Todays podcast

Overview: Powell and Putin play their jokers

- Fed hikes 75bps as expected, looks for 125bps in ’22 then 25bps more in ‘23

- Reactions reveal markets had to some extent ‘bought the rumour’ of a hawkish Fed

- European markets (remarkably) take the Ukraine war escalation in their stride

- BoJ and BoE day, also SNB and Norges Bank

- Australian markets closed in remembrance of Queen Elizabeth II.

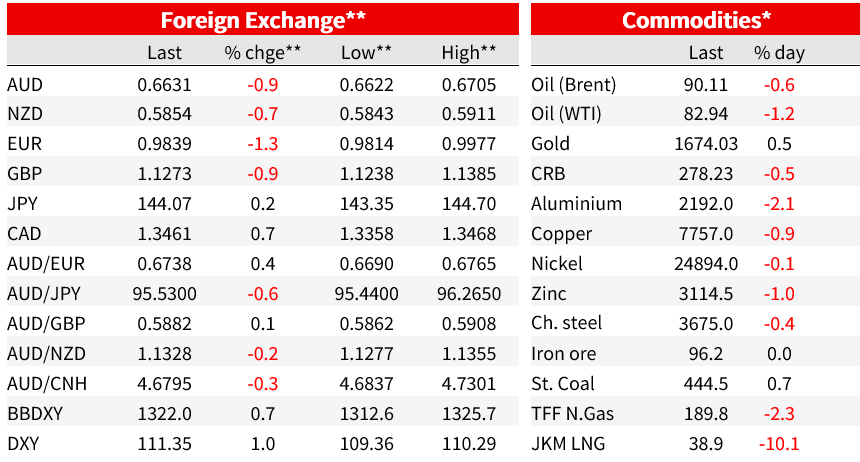

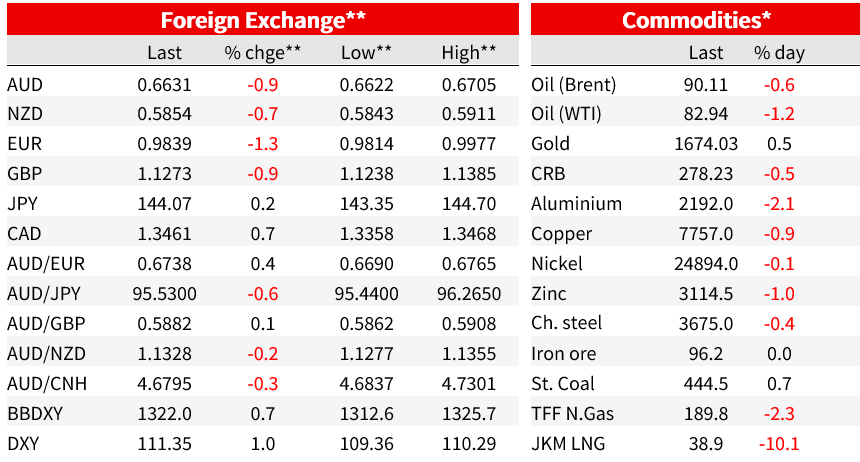

Data round up:

