Total spending grew 0.9% in June.

Bank of Canada surprises with ‘front-loaded’ 100bps rate rise

https://soundcloud.com/user-291029717/us-inflation-rises-and-surprises-everything-is-in-play?in=user-291029717/sets/the-morning-call&utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

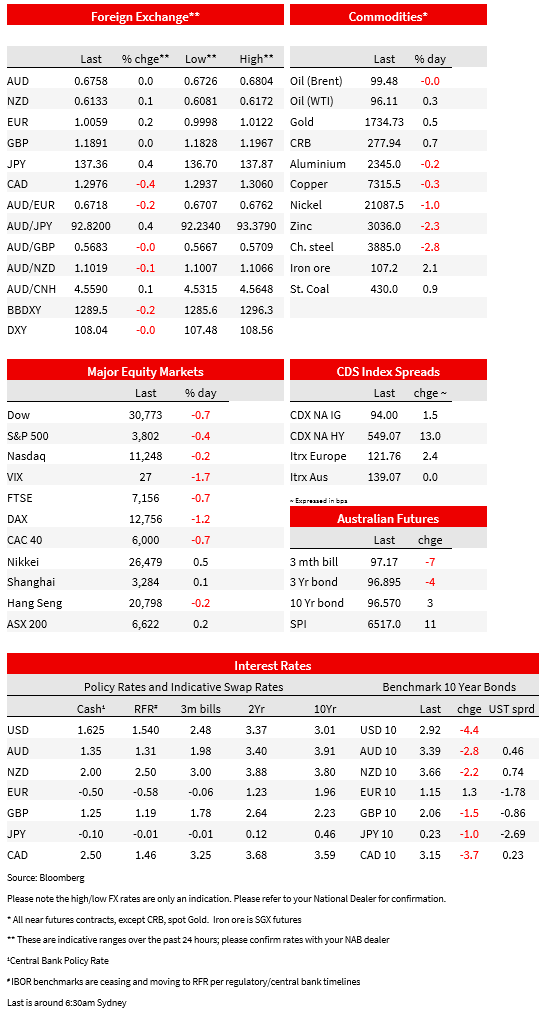

When Fed chair Jay Powell said soon after the FOMC announcement of a 75bps lift to the Fed Funds rate target in June that such a move should not be regarded as ‘common’ in future, no one imagined that was because the next move could be 100bps – just as the Bank of Canada unexpectedly delivered last night. Yet here we are in the wake of a second consecutive big upside surprises in US inflation readings with Fed Funds futures pricing the July meeting at 91.5bps, up from 74.5bps pre-CPI , so putting odds on a 100bp at better than evens. Significant additional US yield curve inversion looks to have restricted gains for the USD, as too a recoil in EUR/USD after the single currency briefly traded below parity (0.9998) for the first time since Dec 5, 2002. AUD/USD has held above Tuesday’s 0.6711 low.

There was nothing in the entrails of last night’s US CPI report to provide any offset to the sticker shock of headline CPI printing above 9% (9.1%) against a rise to 8.8% from 8.6% expected. While the 1.3% monthly rise was driven by a 1% rise for food prices and 11.2% jump in gasoline, core CPI also exceeded expectations with a 0.7% monthly rise, reducing the annual rate by just 0.1% to 5.9% against a fall to 5.7% expected, Most concerning here was the strength in core service sector inflation, in particular a 0.8% rise in primary (actual) rents and 0.7% rise in ‘owner occupied’ rent (the implicit cost of renting your own home).

The notion that goods prices would now be falling to partially offset strength in services inflation received no succour with, for example, a 1.6% rise in used car prices and 0.7% rise for new cars. The broadening out of price pressures was evident in both the Cleveland Fed’s median and trimmed mean measures and the Atlanta Fed’s sticky CPI measure, all showing higher monthly increases than previously.

