Online retail sales growth slowed in May following a fairly strong April

Insight

In Australia there are two macro developments worth watching, Seek new job ads and Consumption imports in the August trade balance.

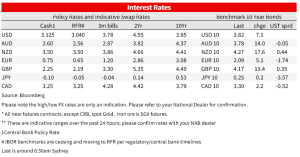

Yields rose notably and risk assets fell overnight. UK gilt yields led the moves with some angst developing about what happens when the BoE backstop ends on 14 October and on 31 October when QT is expected to start. BoE backstop purchases have also been underwhelming over recent days. A letter by BoE Deputy Governor Cunliffe to Parliament’s Treasury Committee highlights the difficulties within the defined-benefit pension fund space and to your scribe it is unclear whether the BoE will be able to end the backstop as soon as next week, or start QT as scheduled (interesting read if you have time, see Cunliffe’s letter for details), especially if yields were to continue to rise. UK 10yr yields were up 13.4bps to 4.17% with moves spilling over to other markets with US 10yr yields +6.3bps to 3.82%. The curve bear flattened with the 2/10s curve falling -3bps to -42.8bps. Also adding in the US were ongoing hawkish comments by Fed officials, a clear pushback on the Fed will pivot narrative that has supported risk assets since the beginning of the week. Data was mostly second-tier and did not have a meaningful impact on market moves.

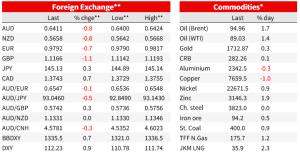

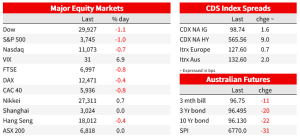

The S&P500 closed down -1.0% after having surged 5.7% early in the week. The USD has also lifted sharply with DXY +0.9% with notable weakness seen across most pairs : GBP -1.2%; EUR -0.7%; AUD -0.9% and NZD -1.0%. USD/JPY has been more stable +0.2% to 145.06, with a likely threat of intervention should 145 be meaningfully breached. Some positioning ahead of US payrolls tonight is also probably a factor – given the rally in risk assets earlier in the week the pain trade would seem to be a ‘good news is bad news’ print. My BNZ colleagues point out the wild moves in NZD which rose 2.7% in APAC yesterday, but then gave all that back overnight to actually finish -1.0% lower over a 24 hour period at 0.5659 (high around 58.14). A similar dynamic played out with the AUD which rose some 1.9% in APAC yesterday to 0.6541, but then gave all that away as USD strength emerged to finish -0.9% at 64.14 with a low around 0.6390.

First to the UK where Gilts led the moves in global yields. As noted above the BoE provided more details on its emergency backstop that began on 28 September and which is scheduled to run until 14 October (link to BoE’s Cunliffe’s letter above). The BoE noted UK-specific factors as the root cause, and the Bank had been warned by liability driven investment (LDI) managers that they would be forced into selling more UK gilts that would create a downward spiral in gilt prices had the BoE not intervened. In the first week of programme, the BoE bought only £3.8b gilts, well below the potential maximum of £35b. Having the BoE as a backstop has supported the market, but markets are now worried what happens when the backstop ends on 14 October, especially in the context if yields were to continue to rise. LDI funds have been actively selling billions of pounds of their most liquid assets to deleverage, centred around European and US credit and US Treasuries. Also tied into the backstop was the decision to delay QT which is now scheduled to begin on 31 October. It’s hard to see QT beginning as scheduled in this environment.

Meanwhile, US Fed Speak remained hawkish with continued pushback on cuts being priced in 2023 (note markets price a peak of 4.55% by March 2023 with 25bps of cuts for the rest of 2023). The Fed’s Evans noted the Fed is headed to 4.50-4.75% by early 2023 (as projected by the median FOMC dot), while the Kashkari said the Fed is “quite a ways away” from pausing rate hikes, with this dependent on “evidence that underlying inflation has solidly peaked and is hopefully headed back down”. On recession talk, Kashkari said “Can we achieve a soft landing?”…My answer is: I hope so — we’re going to try — but we have to bring inflation down. ” Newly elected Governor Lisa Cook also made similar comments. While the commentary is a clear pushback on the Fed will pivot narrative it is also worth noting Bostic’s comments after the close on Wednesday. Although he re-iterated the Fed will stay the course, he also shone a chink of light on the ‘fed pivot’ narrative. Bostic said “ I would like to reach a point where policy is moderately restrictive—between 4 and 4 1/2 percent by the end of this year—and then hold at that level and see how the economy and prices react. I do not think we should continue raising rates until the inflation level has gotten down to 2 percent. Because of the lag dynamics of our policy that I discussed earlier, this would guarantee an overshoot and a deep recession” (see Bostic: Staying Purposeful and Resolute in the Battle against Inflation).

It’s was not only Fed speakers that were hawkish overnight, so too was the BoC Governor. Governor Macklem said that inflation will “not fade away by itself” and “simply put, there is more to be done…the clear implication is that further interest rate increases are warranted…we will need additional information before we consider moving to a more finely balanced decision-by-decision approach ”. This puts the BoC firmly in the camp of the hawkish RBNZ and US Fed and leaves the RBA’s downshift as a potential outlier, though we would classify the RBA’s downshift as not being dovish with the market reaction in seeing a sharp fall in terminal rates overdone. Meanwhile, the IMF signalled a downgrade, for the fourth consecutive quarter, to its updated global growth forecasts to be published next week. The head of the IMF said that a third of the world’s economy would suffer a recession next year and many others would feel like they were in recession, against backdrop of shrinking real incomes and rising prices (see WSJ: IMF to Lower Global 2023 Growth Forecast Amid Shocks to Economy).

As for data it was very quiet and did not have a meaningful impact on market moves. US Jobless Claims were a little higher than expected (219k vs. 204k expected), but remains are very low levels and comes after a 10-week stretch when claims printed below consensus. Across the pond, European data was weak with German Factory Orders -2.4% m/m (-0.7% expected). Factory orders have now declined six out of the past seven months and highlights the high probability of Germany entering in recession this year. Euro-wide Retail Sales were also soft at -0.3% m/m (-0.3% expected) with the annual number now at -2.0% y/y.

Finally in Australia two macro developments worth watching. First, Seek new job ads declined for the fourth consecutive month, down -5.2% m/m in September and is now -10.2% below its recent peak in May 2022. The level of job ads though still remains 53% higher than pre-pandemic December 2019 levels. What is driving the decline in job advertising? It is likely a combination of excess labour demand easing and some recovery in labour supply. The civilian population aged 15 years plus has increased by an average of 17k a month over July and August compared to 5k a month in the corresponding period in 2021; in 2019 it averaged 31k (see SEEK/NAB Employment Report for details). An easing of job ads from elevated levels may signal some loosening up in the tight labour market, which would reduce risks around wages lifting to levels inconsistent with at target inflation. Second, consumption imports picked up in the August trade balance which suggests supply chains are unsnarling, including for backlogged car imports. Non-industrial transport equipment imports (i.e. motor vehicles) rose 9.9% m/m to a new record high (see NAB: Trade data suggests supply chains are unsnarling as surging imports offset some rebound in exports).

NAB Markets Research Disclaimer

© National Australia Bank Limited. ABN 12 004 044 937 AFSL and Australian Credit Licence 230686.