We expect NAB’s Non-rural Commodity Price Index to fall by 4.9% in Q2

Insight

Australian employment data yesterday was showed a tighter labour market than the RBA had been expecting with the unemployment rate plummeting four tenths to 3.5% , a new 48-year low.

https://soundcloud.com/user-291029717/aussies-take-up-jobs-as-draghi-tries-to-quit?in=user-291029717/sets/the-morning-call&utm_source=clipboard&utm_medium=text&utm_campaign=social_sharing

US equities pared losses over the session but the S&P500 still closed in the red for its fifth consecutive day. Fed speakers cooled expectations for a 100bp hike at the July meeting, with Waller reminding that 75bp is still ‘huge’ but remain open to the intervening data flow. Very strong Australian employment yesterday sees market price more risk of a larger 75bp move. In Europe, Draghi offers his resignation but is sent back to parliament to gauge support by President Mattarella.

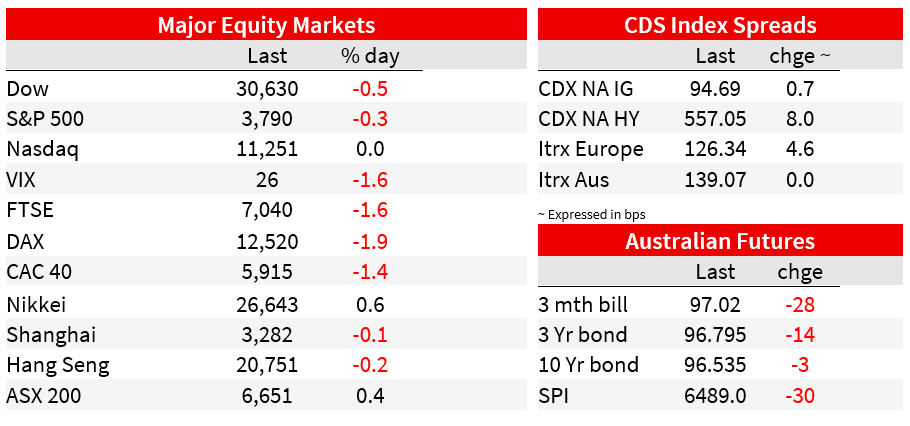

Equities were lower in Europe, the Euro Stoxx 50 down 1.7%, and that continued into the US open. The implications of the higher CPI print and the path of Fed hiking and early bank earnings reports that fell shy of expectations and highlighted concerns about the outlook in the driving seat. But stocks pared losses on those comments from Waller and Bullard (more below). The S&P500 closing just 0.3% lower after being as much as 2.1% down soon after the open. The Dow was 0.5% lower, while the interest-rate sensitive Nasdaq scraped back into the green, just, at 0.0%.

Earnings report from JP Morgan and Morgan Stanley missed analysts’ forecasts. A soft start that cast doubt on upcoming peer results. Citigroup due to publish earnings on Friday followed by Goldman Sachs and Bank of America on Monday. JPMorgan temporarily suspended buybacks, with Jamie Dimon saying it was necessary to quickly meet higher capital requirements. Dimon noted the consumer was in great shape despite a “serious set of issues out there,” while Morgan Stanley’s Gorman said he doesn’t expect a ‘severe’ recession. TSMC also reported earnings, upgrading revenue forecasts and noting that “ our customers’ demand continues to exceed our ability to supply. We expect our capacity to be tight through the end of 2022.”

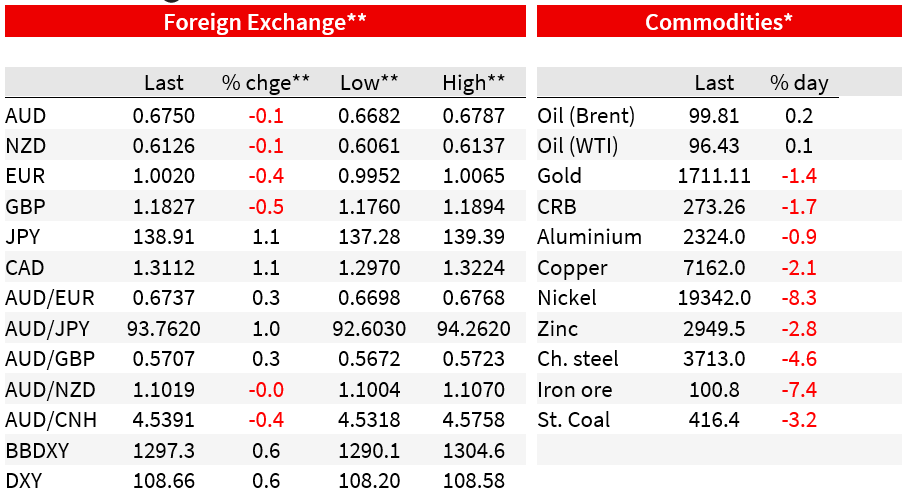

In currency markets, The US dollar was stronger, the DXY 0.6% higher to 108.7. Gains were largest against the yen (-1.1%) and the CAD (-1.0%) with the euro down 0.4% and back above parity at 1.0018. The AUD was one of the better performers against the dollar over the past 24 hours, down 0.1% to 0.6750, recovering alongside the recovery in the euro from an earlier low of 0.6682.