While there a number of indications that July CPI won’t make nearly as grim reading as the June figures (falling fuel prices one sign here) markets have rightly viewed the numbers as signifying the need for the Fed to go still harder in its quest to supress demand even if it the case that some of the supply chain bottlenecks impacting inflation are starting to ease. Fed Funds futures quickly moved to price the 27 July FOMC meeting at 91.5bps from 74.5bp at Tuesday’s close, a move that drew support from post-CPI comments from the Atlanta Fed President Raphael Bostic who said that ‘everything is in play’ in regard to the June meeting.

The Bank of Canada last night was the first advanced economy central bank to opt for a full 100bps rate hike, to 2.5%, against 75bps generally expected, but in doing saying this was a front-loading of hike rather than a sign that their ‘terminal rate’ was likely to be very much higher than previously thought (December money market pricing currently shows 3.7%, up from 3.5% the day before). Governor Macklem said that with the economy was “clearly in excess demand, inflation high and broadening, and more businesses and consumers expecting high inflation to persist for longer” then acting this way now aimed at avoiding the need for even higher interest rates down the road.

Another country where central bank market pricing has lifted is the UK, which now has 48bps for the August meeting up from 40bps the day before. This after the monthly May GDP print came in at 0.5% against 0.1% expected and suggesting the much vaunted UK recession derived from the hit to real household incomes hasn’t yet begun. As for the Conservative party leadership contest, yesterday the field was whittled down to six from two (Hunt and current chancellor Zahawi knocked out) and should be reduced to two by next Thursday, following which the paid-up party faithful should decide who is to be next leader and therefore PM by September 5.

And while on the European political front, there is confidence vote in the Italian Senate tonight over an aid package to households and business suffering from high energy costs. In the governing coalition (led By Mario Draghi) the leader of the Five Star Party Giuseppe Conte (and the second largest party) has threatened to boycott the vote because his party does not agree to measures for a waste incinerator (!). Conte’s decision to stay away – even though it would mean Draghi would win the vote – has led Draghi to say that there is no government without Five Star and he (Draghi) would step down. A collapse of the Italian govt in coming days – were it to happen – would be choice timing ahead of next Thursday’s ‘D-Day’ for the NordStream 1 restart (or not) and thereby Italian (in particular) fragmentation costs on possibly exploding gas prices

As for central bank action in this part of the world, yesterday the RBNZ offered up a “no surprises” Monetary Policy Review, delivering another 50bps hike in the OCR to 2.5% and indicating comfort with its OCR projections in the May Statement which showed an OCR heading to about 4%, well above neutral, before easing back.

The US equity market recovered from an opening CPI-driven hit of about 1.5% for the S&P500 to end the day just under 0.5% lower (NASDAQ a lesser -0.15%), this following falls of +/- 1% for European bourses. Possibly helping stocks was the fall-back in 10-year bond yields, where an initial 10bps spike after CPI has been more than fully reversed, ending the NY day at 2.93%, some 4bps down on Tuesday. Two year notes on the other hand have largely held on to their price losses, the yield about 10bps up on the day at 3.155%. The 2/10s curve at -22bps is therefore now offering a much stronger US recession signal than was previously the case.

In FX , the EUR/USD dip below parity, to a low of 0.9998, came within 10 minutes of the US CPI report, following which we saw a bounce to back above 1.01 and the pair now settling around 1.0050. The much bigger test for the Euro lies ahead via the fate of gas flows through the NordStream 1 pipeline when current maintenance ends, supposedly next Thursday. AUD/USD was weaker post-US CPI but the low of 0.6726 didn’t take out Tuesday’s 0.6711 low. CAD is stronger following the Bank of Canada surprise, but not by that much (+0.4% against the USD while AUD/CAD is down 0.6% on the day). GBP is little moves despite the stronger economic data while USD/JPY made a new high of 137.87 before pulling back alongside lower 10-year US Treasury yields.

Read our NAB Markets Research disclaimer. For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.