Coming in for landing in a heavy cross wind

Insight

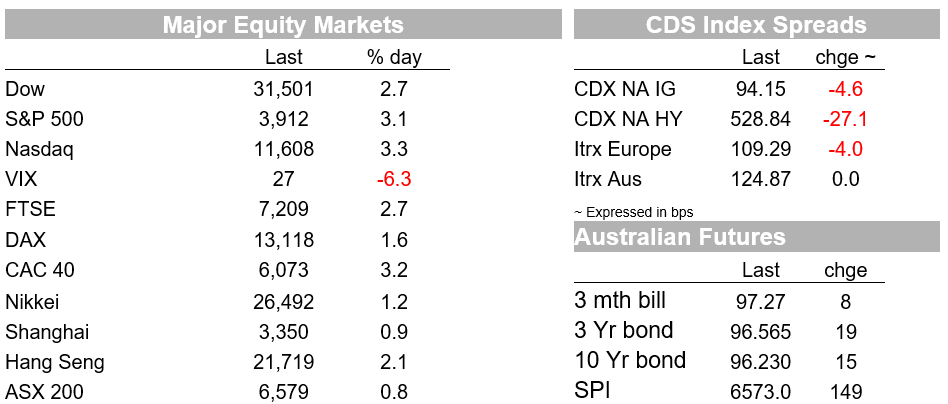

It was a great day for US stocks on Friday, with two-thirds of the mid-month sell-off now retraced.

https://soundcloud.com/user-291029717/is-bad-news-good-news-these-days?in=user-291029717/sets/the-morning-call&utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

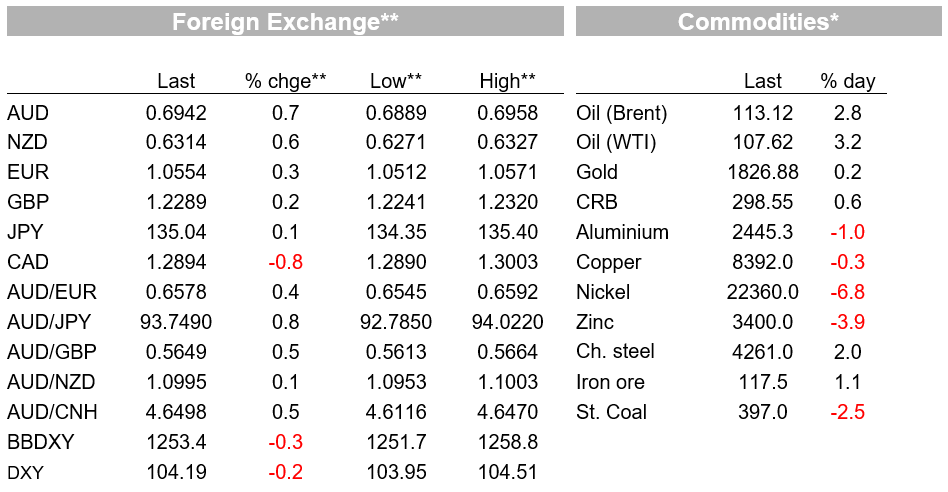

It was a great day for US stocks on Friday, six of the ten S&P500 sub-sectors posting gains of more than 3% to see the index up 3.1% (NASDAQ +3.4%) and meaning that two-thirds of the mid-month sell-off has now been retraced . And while US bond yields were up by 4-6bps across the curve, the risk rally was an overriding influence on currency markets where the DXY USD index lost 0.25% with AUD/USD up 0.7% to 0.6945, albeit up just 0.2% on the week. Oil had a good session Friday, WTI and Brent crudes both up more than $3, to be some 6% up from their intra-week (Wednesday) lows.

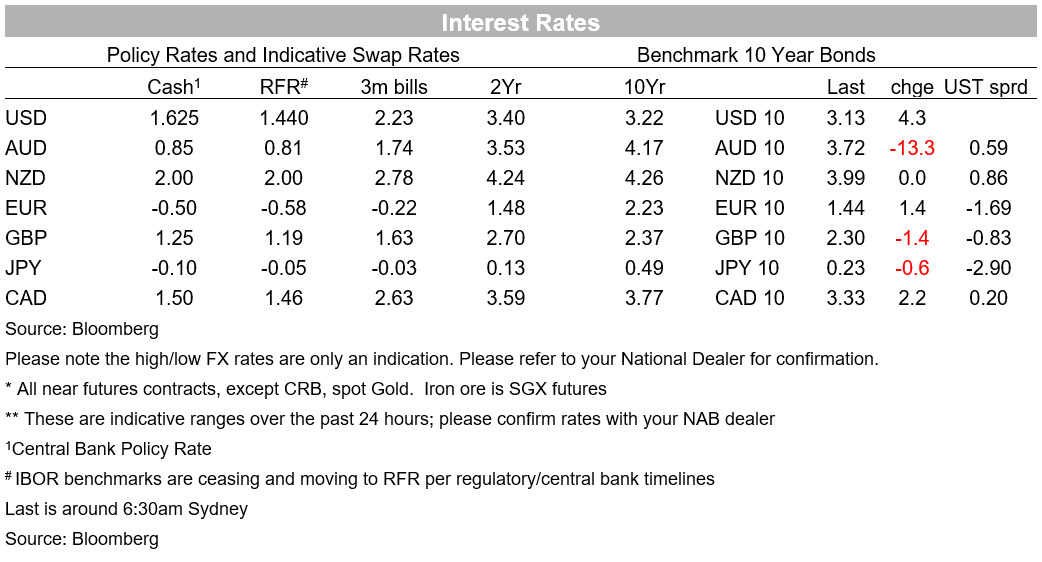

Looking at Friday’s minute-by-minute tick charts for US stocks, it is clear that beyond the jump in prices at the NYSE open, a good chunk of the ensuing rally could be traced directly to the 10am NY time economic data releases. Here, the standout was the final University of Michigan Consumer Sentiment Index, wherein the closely watched 5-10 year inflation expectations read fell from 3.3% in the preliminary release – last seen only pre-GFC – down to 3.1%.