As for data flow, headline US PPI came in stronger at 1.1% m/m, vs 0.8%m/m expected and an upwardly revised 0.9% m/m May number. High fuel prices again a big driver in the June number and the numbers paint a too-high inflation picture to be sure, but in contrast to the CPI a day earlier the detail didn’t make for as universally gloomy reading. Core PPI slowed to 0.4% m/m vs 0.5% m/m consistent with ongoing, but slow easing of upstream inflationary pressures as the expansion in margins from early 2021 slows. Initial jobless claims topped estimates at 244k, up from 235k. Seasonals at this time of year warrant an extra health warning on taking too much from the week-to-week numbers, but the story of low levels but a slow trend higher remains intact.

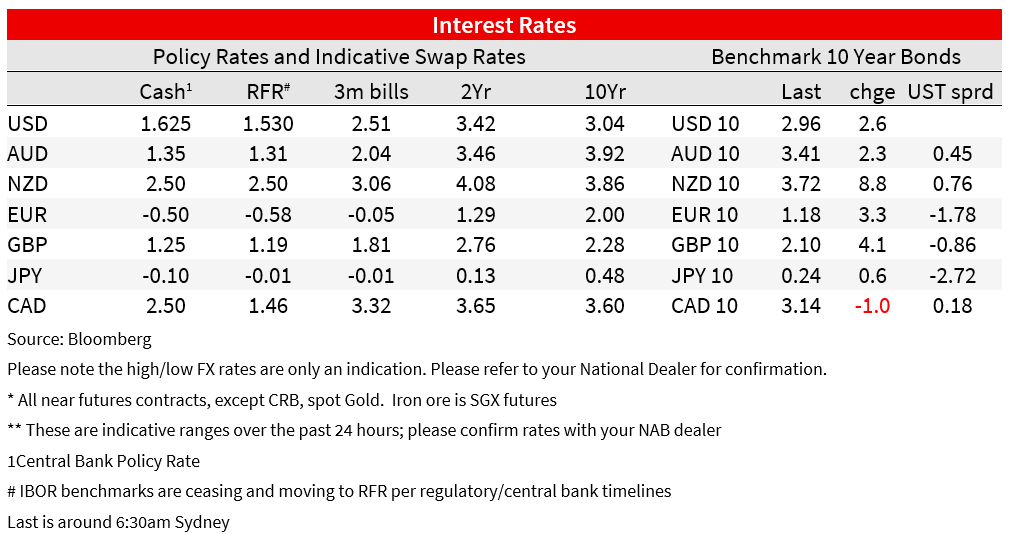

Helping the turn higher in equities and seeing some pull back in US yields was commentary from the Fed’s Waller and Bullard cooling expectations for a 100bp hike later this month. Waller said that “With the CPI data in hand, I support another 75 basis-point increase” while admitting that the CPI data were a “major league disappointment.” Waller sought to remind that 75bp is already ‘huge’, saying that “Don’t say because you are not doing a 100 you are not doing your job…you don’t want to really overdo the rate hikes.” But didn’t close the door to a larger move, saying that “ If that data come in materially stronger than expected it would make me lean towards a larger hike at the July meeting” Similar comments by Bullard were also published Thursday, “as of today, I would advocate 75 basis points again at the next meeting.” Market’s now have 83bp prices for July, back from 90 yesterday but above the pre-CPI 75bp priced. The US 10yr is 2bp lower at 3.13% after reaching as high as 3.26 intraday. The 2s10s inversion narrowing with the 10yr 3bp higher to 2.96%.

Australian employment data yesterday was showed a tighter labour market than the RBA had been expecting with the unemployment rate plummeting four tenths to 3.5% (from 3.9%; 3.8% expected), a new 48-year low. The decline was driven by a sharp rise in employment of 88k, smashing expectations for a 30k gain. In May, the RBA had forecast unemployment to gradually decline to 3.6% by mid-2023, an unemployment outlook that they saw as consistent with trimmed mean inflation only moving back to the top of the target band in 2024. The unemployment rate falling further and faster adds more pressure on the RBA as it seeks to chart a path back to 2-3% inflation and puts 75bp firmly on the table in August, with the next test the Q2 CPI on 27 July.

Market pricing had already pushed past fully pricing a 50bp move following the upside surprise on US CPI and the 100bp move by the BoC, and pricing moved further on the employment data, with futures prices now implying around 61bp of hikes in August and a cash rate or 3.33% by the end of the year.

In Europe, Italian Prime Minister Draghi offered his resignation Italy’s President Sergio Mattarella, who asked Draghi to instead address parliament next week to assess how much support his government would have. Doubts about longevity though are high, with Draghi having noting that “I have always said this executive would only go forward if there was a clear prospect of being able to carry out the government programme on which the political forces had voted their confidence,” and that “those conditions no longer exist.” Italian political risk is an unhelpful addition to an already full gamut of risks facing the continent. As Italy’s political drama evolved, the EUR fell to as

low as 0.9952 before returning above parity. Italy’s 10-year rate rose as high as 3.41% and spreads core bonds widened, before settling down to 3.24%. Italian equities were down 3.4%, outpacing declines elsewhere in Europe. The Euro Stoxx 50 was 1.7% lower.

Read our NAB Markets Research disclaimer. For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.