US Existing Home Sales 4.80m (-0.4%) vs 4.70mn (-2.3%) expected

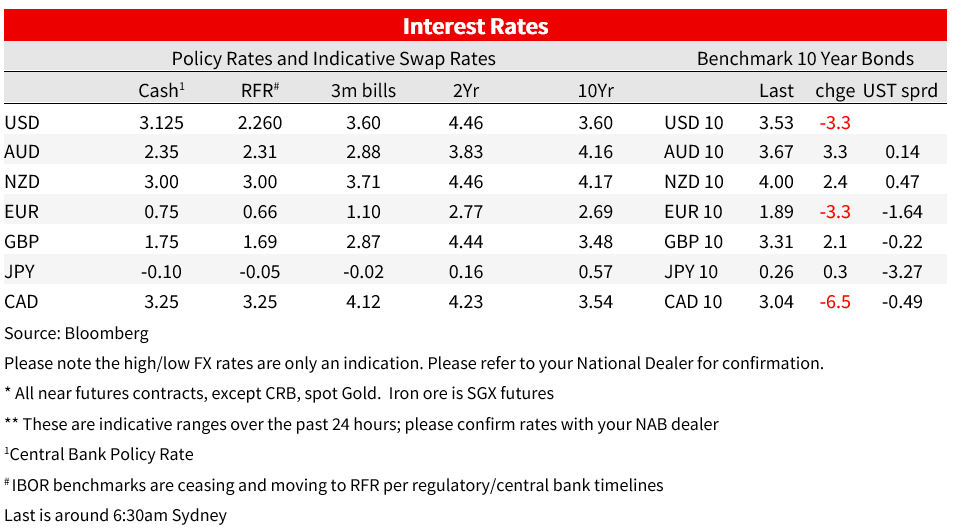

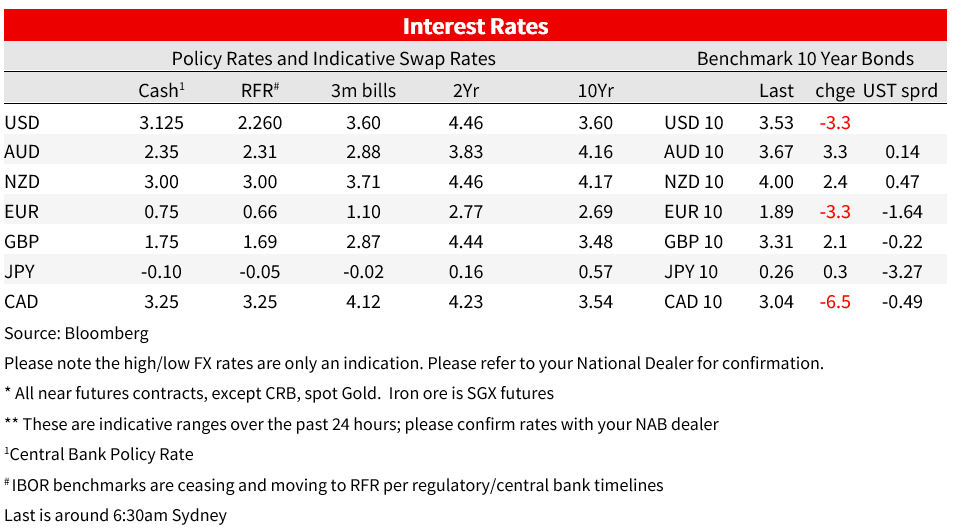

Th Fed has as expected delivered a third successive 75bps funds rate hike taking it to a 3.0-3.25% range. What was not expected by the median economist and market pricing ahead of the decision was the extent of the lift to the median dots in the new Fed dot plot. These see a further 125bps of hikes this year (so an implicit +75bps in October then 50bps in December) followed by a further 25bps hike in 2023, taking the funds rate target range to a peak into a 4.50-4.75% with no cut(s) seen before 2024 (end 2024 median dot of 3.875%). Consensus ahead of the meeting was for a 50bps lift to the 2022 median dot, not the 100bps it got and and 0.375% for 2023 against the 0.875% consensus.

Of some note in the new dot plot is that 9 of the 19 FOMC member dots see no more than 100bps of further tightening this year (10 of the 19 for 125bp or higher – one has +150bp) and the extent of the dispersion in the dots in 2024 and beyond. The 2024 hi/lo range is from 2.625% to 4.625% – no group think here! The median estimate of the long run (so neutral) Funds rate is unchanged at 2.50%, while the 2025 median, produced for the first time at this meeting, is 2.875%. So, a restuictive policy stance is seen as likely to be in place for more than three years from now. For the rest of this year then, two 50bps rate rises are seen to be almost a likely as 75bp then 50bps, intervening data to determine this call.

As for the Fed’s new economic projections , GDP growth in 2022 is now seen at 0.2% against 1.7% seen in June and 2023 at 1.2% from 1.7% previously. So still a soft landing as such with no formal recession. A few FOMC member noses were likely growing when these numbers were being committed to pixel. Consistent with the ‘no recession’ view the unemployment rate is now seen rising to 4.40% in 2023 from 3.9% previously after 3.8% this year up from 3.7%. The 2023 median is 0.9% above the actual low for this cycle of 3.5% recorded for July, so a shade under the 1% lo-to-hi rise that we would classify as recession (which is what NAB has in its 2024 forecast). For inflation, the core PCE deflator measure is now seen at 4.5% this year (4.3% previously) and in 2023 3.1% up from 2.7%. 2024 is unchanged at 2.3% and 2025 – for the first time – 2.1%. Therefore, inflation is not on these numbers back to target before 2026.

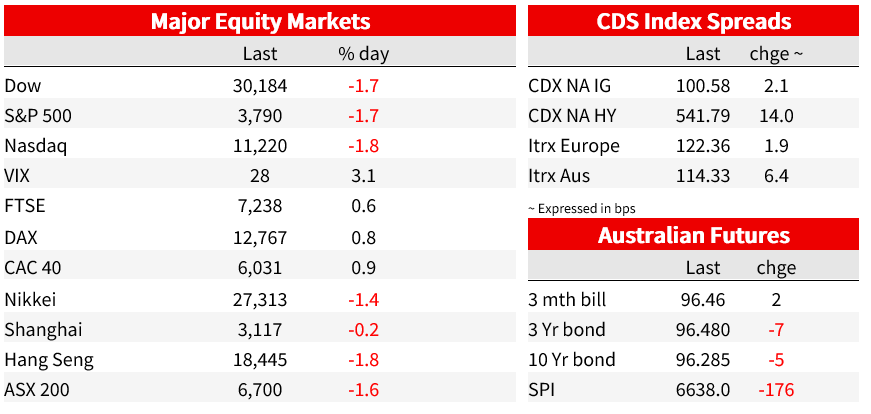

Market reactions to the Fed could ;perhaps best be described as sanguine, or to use a well-worn market adage a case of the market having bought the rumour of a hawkish Fed and the so – to some extent – selling the fact. This is most evident at the longer end of the US Treasury curve where 10-year yields came into the New York close some 3.5bps lower than where they were pre-Fed (3.525% against a 3.56% just beforehand). The two-year note hasn’t been spared the Fed’s new wrath though, rising to just above 4% ahead of time, spiking to above 4.11% and now settling around 4.05%, up 10bps on the day.

