We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Risk appetite has been weighed over the past 24 hours by a trio of soft China data, a surprise ‘windfall’ tax on bank profits in Italy, and a downgrade of a number of small and mid-sized banks by Moody’s.

Risk appetite has been weighed over the past 24 hours by a trio of soft China data, a surprise ‘windfall’ tax on bank profits in Italy, and a downgrade of a number of small and mid-sized banks by Moody’s. The USD dollar is higher, up 0.5% on the DXY and stronger against all G10 currencies. Yields are generally lower and curves flatter.

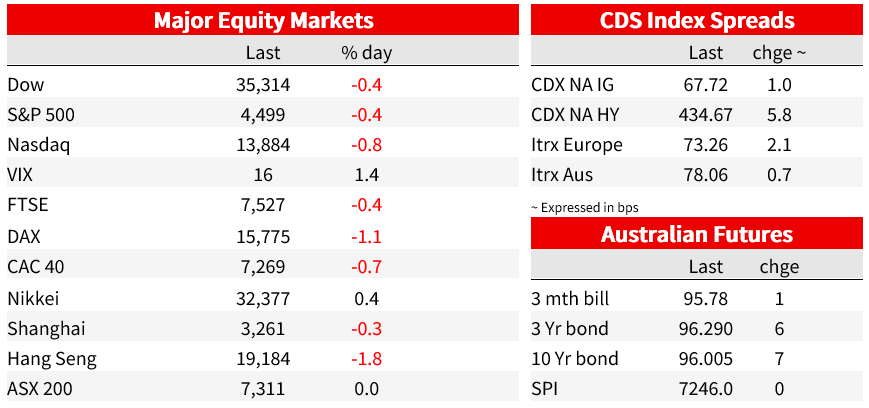

Declines in equities were led by Banks. The S&P500 pared earlier losses of more than 1% to close down 0.4%. Moody’s Investors Service downgraded 10 small and midsize American lenders and said it may do the same with a handful of major firms. The KBW Bank Index was down nearly 4% early in the session, but pared losses to be 1.2% lower on the day. In Europe, the EuroStoxx 50 lost 1.1%, while the EuroStoxx 600 Bank Index was 2.7% lower. Italy unveiled a surprise 40% windfall tax to capture profit stemming from higher rates, with draft text of the proposal indicating the threshold would be based on the increase in net interest margins. The finance ministry said in a statement late Tuesday, after markets closed, that the tax on net interest income would be capped at 0.1% of risk-weighted assets, well below levels analysts had estimated it could reach.

In US economic news, small business sentiment, as measured by the NFIB, nudged up for a third consecutive month, to 91.9 from 91.0, above the consensus, 90.6, although that remains a historically low level. Of note, a net 25% of firms reported higher selling prices, down 4pts and the smallest share since early 2021. The US trade deficit narrowed to $65.5b in June, with both lower export and import values and the latter falling to their lowest level since November 2021.

Chinese trade data was softer than expected for both imports and exports. Imports were -12.4% y/y vs -5.6% expected and -6.8% in June. Exports were -14.5% vs -13.2% expected and -12.4% in June. Some of that export weakness is prices rather than volumes, but it suggests the cooling foreign demand is weighing on exports and is likely to continue to drag looking forward as still elevated export volumes continue to slow. Perhaps more of a concern is the sharp downside surprise in imports. That marked a fifth consecutive monthly fall in imports and is indicative of a domestic demand slowdown that is yet to show signs of easing, and that is being met with an only slow rollout of policy support. Chinese CPI and PPI data are coming up today ahead of a raft of July activity readings next week. Softer signals out of the Chinese data weighed on the yuan, with USD/CNH rising past 7.23, while the Hang Seng lost 1.8%.

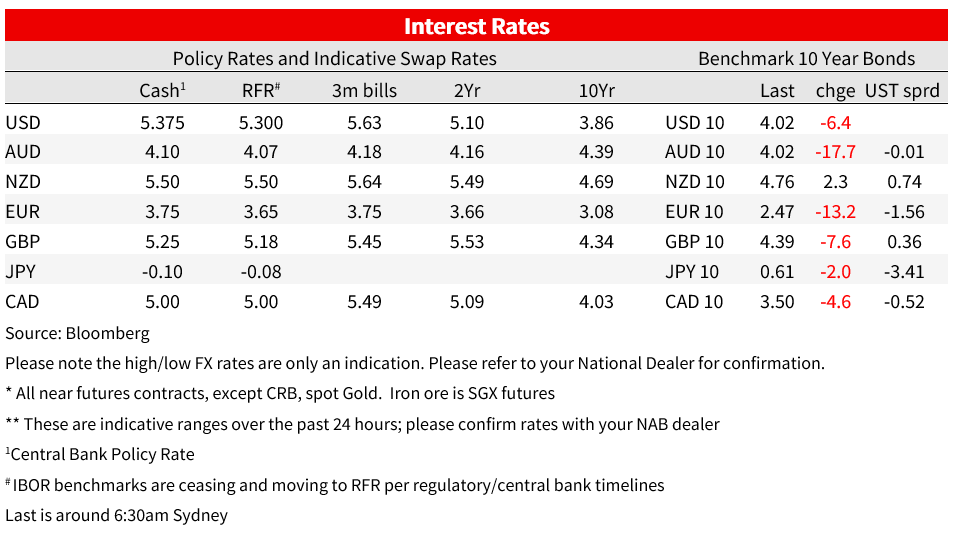

Government bond yields were generally lower. The US 2yr yield was marginally lower at 4.76%, while the 10yr lost 6bp to 4.02%. In Europe, German 10yr bund yields were 13bp lower to 2.47%. Fed speakers didn’t have too much to add to the picture, though Philadelphia Fed President Harker (a voter this year) said he believed that the Fed might be at the point “where we can be patient and hold rates steady and let the monetary policy actions we have taken do their work”, barring any data surprises, and that “sometime probably next year, we’ll start to bring the interest rates down.” Richmond Fed President Barkin (non-voter) didn’t want to pre-judge the decision on rates for September, ahead of the key inflation and labour market reports. Neither echoing the more hawkish sentiments from Governor Bowman recently.

In broader currency markets, the AUD and NZD were underperformers during the Asian session, weighed by the China data, but the Aussie is down 0.5% over the day, around the middle of the G10 pack against the broadly stronger dollar. The AUD touched a low of 0.6497 before recovering to currently sit around 0.6542. The dollar was up 0.5% on the DXY, gaining against all G10 currencies. The euro was 0.4% lower to 1.0955, while the yean lost 0.6%, USD/JPY rising to 143.41, despite lower US yields.

Japanese labour cash earnings for June were lower than expected at 2.3% y/y from an upwardly revised 2.9% in May and well below 3.0% expected. y/y growth was driven by bonuses, with base pay growth softer still. Some of the outcome of the Spring wage rounds may be yet to be reflected in the data, though a BoJ report had suggested most would be reflected by June. The data should keep the BoJ patient, with higher wages growth needed to convince the BoJ that inflation is not heading back below target.

In domestic data, the NAB Business Survey showed resilience, while price measures rose. Conditions were 1pt lower at +10, while confidence rose 2pt to +2. Key measures of demand, profitability and employment all held steady at above-average levels and capacity utilisation rebounded to be well above average at 84.5%. Forward orders remained soft, up 1pt at -1, weighed especially by the retail sector. Importantly, pricing components of the survey were strong and highlight that upside pressures to inflation remain. Labour cost growth rose sharply, boosted by wage adjustments with the new financial year, including large award wage increases, and final prices growth was strong in key consumer facing industries retail and recreation and personal services.

Coming Up

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.