply in July to their lowest level in nearly a year, in doing so breaking the run of significant job layoffs that began late last year. Productivity growth rose by a much stronger than expected annualised 3.7% in Q2, which helps offset strong wages inflation, though the data can be prone to significant revisions. Factory orders rose by an as-expected 2.3%, following the earlier released durable goods orders, the latter revised from 4.7% to 4.6%.

The latest rises in US Treasury yields all occurred prior to the slug of US data, 10s at 4.18% pre-releases and currently at about the same level (highest since 8 November 2022). This 10.4bps rise on the day, and by 12.6bps for the 30-year bond, looks to be largely a continuing impact from this week’s supply announcements as well as higher JGB yields plus resiliency in incoming US economic data. 10-year JGBs hit a high of 0.655% on Thursday before the BoJ stepped in with an unscheduled buying operation.

FX move s in the past 24 hours have been modest, with no G10 USD pair more than 0.4% away from Wednesday’s New York close, albeit AUD/USD made a new post-June 1 low of 0.6514 around 7pm AEST last night. It’s currently up about 0.2% on the day at 0.6550. USD/JPY is down more than 0.5% despite the latest back up in US Treasury yields, but this is after making a near one month high of ¥143.90 during the local Tokto session. GBP/USD is virtually unchanged on 4 hours ago and about half a cent up on pre-BoE announcement levels. The BBDXY USD inbdex is unchanged and narrower DXY -0.1%.

In equities, US stocks opened lower after a uniformly down-day for European shares (Eurostoxx 600 -0.6%, FTSE 100 -0.4%) and clawed back to flat before leaking lower in afternoon trade ahead of a whole heap of S&P500 Q2 earnings report. The highlight has been Amazon, smashing its Q2 earnings estimate ($7.68bn vs $4.72bn) and offering a Q3 revenue range of $138bn to $143bn against a street consensus of 4138.3bn. Its stock is up over 6% after hours. Apple was about to report.

Yesterday’s local data showed retail volumes in Q2 falling 0.5% , bang in line with NAB and the consensus forecast. The fall comes after a 0.8% decline in Q1 and a 0.4% decline in Q4 2022. The annual growth rate of retail volumes was -1.4% y/y. It is not hard to conjure scary headlines from the data, though NAB economists cautious against overinterpreting growth vs. levels. While in growth terms the last time three consecutive quarterly declines were recorded was in 2008 (during the Global Financial Crisis), in level terms, retail volumes are still 2.4 percentage points above a pre-pandemic trend. Excluding food (39% of total retail sales), non-food retail is still 5.4 points above trend. That said, some further correction is likely and forward orders for retail were very weak in the NAB Business Survey in June, suggesting more caution in the retail space.

The June monthly trade surplus beat expectations with the surplus at $11.3bn (consensus $10.8bn, NAB $10.0bn) from a downwardly revised $10.5bn previously. Exports fell 1.7% m/m (or -$1.0bn), while imports dropped far larger at -3.9% m/m (or -$1.8bn). The miss relative to expectations was from a sharp fall in imports of transport equipment (-32.6% m/m or -$1.3bn), which have been very volatile in recent months given order backlogs during the pandemic and some pandemic-era demand incentives which ended on 30 June. June rounds out the quarter and for Q2 the trade surplus was again a very healthy $32.1bn, albeit down from $39.4bn in Q1. The trade balance looks like it will contribute strongly to Q1 GDP however, given a sharp fall in export prices as indicated by the recent Trade Price data.

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.