In the post-meeting press conference, Powell has re-iterated the messages from Jackson hole and other Fed officials since then , that the economy will likely need to see a sustained period of sub-trend growth and history cautions against easing policy too early, when inflation is this high. Powell noted the Fed now saw the cash rate as having “moved into very lowest level of what might be restrictive and certainly in my view, and the view of the committee, there’s a ways to go.”

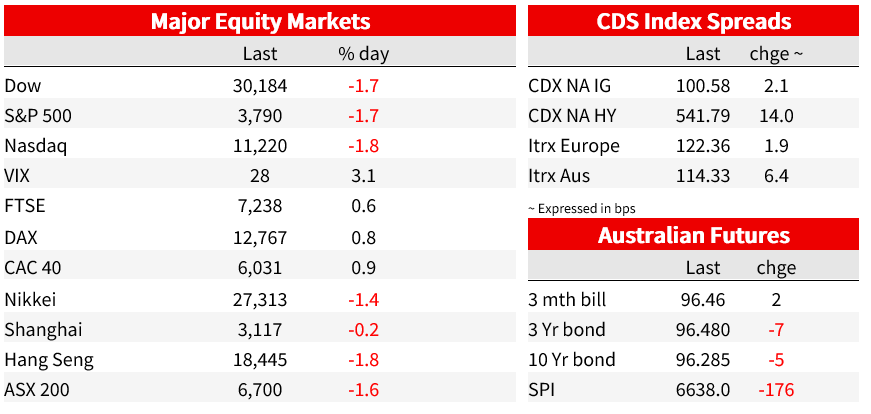

Equity market reaction to the Fed initially looked heroic – an immediate sell off but the S&P500 then up on the day less than an hour after the FOMC had handed down its decisions. Reality has bitten in the last ‘hour of power’ however, stocks finishing on the lows of the day with all three of the major indices down by between 1.7% and 1.8%. All eleven S&P500 sub-sectors are in the red, Consumer Discretionary taking the biggest hit, down 2.4%.

Perhaps more surprising (to this scribe at least) has been the stoicism shown by European equity markets to the escalation of the war in Ukraine via Russian president Putin’s partial mobilisation of the population, allowing for up to 300,000 reservists to be drafted up to join front-line forces. The move takes place ahead of referendums starting this weekend in Russian-occupied territories in Eastern Ukraine, the result of which will see Russia annex those areas and hence deem them now part of Russia, requiring if necessary ‘self-defence’. Putin also implicitly threatened the use of nuclear weapons saying Russia would “use all the means at our disposal”, adding “this is not a bluff”. Remarkably, the Eurostoxx 50 finished its day up 0.7% with the German Dax +0.8% and the CAC-40 0.9%. Benchmark bonds at least drew something of a flight to safety bid, 10-year Bunds -3.4bps on the day (closing before the Fed decision).

To currencies and no surprise to see that the DXY USD index, which had already made new cycle highs late in our day yesterday on the EUR/USD drop immediately following the above pronouncements from Putin, extended these offshore, to a high of 111.6 (EUR/USD down 1.3% on the day with a new low of 0.9814). AUD/USD, which had already dropped to new post-May 2020 cycle low of 0.6655 in late afternoon Sydney trade, has since extended those losses to 0.6622. The NZD has performed only marginally less badly, off 0.7% on the day and seeing a new low of 0.5843 (lowest since late March 2020). To no impact on the kiwi in Wellington, Fonterra has just re-iterated its 2022-23 milk price mid-point forecast of NZ$9.25/KG.

Coming Up

- Australian markets are closed so it is a non-settlement day for AUD as Australia observes the day of remembrance for Queen Elizabeth II.

- Bank of Japan the main evident in our time zone and then this evening, the Bank of England.

- For the BOJ (outcome likely one side or other of 13:00 AEST), we think a policy shift is coming (to be justified by a revised view of the ‘temporary’ nature of current above-target inflation) but if so, then more likely out of the end October meeting than tomorrow, the latter being when the BoJ next update its inflation and other forecasts. Any formal change in the language on inflation today (with respect to recent strength no longer being seen as temporary) would be significant, while there is an outside chance BoJ shifts from a formal easing bias (i.e., rates to be unchanged ‘or lower’) to a neutral bias. Either or both would hint an imminent policy shift and likely see JPY stronger and market (swap) rates higher.

- As for the Bank of England, around 80% of economist polled by Bloomberg look for a 50bps rise to Bank Rate today, the remainder 75bs (no takers for a Riksbank-style 100bps!). Money markets have around 65bps of hikes priced, so slightly better positioned for 75bps than 50bps.

- The Norges Bank (seen +50bs and SNB (+75bps) also hand own policy decisions

- On the data front, NZ has trade data this morning, France has various business confidence surveys, the US weekly jobless claims. Consensus for the latter is for a still low 217k after 213k last week.

Market Prices

NAB Markets Research Disclaimer