The significance of this is that in his post-FOMC press conference on June 15, Fed chair Powell explicitly mentioned the jump in inflation expectations in the June 10 preliminary release (from 3.0%) as relevant to the decision to hike rates by 75bps. Also of note on the inflation expectations front is that market-implied inflation expectations (“break-evens”) have fallen by more than 20bps at 10-years since the FOMC decision and are now 50bps down on their 3.075% April 22 cycle high.

It’s possible that the jump in the UoM inflation expectations read in the preliminary release and fall-back in the final one are little more than noise. But it’s equally, or more plausible that both the initial rise was genuine, coming after two months of headline CPI above 8%, and too the fall-back in the final version given that the US recession narrative had come to so dominate the busines and finance news agenda in the two weeks since the preliminary release and which coincided with the severe mid-month US equity market sell-off.

Market conviction that perhaps the Fed won’t now hike rates as aggressively as previously feared and/or that rates cuts before the end of 2023 are now an even more realistic prospect if recession-like conditions lay ahead, have had a big hand in last week’s improvement in risk sentiment and which has now seen about two-thirds of the June 9-16 sell-off walked back.

As well as the fall-back in inflation expectations, the UoM release also saw the level of consumer sentiment revised down, to 50.0, so a new record low-water mark for the series that dates back to the late 1970s. US New Home Sales in May surprised to the upside with a 10.7% jump and off an upward revised -12% in April (from -16.6%) but which looks to be more noise than signal with trends in just about every other housing market indicator still pointing firmly down.

In Europe, UK retail sales in May surprised very slightly to the upside (headline -0.5% against -0.7% expected) but there were very big downward revisions to the April numbers of more than 1% for the core readings and which proved worthier of market attention, UK money markets shaving a few basis points off their prior BoE tightening expectations.

In the EU, the German June IFO survey saw the headline Busines Climate index fall to 92.3 from 93.0 (92.8 expected) led by a drop in the Expectations component to 84.8 from 86.9 (a rise to 87.4 had been expected). So broadly mirroring the greater than expected weakness in last week’s flash German PMIs.

Fed speak of note Friday came from San Francisco Fed President Mary Daly , who told reporters following a speech in California that, “Seventy-five in July is where I’m starting because I think that right now, that looks like what we’ll need to do”. Beyond that, Daly says “How much additional tightening will be required depends on a number of factors that fall outside of the Fed’s direct control, including the speed and magnitude of supply chain recovery, the duration of the war in Ukraine, and the willingness of individuals who have left the labor force to re-enter.”

Also speaking Friday, in Zurich on the same panel as RBA Governor Lowe (see below) St. Louis Fed President James Bullard said fears of a US recession are overblown, as consumers are flush with cash built up during the Covid-19 pandemic and the expansion is in an early stage. “I actually think we will be fine,” Bullard said. “It is a little early to have this debate about recession probabilities in the US.” Bullard repeated his call for further “front-loading” of rate hikes to contain inflation. Presumably he will therefore also be in the 75-point camp come the July 27 Fed decision, though he has shown himself to be deferential to the recommendation of the Fed chair in this respect.

As for Dr Lowe, the RBA Governor spoke of their being only a “narrow path” to curbing inflation without triggering an economic downturn, warning that if workers and business did not believe that the RBA could chart a “credible path” back to its inflation target, they may get stuck in a higher inflationary mindset. For more on this see Friday night’s report from NAB’s David de Garis: “Lowe: Worried about a developing higher inflation mindset downunder”.

In bond markets , the really big mover last week was Australia, where the 13.5bps decline in implied yields on 10-year futures on Friday brought the cumulative weekly change to -42bps, versus a fall of just over 9bps for equivalent US Treasuries and twice that seen for either German Bunds (-21.9bps ) or UK Gilts (-19.6bps). On Friday as for much of last week, it was the offshore market driving this significant yield spread compression.

In FX , the story of the week, fundamentally, was the recovery in risk sentiment, alongside a pull-back in Fed tightening expectations amid deepening recession fears. This saw the BBDXY USD index off 0.3% on Friday and 0.6% lower on the week (DXY-0.5%). AUD/USD did well on Friday(+0.8%) but couldn’t fully capitalise on USD slippage over the course of the full week, up just 0.2%.

Of some relevance here may have been the aforementioned significant AU-US yield spread compression, together with it being a mostly down week for commodities (e.g. CRB index -3%, iron ore similarly) notwithstanding the smart recovery in oil prices in the latter half of the week and which boosted NOK above all other G10 currencies and was also particularly helpful to CAD.

Read our NAB Markets Research disclaimer. For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.